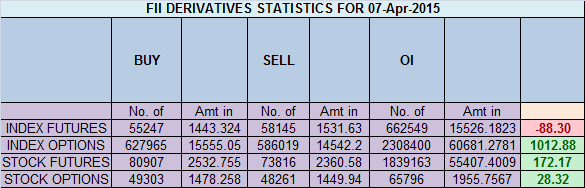

- FII’s sold 2.8 K contract of Index Future worth 88 cores,7.4 K Long contract were added by FII’s and 10.3 K short contracts were added by FII’s. Net Open Interest increased by 17.8 K contract. Developing a Successful Trading Strategy

- Nifty continued with its rally after intraday dip 107 points and recovering in last hour of trade forming hanging man candlestick pattern.As per gunner Nifty took support at Green arc and is now head to the gann line as shown by red line. So level of 8720 will act as important level going forward. As discussed yesterday Pyrapoint Analysis also suggests 135 degree line @8673/8693 range will be trend deciding level for RBI day. High made today was 8693 and Nifty corrected 107 points. Tomorrow also 135 degree line will act as important level.

- Nifty April Future Open Interest Volume is at 1.85 core with liquidation of 0.47 lakhs with increase in cost of carry suggesting short position got closed in today. As discussed yesterday Net OI is decreased 32.3 lakhs in 5 trading sessions.Nifty Future are near its rollover range of 8630 suggesting now OI is neutral and RBI decision will affect the next market move for the series. Low made today was 8616 NF and rallied 100 points.

- Total Future & Option trading volume was at 2.45 core with total contract traded at 5.41 lakh. PCR @0.95 suggesting sentiments is turning bullish.

- 8800 CE OI at 33 lakh , wall of resistance @ 8800 .8300/8600 CE saw liquidation of 4 lakhs ,so bears have covered all their position and 1.1 lakh addition in 8700 CE suggests can see some pullback . FII bought 13 K CE longs and 1.7 K CE shorted CE were covered by them.

- 8400 PE OI@ 39 lakhs so strong base @ 8400. 8600/8700 PE added 6.2 lakh so bulls are making position for higher levels. FII bought 40 K PE longs and 13.6 K PE were shorted by them.

- FII’s bought 143 cores in Equity and DII sold 326 cores in cash segment.INR closed at 62.06.

- Nifty Futures Trend Deciding level is 8679 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8557 and BNF Trend Deciding Level 18564 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 18413 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8694 Tgt 8706,8750 and 8788 (Nifty Spot Levels)

Sell below 8645 Tgt 8620,8586 and 8573 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Hanging man is a bearish reversal pattern , right?

All Pattern required follow up move.

Boy o Boy…..! u amaze me with your dedication….My son is def. your sishya in a few weeks from now………….

Thank you sir.

Thank you for your lovely article. A clear view of market. Regards

Thanks