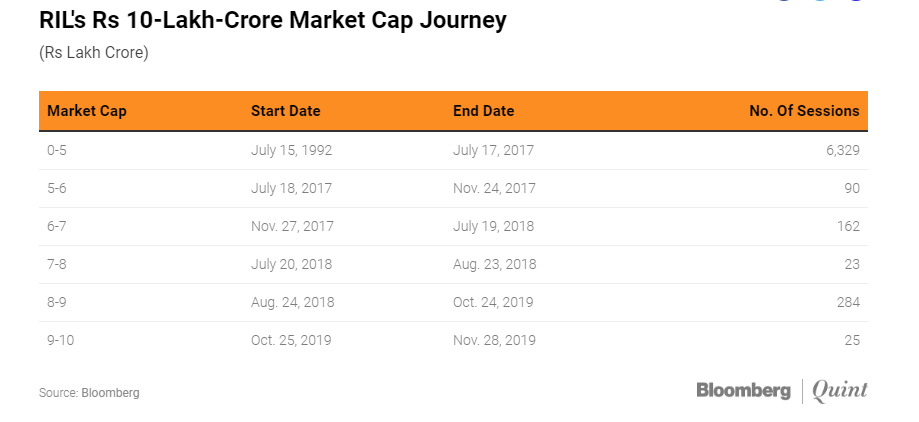

RIL becomes first Indian firm to hit Rs 10 lakh crore m-cap mark.The oil-to-telecom conglomerate’s market capitalisation (m-cap) zoomed to Rs 10.02 lakh crore during morning trade on the BSE. The company’s stock rose 0.73 per cent to a record peak of Rs 1,581.25 in intra-day trade on the stock exchange.

Let Look at this amazing Journey which every Indian should be PROUD OFF

1960s

Dhirubhai Ambani made its initial public offering on the Bombay Stock Exchange. The issue was oversubscribed by seven times.

1985

1986-1992

The company expands its installed capacity for producing polyester yarn by over 145,000 tonnes per annum.

1996

RIL is rated by international credit rating agencies — a first for any private sector company in India.

The conglomerate enters the telecom sector with a joint venture NYNEX, US, as Reliance Telecom Private Limited.

RIL introduces packaged LPG in 15kg cylinders under the brand name Reliance Gas

2001

Both Reliance and Reliance Petroleum Ltd. achieve the status of India’s two largest companies in terms of all major financial parameters. In 2001-02, Reliance Petroleum is merged with Reliance Industries.

In one of the largest gas discoveries in the world, Reliance discovers gas deposits at the Krishna Godavari basin, which is a first for a private sector company in India.

The in-place volume of natural gas is found to be in excess of 7 trillion cubic feet, equivalent to about 1.2 billion barrels of crude oil.

Reliance purchases a majority stake in Indian Petrochemicals Corporation Ltd, India’s second largest petrochemicals company, from the Indian government. It’s later merged with RIL in 2008.

2005 and 2006

The company reorganises its business into power generation and distribution, financial services and telecommunication services.

Reliance launches ‘Reliance Fresh’ and enters the organised retail market in India. By 2008 end, Reliance Retail had 600 stores across 57 cities.

2006

Ambani brothers’ split is formalised. Mukesh gets Reliance Industries and IPCL and younger brother Anil gets telecom, power, entertainment and financial services. This very year, Reliance Industries becomes India’s first private sector enterprise to cross $2 billion profit mark.

2009

Reliance acquires Infotel Broadband Services Limited and enters the broadband services market.

Reliance and BP plc enter a partnership in the oil and gas business. BP plc takes a 30 per cent stake in 23 oil and gas production sharing contracts that Reliance operated in India, including the KG-D6 block for $7.2 billion. Reliance also forms a 50:50 joint venture with BP plc for sourcing and marketing of gas in India.

2013

Reliance Retail reports to have more than 1,400 stores across India. The business is largest with brands like Reliance Footprint, Reliance Trends, Reliance Digital, Reliance Kitchen and others.

2016

Reliance Jio is launched with Isha and Akash Ambani as directors. It becomes a major market disruptor with data plans priced at 1/10th of the market rates.

2017

Jio reports a total of 100 million user base at the end of one year of its launch.

2018

Shares of Reliance Industries Ltd (RIL) escalate and its market capitalisation touches $100 billion.