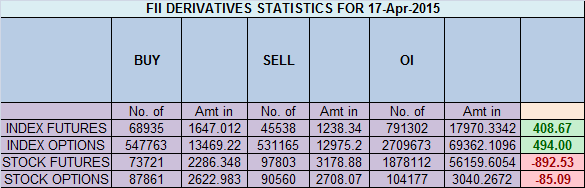

- FII’s bought 23.3 K contract of Index Future worth 408 cores,23.1 K Long contract were added by FII’s and 216 short contracts were squared off by FII’s. Net Open Interest increased by 22.9 K contract.Holy Grail for Successful trading

- Nifty continued forming lower low but closed below its20/ 50 SMA, Nifty is now near a very crucial level as per daily gunner as last time also nifty took support in red arc. If broken we can see a downfall till 200 DMA. Holding the same we can see a sharp and swift rally towards 8854/8900. Also as per pyrapoint analysis support @180 degree@8525.

- Nifty April Future Open Interest Volume is at 2.04 core with addition of 11.3 lakhs with increase in cost of carry suggesting long position got added.

- Total Future & Option trading volume was at 2.26 core with total contract traded at 3.7 lakh. PCR @0.92 suggesting sentiments is turned neutral.

- 9000 CE OI at 56.1 lakh , wall of resistance @ 9000 .8700/8900 CE saw addition of 22.5 lakhs ,so bears who added aggressively in and added 52.5 lakh in past 3 trading session. FII bought 12.9 K CE longs and 18.6 K shorted CE were covered by them.

- 8500 PE OI@ 49.4 lakhs so strong base @ 8500. 8700/8900 PE liquidated 2.5 lakh so bulls still holding 36lakh added in 4 days, still no panic in bull camp so we can see . FII bought 46.9 K PE longs and 24.6 K shorted PE were covered by them.

- FII’s sold 675 cores in Equity and bought 75 cores in cash segment.INR closed at 62.37.

- Nifty Futures Trend Deciding level is 8672 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8662 and BNF Trend Deciding Level 18497 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 18577 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8635 Tgt 8670,8691 and 8737 (Nifty Spot Levels)

Sell below 8595 Tgt 8570,8550 and 8531 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Thanks so much Mr Bramesh……

Sir, above all questions are important.. i have a single question..

As we are going near to expiry of this month.. can you plz.. give expiry special technical info ? plz post the levels of infosys, reliance ind & hdfc if the charts are pertaning to gunner and pyrapoint. As gunner & pyra are giving very much true analysis.

thanks & cheers…

Hi Bramesh,

On daily charts NIFTY moved from 9119 to 8269(A) again from 8269 to 8844(B). Now it started down move. Is it correct to consider this move as ‘C’ move in AB-CD Pattern?

It seems that my guess is correct. NIFTY should stop around 8040 again up move. I have to observe this.

Just following

🙂

Yes DR. Welcome. Next good to your partner in photo to follow.

If on monday not breck 8550 than nifty bounc sharpli to 8700 relienc good result give sam sports to mkt but dow 1.5% minus seaing bears will sorts nd bulls eill trep them

Barmesh ji 8600 8700 put rider not covring their sorts panick as nifty trading near 8600 so some bounc seing on nifty aftr 8550 tuching to 8700 now call maximm at 8800 nd put on 8500

thank you please update daily that report

Sir what is nifty support as per gunner red arc

FIIs are Long in Options? Good. I was bit perturbed by their equity liquidation. Friday’s negative net purchase made their 5 day average as net sell,albeit marginally. Monday opening will answer one interesting question too. Did DJ follow NIFTY or will NIFTY take further cue from Friday DJ close.

Thank you and have a great week end.

from past 3 days you are not writing nifty futures add or shed and cost of carry position and long or short positionn please write this