- FIIs sold 36045 contracts of Index Future (Entered fresh shorts in 31007 contracts and booked profit in 5038 Longs) worth 963 cores with net Open Interest increasing by 25969 contracts. So as per data analysis, FII’s are still entering in fresh shorts in NF and BNF,The rally we saw today was backed by short covering and fresh shorts were entered at higher levels. So from past 3 days nifty is rallying and FII’s are entering shorts so probably we can see one more downside near expiry.Do remember FII’s are always hedged so blindly do not short the market thinking FII’s are shorting, Be with your trading system.

- Nifty continue with its relief rally, but with range contraction as discussed in yesterday analysis ,As per classical technical analysis Support becomes resistance Nifty is also working on same line as the range of 5477-87 was strong support for nifty and same is acting as resistance now. Nifty tried moving above 5504 today made an high of 5528,but closed at 5476 so previous support bulls are unable to break above it on closing basis.

- Nifty Future Aug Open Interest Volume is at 2.13 cores with liquidation of 19 lakhs in Open Interest, Rollovers have started and whole 19 lakhs got rollovered and additional 5 lakhs got entered in September series,Cost of carry was huge negative.

- Total Future & Option trading volume at 2.2 lakh with total contract traded at 3.6 lakh , PCR (Put to Call Ratio) at 1.14. VIX closed at 26.38.

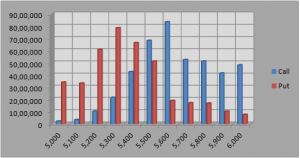

- 5600 Nifty CE is having highest OI at 83.5 lakhs with liquidation of 0.54 lakhs in OI. 5500 CE liquidated 8.5 lakh in OI will be resistance in short term, today closed below 5500 even though opened above 5500 :). As per Option data OI analysis FII entered long in 10.6 K call options mostly in 5500/5600 CE and 9.1K contracts of profit booking in written calls. 5400-5700 CE liquidated 17.8 lakh in OI.

- 5300 PE OI at 78 lakh remain the highest OI, remains the firm support for time being. 5400 PE liquidated 9.6 lakh in OI,profit booking in written puts and remain a short term support.16 Lakh addition in 5500 CE suggests Bulls are eying a close 5500 tomorrow. As per Options Data analysis, FII has booked profit in 54.6 K ITM PE and also entered 3.8 K in Put writing , so basically FII’s are seeing a reduction in VIX and shorting OTM PE’s as premium will come down fast as we are nearing expiry .5300-5700 PE added 4.5 lakh in OI.

- FIIs sold in Equity in tune of 607 cores ,and DII bought 410 cores in cash segment ,INR closed at 64.31 again nearing life highs.

- Nifty Futures Trend Deciding level is 5486(For Intraday Traders).Nifty Trend Changer Level 5639 and Bank Nifty Trend Changer level 9875 .

Buy above 5478 Tgt 5504,5518 and 5540 (Nifty Spot Levels)

Sell below 5440 Tgt 5412,5370 and 5350(Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/

We do discussion in Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863