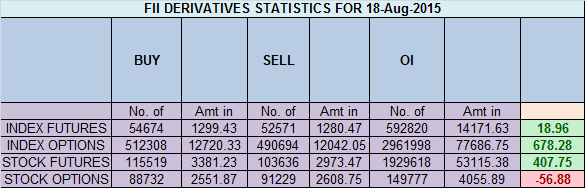

- FII’s bought 2.1 K contract of Index Future worth 18 cores ,2.6 K Long contract were squared off by FII’s and 4.7 K short contracts were squared off by FII’s. Net Open Interest decreased by 7.3 K contract, so today’s fall in market was used by FII’s to exit long and exit shorts in index futures .Trading Is Harder Than You Think: Complexity Of Trading

- Nifty has formed multiple tops near 8530/8525 in past 3 trading sessions and formed 2 Inside day candle in past 2 sessions, also forming a contracting triangle pattern suggesting big move is round the corner. If 8420 is held we can see Nifty moving towards 8635 as per abc pattern as shown in below chart. Pyrapoint also suggests big move round the corner.

- Nifty August Future Open Interest Volume is at 1.42 core with liquidation of 2.4 Lakh, with increase in CoC suggesting short positions got closed today.NF Rollover price came at 8503 and NF close below it.

- Total Future & Option trading volume was at 2.58 core with total contract traded at 3.7 lakh . PCR @0.90.

- 8600 CE OI at 50 lakh , wall of resistance @ 8600 .8400/8800 CE liquidated 3.9 lakh in OI so bears covered marginally at 8400 CE. FII bought 5.2 K CE longs and 2.9 K CE were shorted by them.Retail bought 30 K CE contracts and 2.8 K CE shorted were covered by them.

- 8200 PE OI@ 62.6 lakhs strong base @ 8200. 8300/8600 PE added 3.4 lakh so minor addition was seen in 8400/8500 PE still bulls are holding and 70 lakh from start of series . FII bought 17 K PE longs and 2.2 K shorted PE were covered by them.Retail bought 68 K PE contracts and 61 K PE contracts were shorted by them.So retailers playing for range bound move.

- FII’s sold 255 cores in Equity and DII’s bought 183 cores in cash segment.INR closed at 65.31 trading at 2 year low.1997 Asian Currency Crisis happening again

- Nifty Futures Trend Deciding level is 8483 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8519 and BNF Trend Deciding Level 18773(For Intraday Traders) BNF Trend Changer Level (Positional Traders) 18786 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .NF and BNF gave 200 and 700 point in just 2 trading sessions.

Buy above 8480 Tgt 8500,8530 and 8550 (Nifty Spot Levels)

Sell below 8425 Tgt 8400,8375 and 8350 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

big moves can be both ways or only upside??

Nifty will touch 8625 in 2 days

Market us in uptrend and two inside day trading patterns suggesting significant break out on upside so nifty will cross 8600 by this weekend. Also break out in IT sector alongwith positive on banking sector will help to short covering in metal sector so technically and fundamental both way bullish for short term nifty will cross 8600

what if 8420 is not held ? today i think 3rd day of “inside day pattern” with a progressively lower top and lower closing low in a bull market rampaging for last 2 months. it appears bulls are unable to push beyond a point and its time to book profit on longs. your comments.

8315will not break in this series it will be 8580

Thank you for the analysis. Looks like 8500 is proving to be major resistance. Break and close below 8315 in the next few sessions will suggest a big bear market ahead and lot lower levels for this overvalued market.

What is significance of rollover price in trading?

Bullish above it and bearish below it.

Thank you very much for the reply