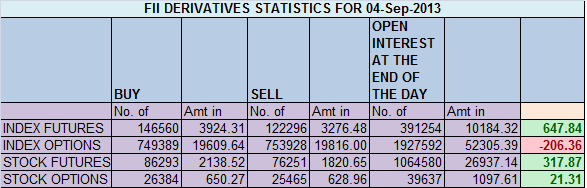

- FIIs sold 68508 contracts of Index Future (Sold 2234 long contract and 26498 fresh shorts were liquidated) worth 648 cores with net Open Interest decreasing by 28732 contracts.So FII shorted 50K contract yesterday has exited 26K contract in today’s rise and are still holding the remaining 23K contracts.So net to net basis are still short in market.

- Last 2 trading days have been a roller coaster ride for traders.Nifty has retraced almost 50% of yesterdays fall but close was below 5477 previous resistance. 5482 is Golden Ratio which needs to be watched closely.Traders needs to understand after falling almost 800 points nifty needs to consolidate and form a trading range before making the next decisive move so tone down your expectation :). So try to trade in less quantity as traders main aim should be protect the capital and preserve profits made in last month.

- Nifty Future Sep Open Interest Volume is at 1.84 cores with liquidation of 1.7 lakhs in Open Interest, no major shorts entered even though nifty fall down 210 points,suggesting no conviction in fall today by big players. This is what we discussed yesterday, so we were not surprised by the rally.

- Total Future & Option trading volume at 1.43 lakh with total contract traded at 5.2 lakh ,PCR (Put to Call Ratio) at 1.10. VIX bounced back and closed at 31,suggesting more volatility on cards.

- 5500 Nifty CE is having highest OI at 41.8 lakhs with addition of 3.4 lakhs in OI. 5400 CE added 1 lakh in OI will be strong resistance in short term.As per FII analysis,22.2 K long were entered in Calls so hedged bet again by FII’s 25 K contract were written so FII playing for range bound moves. 5100-5700 CE added 5.5 lakh in OI.

- 5300 PE OI at 74.2 lakh remain the highest OI, remains the firm support for time being. 5400 PE liquidated just 4 lakh in OI, so we got answer today why PE writers did not panic. . As per FII data they added 26 K contract of PE and wrote 27.8 K contract so hedged bet taken by FII, signalling range bound moves on cards.5100-5700 PE added 16.3 lakh in OI.

- FIIs bought in Equity in tune of 172 cores ,and DII sold 222 cores in cash segment.INR closed at 67.67. Has Indian Rupee made Short term Top, Weekly Analysis

- Nifty Futures Trend Deciding level is 5422 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 5430 and BNF Trend Changer Level (Positional Traders) 8981.NF trend changer level was quiet volatile and triggred sl for shorts carried forwards from yesterday. Do not lose discipline stick to system. One good move is bound to come in next 2 days looking at behavior of trend changer level.Try to book profit as volatility might eat away your profit.

Buy above 5460 Tgt 5482,5508 and 5550 (Nifty Spot Levels)

Sell below 5430 Tgt 5410, 5380 and 5357 (Nifty Spot Levels)

I have been getting lots of mail to share performance of positional calls based on new trading course we have launched , Readers can see the performance http://positionalcallsperformance.blogspot.in/

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/

You can LIKE Facebook page by clicking on the below link and get timely update.http://www.facebook.com/pages/Brameshs-Tech/140117182685863

“one good move is bound to come in next 2 days looking at behavior of trend changer level” what is the specific behavior you are highlighting here about trend levels ?

Dear Vinod,

Study the past data you will get the answer !!

Rgds,

Bramesh

Thanks sir 🙂

Ya Brahmesh….i got it..

Can you please help me to understand how it impacts trade setup..will it act as just resistance or is that number a trend decider ?

This will act as resistance..

Dear Brahmesh…

Can you help me to understand the importance of Golden Ratio Number?

Thanks for your time !!

Regards,

Hemanth

Golden Ratio is 61.8% Fibo Retracement ..

Rgds,

Bramesh