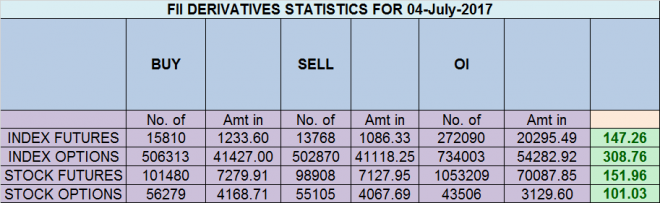

- FII’s bought 2 K contract of Index Future worth 147 cores ,428 Long contract were added by FII’s and 2.6 K Short contracts were added by FII’s. Net Open Interest decreased by 1.6 K contract, so fall in market was used by FII’s to enter long and enter short in Index futures. FII’s Long to Short Ratio at 3.29 How can one make Money from Trading

- As discussed in last analysis Nifty closed exactly near the gann angle as shown in below chart, close above 9624 is very important for next move towards 9720/9790. Bearish below 9580 for a move back to 9520/9480. Nifty Bulls again failed to close above 9624 but also protected 9680, As per current technical structure nifty is doing squaring of space and when it happens we see impulsive move in next 1-2 days ,Bulls will get active above 9624 for a move towards 9710/9790. Bearish below 9580 for a move towards 9525/9480. Bank Nifty Bulls again protect the gann angle

- Nifty July Future Open Interest Volume is at 2 core with addition of 4 Lakh with decrease in cost of carry suggesting short position were added today, NF Rollover cost @9559 Closed above it, Rollover at 69.7%

- Total Future & Option trading volume at 4.22 Lakh core with total contract traded at 1 lakh , PCR @1.01

- 9700 CE is having Highest OI at 39.7 lakh, resistance at 9700 followed by 9800 .9300-9800 CE added 7.2 Lakh in OI so bears added major position in 9600-9800 CE FII bought 2.3 K CE longs and 1.7 K CE were shorted by them.Retail bought 44.5 K CE contracts and 35.9 K CE were shorted by them.

- 9400 PE OI@60.6 lakhs having the highest OI strong support at 9400. 9300-9800 PE added 26 Lakh in OI so bulls added position in 9300-9400 PE . FII bought 10.3 K PE and 7.5 K PE were shorted by them. Retail bought 32.1 K PE contracts and 24.2 K PE were shorted by them.

- FII’s sold 834 cores in Equity and DII’s bought 295 cores in cash segment.INR closed at 64.74

- Nifty Futures Trend Deciding level is 9621 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 9562. How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 9624 Tgt 9644,9672 and 9700 (Nifty Spot Levels)

Sell below 9590 Tgt 9565,9545 and 9510 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh

Mumtaz,

It indicates strong bullishness in the market – the FII are betting the market to go up.

Hi kishore, maharajah,

He means impulsive move could be either side..

Be ready for the move amd he’s indicated levels to take advantage of a move either side

thanks for explaining Sukhdeepji !!

You are very good in Charting, But you should give probabilities to , like Chance of Long is Higher or Less , Chance of Short is Higher or less. Because you are always dark in statement.

In last 2 Days Nifty Crossed 9624 and then came down, so we go long and stop out. Plz give probabilities of Move.

Fii Long Short ration 3.29 is not Understood ??

I have my own way of analyzing and i would like to be myself not what other want me to do..

Sir

“Squaring of space, when this technical structure appears, we could see impulsive move in 1-2 days ”

Need confirmation , if impulsive move could be only on higher /positive side or it could be both , either positive ( up) or negative ( down side ) ?

Rgds

Sir, when you say impulsive move is coming, Is it upmove or a down move or any of the two ? Please clarify. Thanks

SN