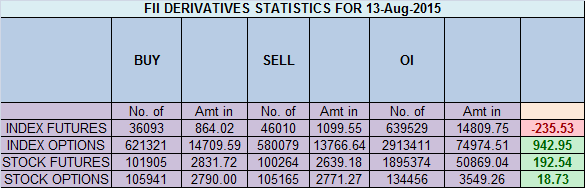

- FII’s sold 9.9 K contract of Index Future worth 235 cores ,6.8 K Long contract were squared off by FII’s and 3 K short contracts were added by FII’s. Net Open Interest decreased by 3.7 K contract, so today’s fall in market was used by FII’s to exit long in index futures and enter shorts .Are you Losing Money as Trader ?

- Nifty continue forming lower low and lower high and now is entering the support area as discussed in Weekly analysis. As per Gann Box Nifty traded perfectly between 2×1 and 3×1 angle and traders trading on gann box would have captured both tops and bottom of market today.Weekly closing tomorrow and Nifty is trading near the weekly trendline, so tomorrow price action will be closely watched.

- Nifty August Future Open Interest Volume is at 1.56 core with liquidation of 3.2 Lakh, with increase in CoC suggesting short positions got closed today.NF Rollover price came at 8503 and NF and close below it.

- Total Future & Option trading volume was at 2.47 core with total contract traded at 4.6 lakh . PCR @0.92

- 8600 CE OI at 51.9 lakh , wall of resistance @ 8600 .8400/8800 CE added 10 lakh in OI so bears continue to add 64 lakh in 4 trading session. FII sold 1.5 K CE longs and 8.1 K CE were shorted by them.Retail bought 48.3 K CE contracts and 33.3 K CE were shorted by them.Retailers are long suggesting fall can continue.

- 8200 PE OI@ 58.6 lakhs strong base @ 8200. 8300/8600 PE added 1.9 lakh so minor addition was seen in 8400 PE still bulls are holding and 46 lakh from start of series . FII bought 38.2 K PE longs and 12 K shorted PE were covered by them.Retail bought 20.9 K PE contracts and 28.7 K PE contracts were shorted by them.

- FII’s sold 625 cores in Equity and DII’s bought 545 cores in cash segment.INR closed at 65.09 trading at 2 year low.1997 Asian Currency Crisis happening again

- Nifty Futures Trend Deciding level is 8406 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8527 and BNF Trend Deciding Level 18282 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 18805 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .NF and BNF gave 200 and 700 point in just 2 trading sessions.

Buy above 8380 Tgt 8400,8418 and 8446 (Nifty Spot Levels)

Sell below 8335 Tgt 8310,8290 and 8272 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

thank you sir for your valuable opinion.

Niftys “inside day “trading pattern means bears have not short covered their positions totally nor bull have taken control of that day. If in the next trading day where ever previous day high or low breaks out and sustains that exuberance till the closing then knows who has taken the control of the nifty for the time being only. And follow on trading days trend may be confirmed.

Aug 2013 crude made life time high 115 and usd made low 69 and nifty @4100. All said Indian import bill double the reason behind this.

Today crude made life time low 41 and usd trading 65.20, why?, is it not good news for India?.

Moral- those who follow fundamental can’t make money. FOLLOW ONLY TECHNICAL

Buy Nifty with the target of 8464 tomorrow.

did nifty formed “inside day” pattern today ?

yes

Go long at these levels and drop till 8180 with proper risk management for a target of 8540 in 3 weeks

Nifty will touch 8545 on monday

Thank you bramesh ji