Idea

Idea is trading in a perfect up trending channel and is near the trendline support of 155. Holding 155 and trading above 157 gives target of 165,178 in short term. Any close below 154 will see a quick correction till 144.

Idea is trading in a perfect up trending channel and is near the trendline support of 155. Holding 155 and trading above 157 gives target of 165,178 in short term. Any close below 154 will see a quick correction till 144.

Buy above 157 Tgt 158.5,160,161.5 and 163.2 SL 156

Sell below 155 Tgt 153.6,152 and 149 SL 156

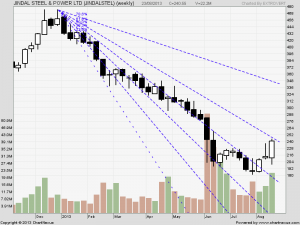

JSPL

JSPL after rising from 199,and made a high of 245, Stock is approaching near its next Fibo Fan resistance of 254. Any close above 254 gives target of 267,288 in short term.Any close below 233 will give target of 212 in short term.

JSPL after rising from 199,and made a high of 245, Stock is approaching near its next Fibo Fan resistance of 254. Any close above 254 gives target of 267,288 in short term.Any close below 233 will give target of 212 in short term.

Buy above 241 Tgt 245,249 and 254 SL 239.5

Sell below 238 Tgt 233,227 and 223 SL 239.5

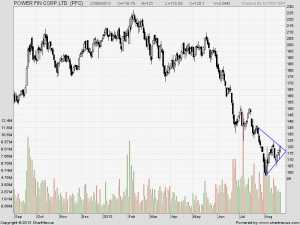

PFC

PFC has been trading in symmetrical triangle and is approaching the breakout zone above 121.Any close above 123 will give short term target of 131. Unable to close above 123 after touching stock is correcting all the way back to 110.

PFC has been trading in symmetrical triangle and is approaching the breakout zone above 121.Any close above 123 will give short term target of 131. Unable to close above 123 after touching stock is correcting all the way back to 110.

Buy above 121 Tgt 122.1,123 and 124 SL 120

Sell below 118.5 Tgt 116.8,114 and 111 SL 120

Stock Performance Sheet for the Month of June is Updated @http://tradingsystemperformance.blogspot.in/ Net Profit for the month of Aug is 1.26 Lakh

- All prices relate to the NSE Spot

- Calls are based on the previous trading day’s price activity.

- The call is valid for the next trading session only unless otherwise mentioned.

- Stop-loss levels are given so that there is a level below/above, which the market will tell us that the call has gone wrong. Stop-loss is an essential risk control mechanism; it should always be there.

- Book, at least, part profits when the prices reach their targets; if you continue to hold on to positions then use trailing stops to lock in your profits.

We do discussion in Live market to update Nifty/Stock levels If you are interested you can LIKE the page to get Real Time Updates.