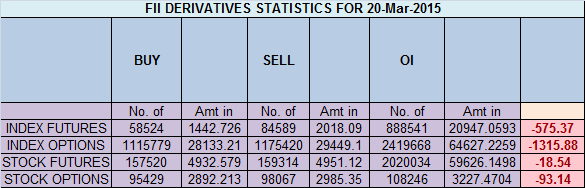

- FII’s sold 26 K contract of Index Future worth 575 cores,8.8K Long contract were squared off by FII’s and 17.1 K short contracts were added by FII’s. Net Open Interest increased by 8.3 K contract.

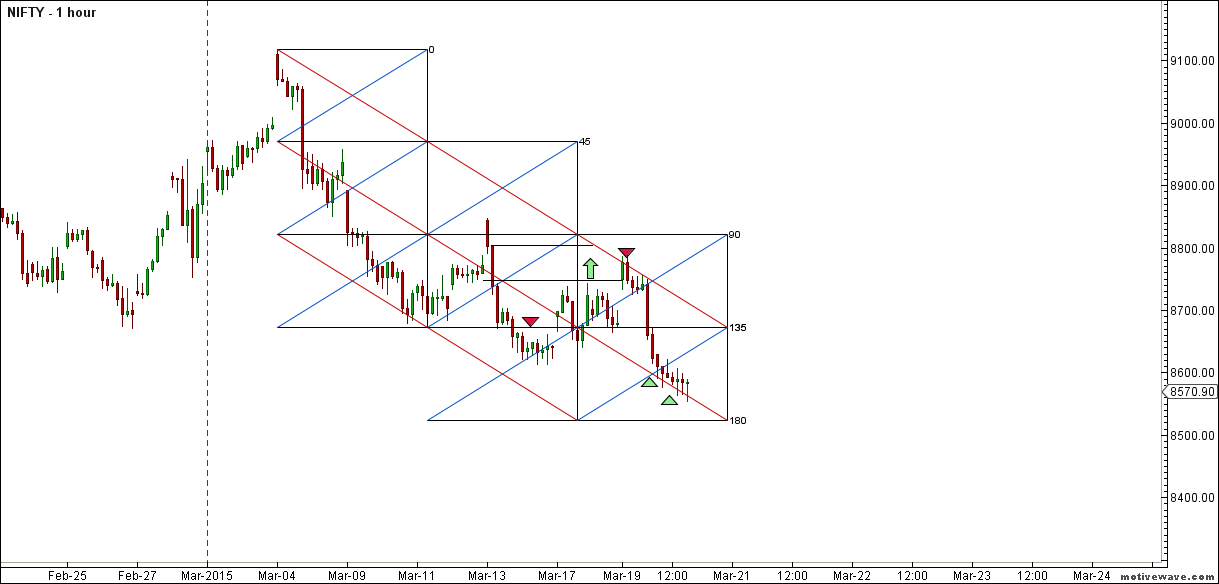

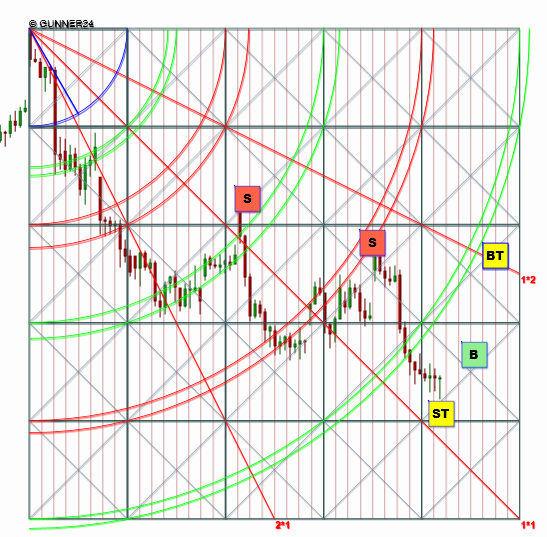

- As per Pyrapoint Analysis Nifty Opened nifty is entering the support zone of 180 degree and holding well above its red line. Gann Box also suggests we are entering a support zone and shorts should be cautious. Also Gunner in the second chart suggests we are nearing the sell target, so profit booking in shorts should be done. We can see another round of decline if 8550 on Nifty is broken , if not we can see a fast and swift bullish move above 8600 for intial target of 8800 as shown in Gunner chart. We have seen fast volatile move in range of 8600-8800 in past 9 trading session, suggesting trending move is round the corner. Market is consolidating in a range to prepare a base for next round of move.

- Nifty March Future Open Interest Volume is at 2.28 core with liquidation of 2 lakhs with increase in cost of carry.

- Total Future & Option trading volume was at 3.27 core with total contract traded at 4.4 ,lakh. PCR @0.86.

- 9000 CE OI at 50.3 lakh ,wall of resistance @ 9000 .8600/8700 CE saw addition of 12 lakhs,so bears added big time in 8700 CE and still holding 100 lakhs in past 5 session. FII sold 26.1 K CE longs and 8.9 K CE were shorted by them. Biggest beneficiaries of this range bound move in the series is for Option Writers.

- 8500 PE OI@ 52.7 lakhs so strong base @ 8500. 8700/8900 PE saw liquidation of 13 lakhs so finally weak bulls started covering their positions . FII sold 6.9 K PE longs and 17.5K PE were shorted by them.

- FII’s bought 354 cores in Equity and DII sold 219 cores in cash segment.INR closed at 62.46.

- Nifty Futures Trend Deciding level is 8612 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8816 and BNF Trend Deciding Level 18733 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 19330.How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8584 Tgt 8610,8630 and 8658 (Nifty Spot Levels)

Sell below 8570 Tgt 8540,8509 and 8465 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

I think there is tug of war between HNI vs FII. FII in + & HNI bearish. One has to reverse position. FII has good cash flow, so my opinion FII win & close this seris above 8750.

HI Brahmesh ji…

Since FII data is negative,does it means that they have bought in cash segment…

Which means they are bullish now, as per your previous post??

Sir, your analysis is excellent and useful.

really helpful. please keep it up

Good anaylisis keep it up