Last week we gave Chopad Levels of 8936 Nifty did 2 target on upside and 1 target on downside in a volatile week which saw RBI cutting rate. Lets analyze how to trade next week.

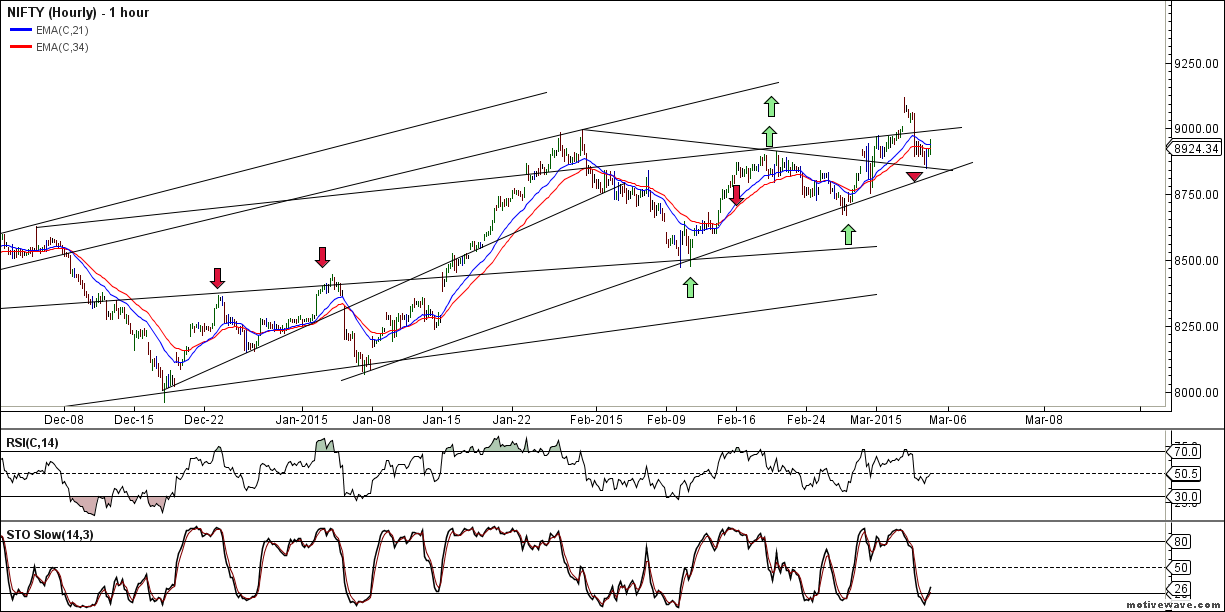

Nifty Hourly Chart

Nifty Hourly charts took support at its lower trendline but closed below its 34 EMA,suggesting weakness on Hourly charts. Break of 8850 will lead to further downfall till 8750/8698. Holding the same 8968/9088 is back on cards.

Nifty Hourly Elliot Wave Chart

Elliot wave chart on Hourly is shown above suggesting 8850 will play a crucial role in coming week.

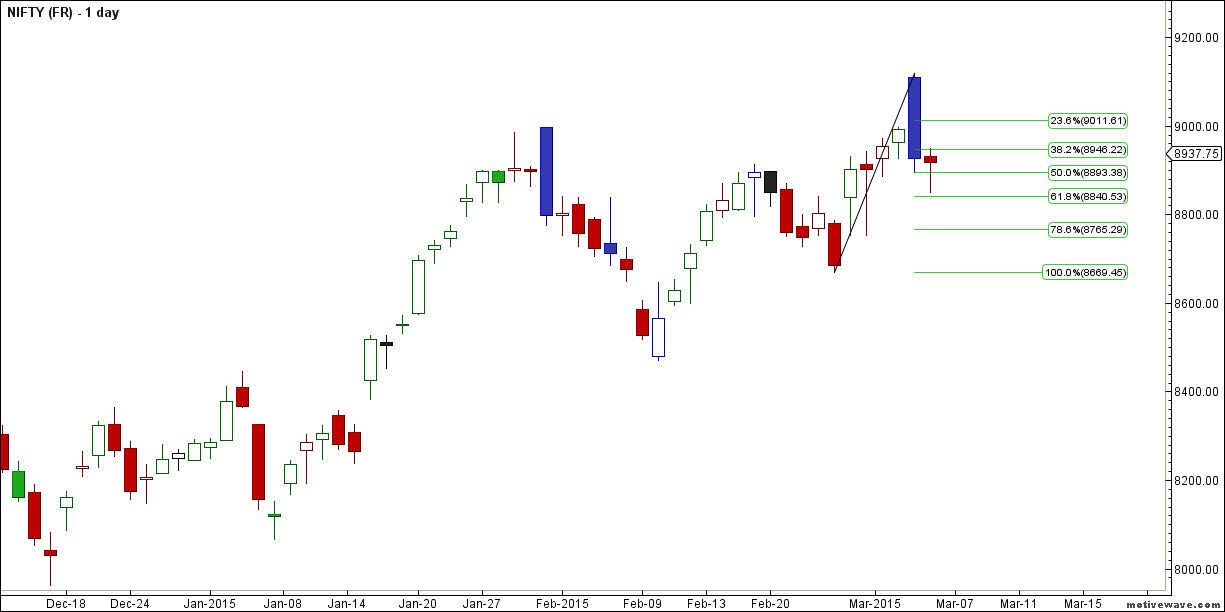

Nifty Market Profile

As per Market Profile 8873/8850 should be watched tomorrow , Holding the same Nifty above 8982/9046 is back on charts. Weakness will creep below 8850 levels.

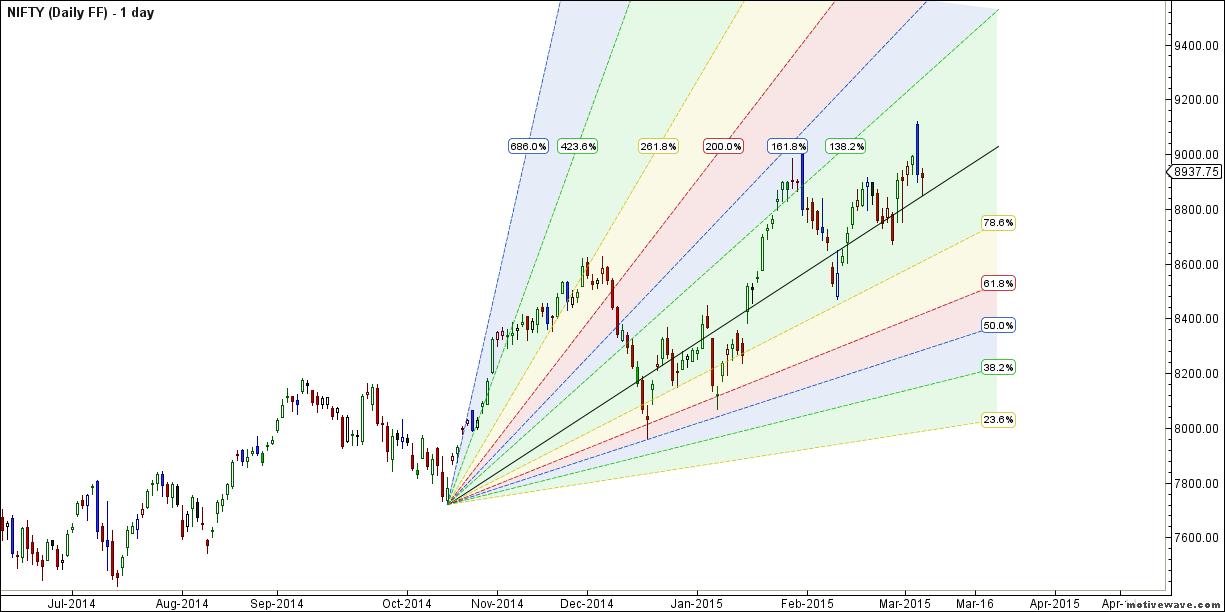

Nifty Daily

RBI rate cut was unable to break the upper trendline which has been holding since 2014. Correction are in range of 400/526 points from this trendline we have seen 269 correction so far. Another 150/200 points can be seen break of 8850.

RBI rate cut was unable to break the upper trendline which has been holding since 2014. Correction are in range of 400/526 points from this trendline we have seen 269 correction so far. Another 150/200 points can be seen break of 8850.

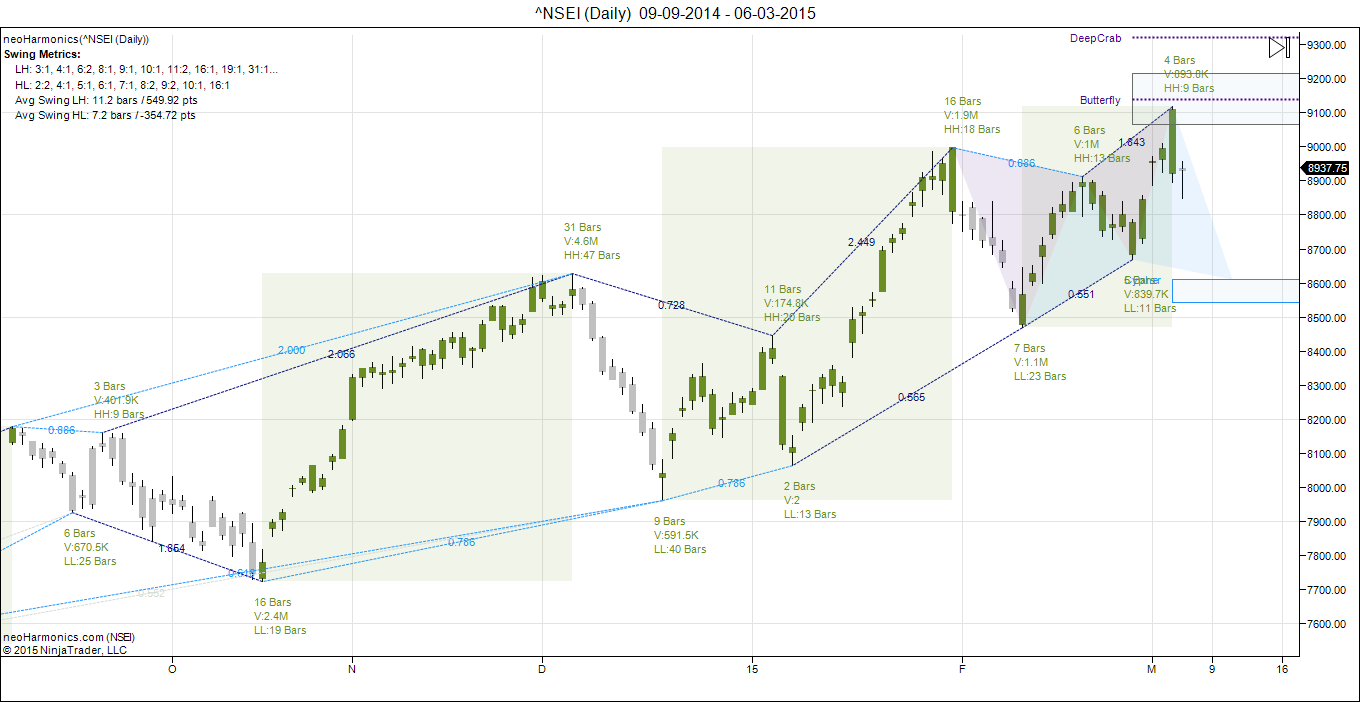

Nifty Harmonic

Nifty has completed its Butterfly pattern with move till 9119 and move till 8600 is on cards as per harmonic analysis.

Nifty Daily Elliot Wave Chart

As per EW more legs are left to the rally use dips around 8500/8960 to take exposure to quality large and mid caps stocks.

Nifty Gann Date

Nifty As per time analysis 10/12 March is Gann Turn date , except a impulsive around this dates. Last week we gave 04 Mar Day and Nifty saw a volatile move on both the days .

Nifty Gann Emblem

Nifty did not reacted to Gann Emblem date on 16 Feb last week went very neutral so can see big move in coming week.

Nifty Gaps

For Nifty traders who follow gap trading there are 7 trade gaps in the range of 7000-7800

- 7067-7014

- 7130-7121

- 7276-7293

- 7229-7239

- 7454-7459

- 7526-7532

- 7598-7568

- 7625-7654

- 7780-7856

- 7927-7974

- 8029-8065

- 8378-8327

- 8102-8167

- 8277-8380

- 8711-8729

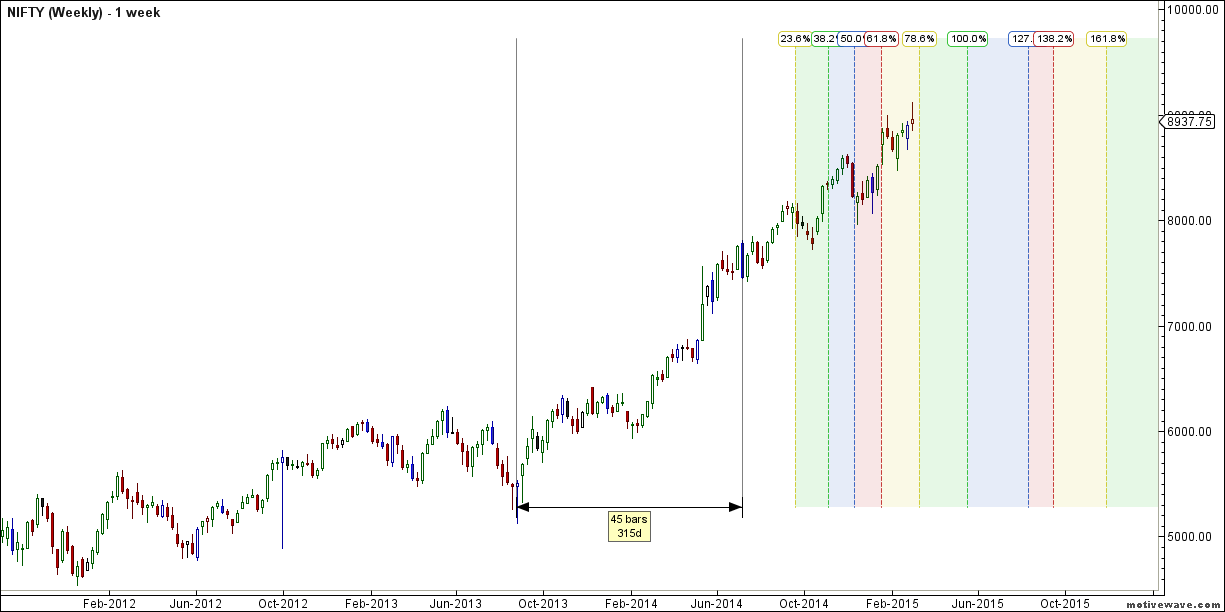

Fibonacci technique

Fibonacci fan

Nifty took exact support @ gann fan As per Fibo retracement theory break of 8840 can see move towards 8765.

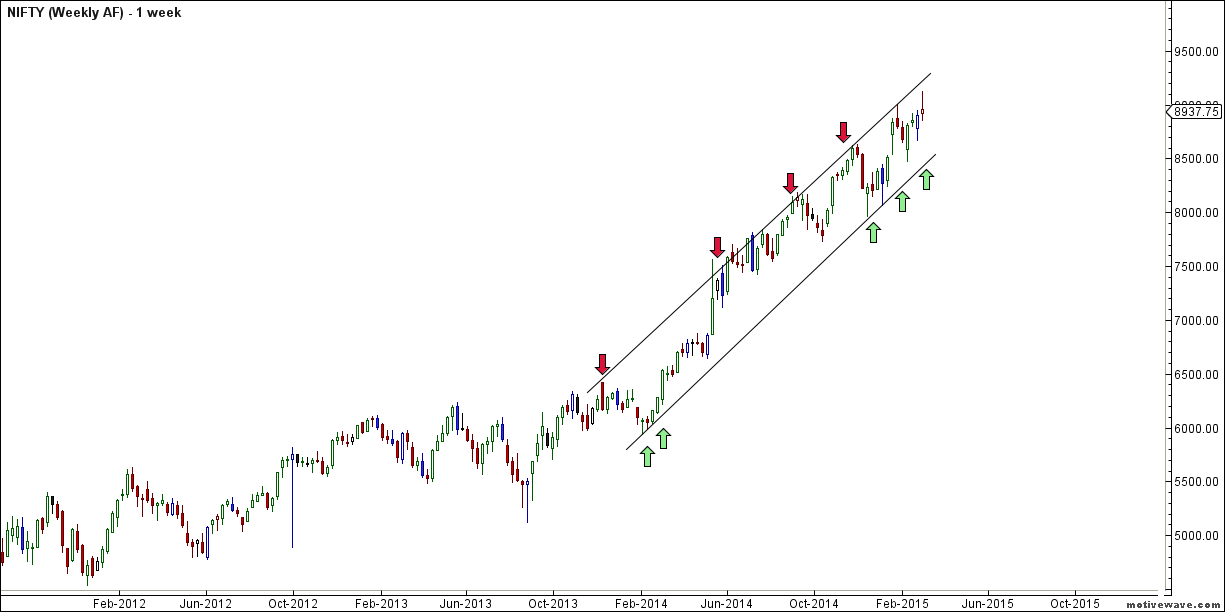

Nifty Weekly Chart

It was positive week, with the Nifty was up by 35 points closing @8936 forming a DOJI candlestick pattern, holding on to its trendline resistance also As per Harmonic trend has turned sideways till we do not close above 9000, Also we are entering a new time cycle from 09March-27 March which will be highly volatile so trade cautiously.

Trading Monthly charts

Nifty reacted from its lower trendline support of Monthly channel break of 8750 can see move towards 8600 on upside break of 8996 can lead to further upmove.

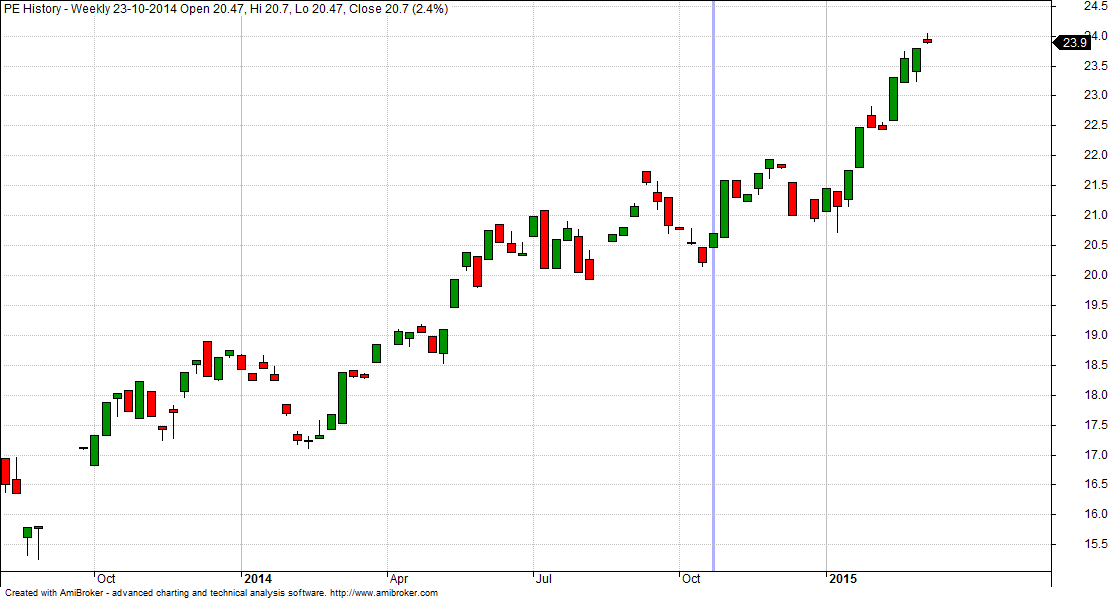

Nifty PE

Thanks to Ganesh K for helping me on PE chart

As per PE ratio we are entering to higher end of 24. 28 is bubble category which was formed in 2000/2008, Still away from Bubble valuation but need to caution on delivery position.

Nifty Weekly Chopad Levels

Nifty Trend Deciding Level:8936

Nifty Resistance:8996,9088,9150

Nifty Support:8818,8698,8550

Levels mentioned are Nifty Spot

Let me go by Disclaimer these are my personal views and trade taken on these observation should be traded with strict Sl.Please also read the detailed Disclaimer mentioned in the Right side of Blog.

Want to see post in your Inbox,Register by adding your email id in Post in your Inbox section

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/140117182685863

Bramesh ,

Can you please explain the PE chart by Ganesh K . I could not understand much

Thankyou for super analysis..

I doubted on “As per EW more legs are left to the rally use dips around 8500/8960 to take exposure to quality large and mid caps stocks.” – around 8500/8690 or 8960?

again thankyou for your excellent valuation supports.

http://www.brameshtechanalysis.com/charts/

As for fii analises fii acumlet putts and hasing their longs in my view next week will voletole with beiresh tone pls give your own view on nifty

Dear Sir,

I have discussed in my Weekly Analysis.

Rgds,

Bramesh

Thank you sir as your analises to much helpfull for sort term traders

Sir,

In NIFTY Harmonicis it 8119 or 9119

9119

bramesh ji i am appriciating your whole hearted effort to annalys the market. kindly post regularly PE of BANK NIFTY also. IT WOULD BE A GREAT HELP.

THANKS IN ADVANCE.

Again excellent analysis