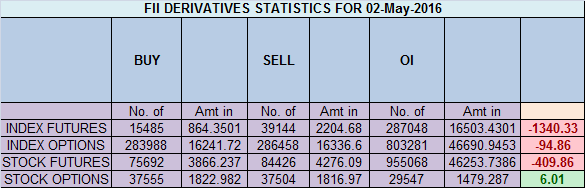

- FII’s sold 23.6 K contract of Index Future worth 1340 cores ,16.1 K Long contract were liquidated by FII’s and 7.5 K short contracts were added by FII’s. Net Open Interest decreased by 8.5 K contract, so fall in market was used by FII’s to exit long and enter shorts in Index futures. Qualities professional trade needs to develop

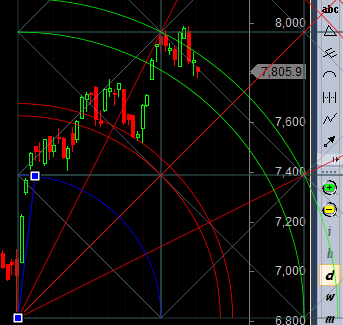

- As discussed in last analysis If we close above 7850 on weekly basis can see move back to 7950-7972 range and weekly close below 7850 can see move towards 7750-7700. Nifty made low of 7777 before bouncing back but closing below 7850, which has bearish implication and we can fall all the way till 7546-7501 in next 2-3 weeks if 7850 is not crossed. Bank Nifty ready for big move,EOD Analysis

- Nifty April Future Open Interest Volume is at 1.98 core with liquidation of 0.84 Lakh with decrease in cost of carry suggesting long position were closed today, NF Rollover cost @7953, continue to trade below it.

- Total Future & Option trading volume was at 1.66 Lakh core with total contract traded at 1.48 lakh , PCR @0.89, Trader’s Resolutions for the New Financial Year 2016-17

- 8200 CE is having Highest OI at 44.5 lakh, resistance at 8200 .7700/8200 CE added 26.2 lakh so bears added position on higher level and will hold till nifty do not close above 7972 .FII bought 5.1 K CE longs and 10 K CE were shorted by them .Retail bought 49.1 K CE contracts and 28.8 K CE were shorted by them.

- 7700 PE OI@39.7 lakhs having the highest OI strong support at 7700. 7200-7700 PE added 5.5 Lakh in OI so strong base near 7500-7600 zone .FII bought 8.1 K PE longs and 5.6 K PE were shorted by them .Retail bought 15 K PE contracts and 21 K PE were shorted by them. FII’s added aggressive Nifty put at start of series, high of 7950 not broken bias remain bearish.

- FII’s bought 435 cores in Equity and DII’s bought 109 cores in cash segment.INR closed at 66.45

- Nifty Futures Trend Deciding level is 7837 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7889, TC followers got a good entry as NF made exact high of 7950 before correcting 100 points. How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 7810 Tgt 7831,7856 and 7883 (Nifty Spot Levels)

Sell below 7777 Tgt 7751,7730 and 7700(Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Sir ur given levels r best

If there’s GOD of trading.. It would be surely you.. Never seen or met a person whose trading calls are so perfect.. Sometimes make we wonder that ARE YOU FOR REAL.. mind boggling stuff !

Dear Sir,

Nothing like that, just following the training i was taught by my guru..

Rgds,

Bramesh

what is monthly charges of consultancy ?

I do not have any consultancy/advisory services.

Dear Sir,

Thanks for your valuable blog… we start to benefit form it.

Moreover, you are giving the Nifty/Bank Nifty Spot values, do we need to buy/sell nifty/bank nifty futures based on the spot value, whatever the value of future be when corresponding to Spot Price?

if possible please clarify.

Thanks.

yes thats the right understanding..

Thank you sir!!!