Last week we gave Chopad Levels of 7563 , Shorts were stopped out on Tuesday and long taken as per Chopad levels got rewarded with 200 points as Nifty did all 3 targets. Important Events For Next Week – All eyes on Fed, BoJ and Greece and we also have trading Holiday on 17 Sep. Lets analyze how to trade market in coming week.

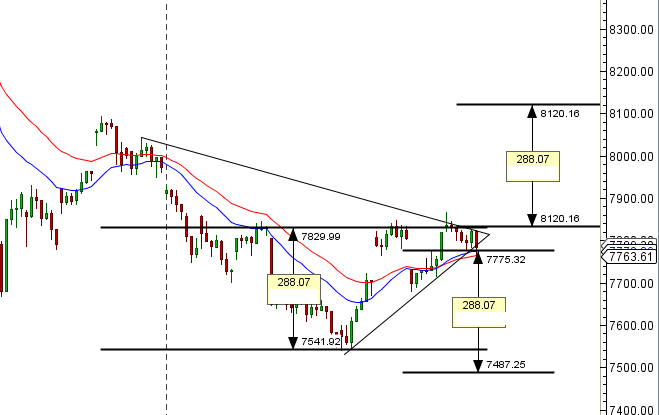

Nifty Hourly Chart

Nifty hourly chart is in neutral mode as it closed around 21/34 EMA, also forming contracting triangle pattern whose targets are shown above.

Nifty Supply and Demand

Closing above 7865 nifty is heading towards 7958.

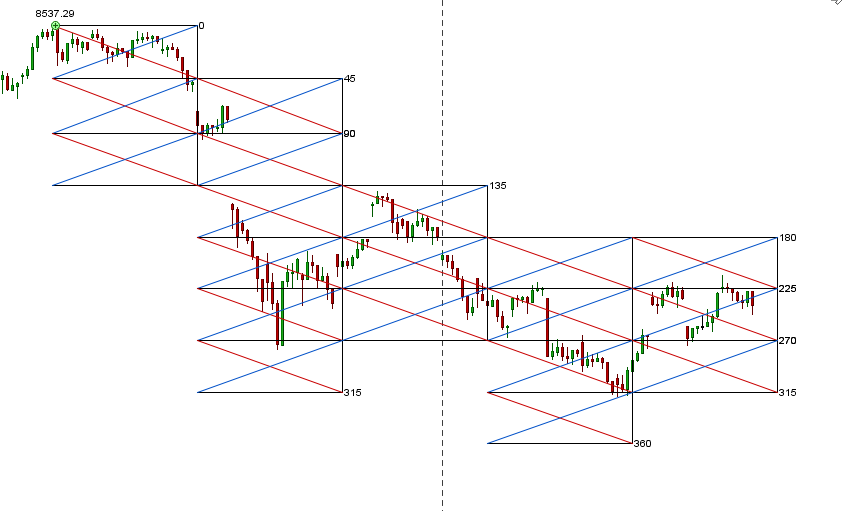

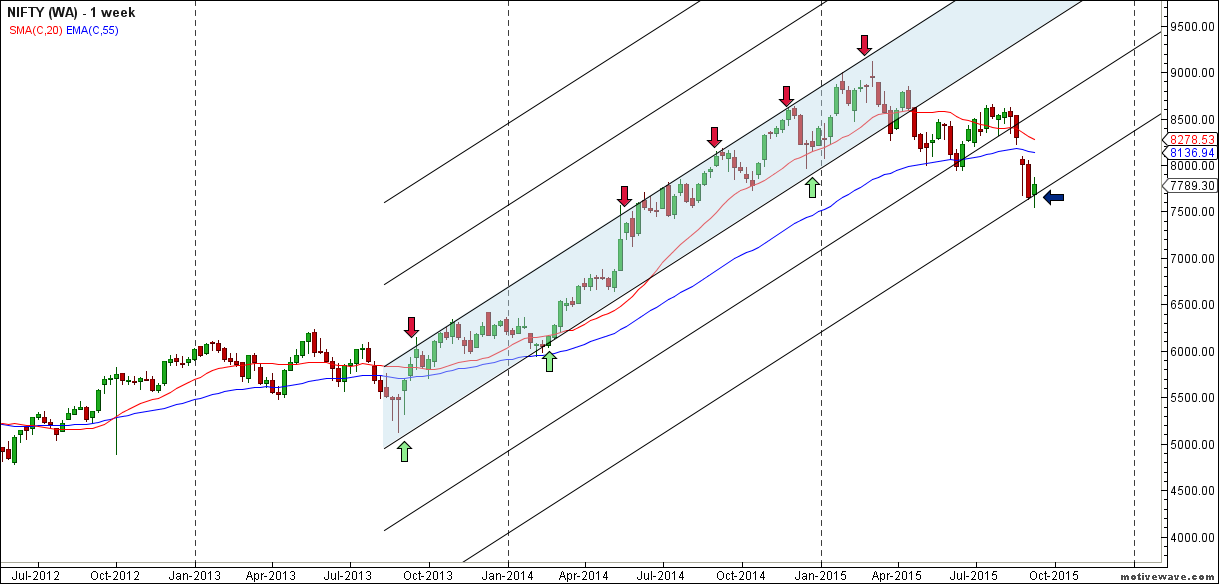

Nifty Gann Box

Nifty Pyrapoint

Support @270 and Resistance @225 as per pyrapoint analysis, Breaking the same big move will be seen,

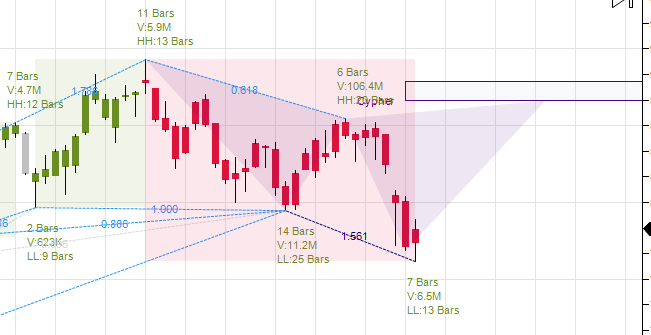

Nifty Harmonic Analysis

Nifty as per Harmonic Analysis has formed Butterfly pattern if 7563/7550 is held nifty can boucne back to 8050/8200 odd levels.

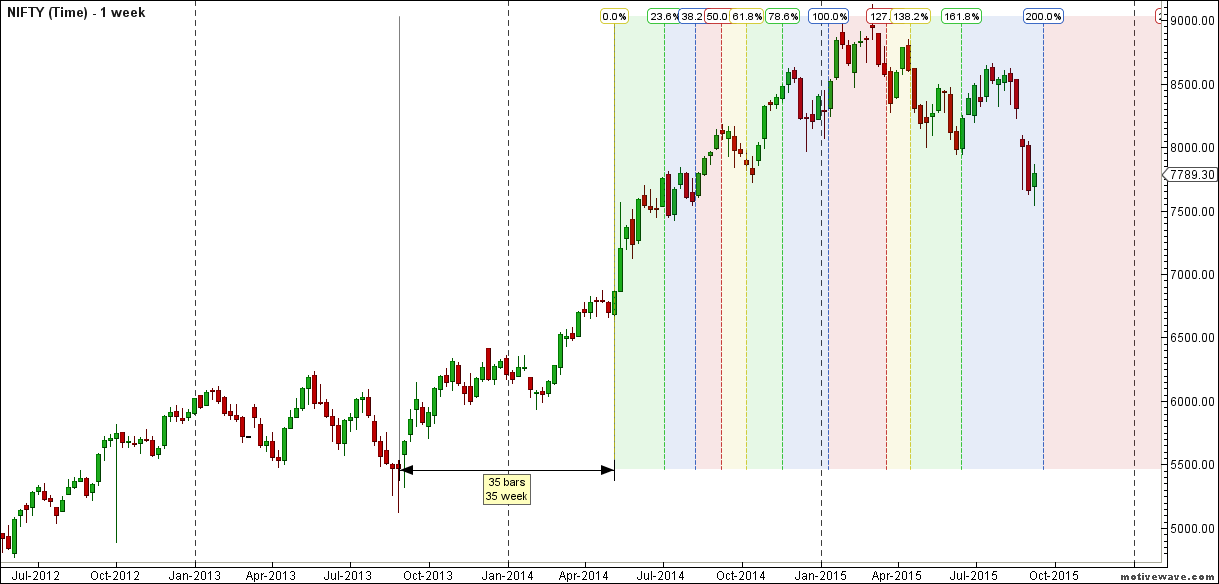

Nifty Gann Date

Nifty As per time analysis 15 September/18 Sep is Gann Turn date , except a impulsive around this dates. Last week we gave 08 September/10 Sep Nifty saw a volatile move .

Nifty Gaps

For Nifty traders who follow gap trading there are 15 trade gaps in the range of 7000-9000

- 7067-7014

- 7130-7121

- 7276-7293

- 7229-7239

- 7454-7459

- 7526-7532

- 7598-7568

- 7625-7654

- 7780-7856

- 7927-7940

- 8174-8195

- 8091-8102

- 8322-8372

- 8355-8381

- 8937-8891

- 7971-7930

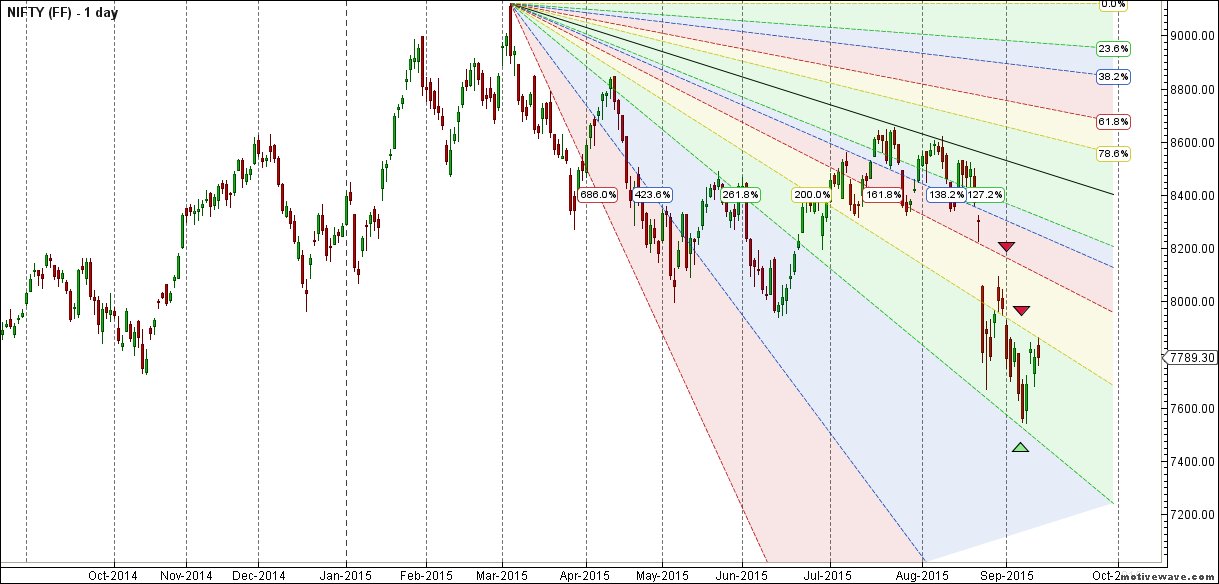

Fibonacci technique

Fibonacci Retracement

7961 is 38.2% retracement /7907 should be watched in coming week.

Touched the high of Fibo Fan and retraced back.

Nifty Weekly Chart

It was positive week, with the Nifty up by 134 points closing @7789 , and closing below its 55 WEMA and 20 WEMA and held its trendline support as shown in above chart.

Trading Monthly charts

Monthly chart took support @50% retracement line and showed bounce back.

Nifty PE

Nifty PE @21.59 , so at last seeing some correction in valuation

Nifty Weekly Chopad Levels

Nifty Trend Deciding Level:7815

Nifty Resistance:7865,7955,8056

Nifty Support:7732,7650,7597

Levels mentioned are Nifty Spot

Let me go by Disclaimer these are my personal views and trade taken on these observation should be traded with strict Sl.Please also read the detailed Disclaimer mentioned in the Right side of Blog.

Want to see post in your Inbox,Register by adding your email id in Post in your Inbox section

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/140117182685863

Please send me course details

Hello Sir,

How to identify that on given Gann date wheather the market will move up or down or will be volatile both side.

Hello Sir,

Please help me with details of your trading courses.

Thank you

Deepak

More pain left in short…. after high volatility period rarely see stocks going up…

Sir, How to trade Nifty using the Chopad levels. Is there a method to it.

Thanks

So where we can forecast nifty on 18friday 7400 or 8200

I think we are entering a very bearish phase. 7930 is the neck line of the head and shoulders pattern, so that’s the max upside possible. In a deflationary scenario markets can correct to 15 p/e type valuations which is over 25% down from here.

Sir,

Your Gann dates are perfect, request to please tell how to find these turn dates.

regards

anil

I cover the same in my Gann trading course.

Rgds,

Bramesh

Sir,

pl send details on my mail address.

thanks & regards

Anil

great analysis sir.

1 question- the bullish time cycle is getting over as you mention every week until mid-september we are in bullish phase . so what does the next time cycle signify as we are approaching 2nd half of Sept2015?

thank you

regards,

mohit

Yes, I have been reading the same line too. I would like to know.

Also – I see FII has been net sellers and have sold in huge quantity. This is not about 1 week or 2 week, if you see charts they have been selling since 3-4 months now……and August was heavy sell comparable to heavy buying before. What is your view about it ?

Do you think bullish cycle is over ? too.

Time Cycle will not be updated going forwards as its confusing many readers. Bullish time cycle is what most of readers read but risk management is what most of readers forget.

Can we have a general post from you on various practical aspects of risk management, how do it ? Please. Like buying puts or shorting small quantity in futures. Please let me know what exactly you mean.

Will try to write in future