- FII’s sold 15.3 K contract of Index Future worth 858 cores ,5.8 K Long contract were liquidated by FII’s and 9.4 K short contracts were added by FII’s. Net Open Interest increased by 3.6 K contract, so today’s fall in market was used by FII’s to exit long and enter shorts in Index futures, We have discussed various scenarios which we can see after Bihar Election results are declared Bihar Election Result impact on Stock Market

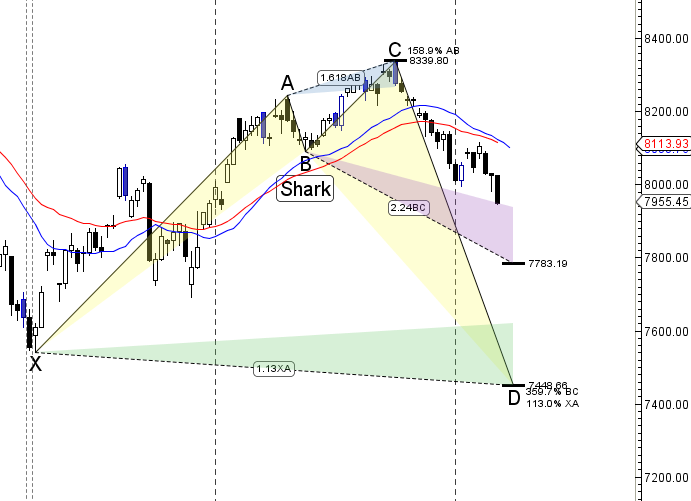

- Nifty opened with gap down again got sold off and finally came near our demand zone of 7930 made low of 7944, Unable to hold 7930 Nifty can go down all the way till 7783 as per SHARK harmonic pattern. As per Gunner also closing below today low can see nifty move towards the green arc, around 7800.Bullish only on close above 8088 which we have been discussing from past many session. Bank Nifty near crucial junction, ready for Big move

- Nifty November Future Open Interest Volume is at 1.90 core with addition of 3.5 Lakh with decrease in CoC suggesting short position were added today.NF closed below the Rollover cost @8294

- Total Future & Option trading volume was at 1.72 Lakh core with total contract traded at 1.42 lakh so increase in lot size showing effect on volumes, PCR @0.83. Live SGX Nifty chart from 6:30-11:30 http://sgxrtchart.blogspot.in/

- 8500 CE OI at 44 lakh , wall of resistance @ 8500 .8100/8400 CE added 23.3 lakh in OI so bears adding aggressive position at higher levels.FII sold 1.7 K CE longs and 36.5 K CE were shorted by them.Retail bought 73.9 K CE contracts and 8.4 K CE were shorted by them.

- 7800 PE OI@ 44.6 lakhs strong base @ 7800. 7500/7900 PE added 16.9 lakh so bulls are also building up position eventhough nifty is not able to sustain higher levels almost 105 lakhs added in 5 days which will be tested by friday is it weak bulls or strong bulls are adding position.FII bought 7.2 K PE longs and 3.2 K PE were shorted by them .Retail bought 21.8 K PE contracts and 27.4 K PE were shorted by them.FII going with bearish bias from start of series and effect is showing with rise we are seeing equal selling .

- FII’s sold 992 cores in Equity and DII’s bought 636 cores in cash segment.INR closed at 65.74.

- Nifty Futures Trend Deciding level is 8019 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8095 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 7980 Tgt 8009,8031and 8064 (Nifty Spot Levels)

Sell below 7920 Tgt 7889,7860 and 7835 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Follow on Twitter during Market Hours: https://twitter.com/brahmesh

Nifty is totally bearish .. Fall will be very big and quick. Market has already decided to go down, fast and heavily, irrespective of Bihar results. Exception could be when gap -up open of minimum 5% from this level. Otherwise no one can save this nifty this time. FII’s cutting their position in future, buying puts heavily and shorting calls heavily .. at least last 10 days in continuation. I don’t think anybody has guts to jump in fire and burn themselves unless its a fat fish and confident that it can sail through any disturbance.

My view is -nifty has already decided to fall big, NDA wins or MGBNDHN wins.. at least trades are telling that way

dear sir nor bught nifty …? mode low 7927…? plz ans…

CAUTION — 7980 / 7920 :- 60 PTS NEUTRAL ZONE