- FIIs sold 37489 Index Future worth 1071 cores with net Open Interest increasing by 58195 contracts.FII continued shorting in index futures. So as discussed yesterday read again for investor who are thinking of fearful scenarios as advertised by Blue channel Will Stock Market crash if Fed ends the QE

- Today Nifty opened with gap of 80 points and kept on sliding down, many traders were taken aback with ferocity of such fall but this is how market is all about, that’s where i want to highlight How following a trading system will keep you at peace. Island reversal pattern got invalidated today.Nifty reaching a significant intermediate support of ascending trend line around 5640-50 levels is important with regards to prior down trend and it reflects the possibility of temporary halt in current down trend and signals the probability of minor bounce back in Nifty in near term.

- Nifty Future June Open Interest Volume is at 2.15 cores with addition of 29.9 lakhs in Open Interest, huge shorts are back in the system with fall in cost of carry.

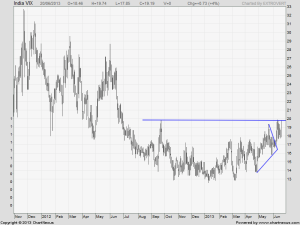

- Total Future & Option trading volume at 2.09 lakh with total contract traded at 3.48 lakh , Cash market volume were highest in series signalling delivery based selling by fund houses. PCR (Put to Call Ratio) at 0.87. VIX is approaching another breakout on daily charts and if this happens we are going for another volatile ride during expiry week.

- 5800 Nifty CE is having highest OI at 84.8 lakhs with addition of 29 lakhs in OI, Do remember 35 lakh addition last week which shows smart money had inkling of such fall coming, 5800 remains the ceiling for this June series. 5700 CE OI at 60 lakhs suggests upmove will be met with strong resistance and its sell on rise market . 5500-6000 CE added 69 lakh in OI,blowout punch by bears.

- 5600 PE is having highest OI of 74.6 lakh and will remain the wall of support. 5700 PE OI at 66 lakh with addition of 16.3 will act as minor resistance on rise . 5500-6000 CE liquidated 30 lakh in OI.

- FIIs sold in Equity in tune of 2094 cores highest sell in past 6 months ,and DII bought 1332 cores in cash segment ,INR closed at 59.81.FII has sold 6855 cores in JUne series in cash segment alone.

- Nifty Futures Trend Deciding level is 5654 (For Intraday Traders).Nifty Trend Changer Level 5876 and Bank Nifty Trend Changer level 12070.Last time the short signal came on 7 June at 5989 and we are down more than 320 points, as per my understanding most of 80% traders would not have held this long time, but do remember big money is always made when you sit on the positions. SAR traders who are holding shorts would request you to book 90% of shorts.

Buy above 5687 Tgt 5700,5724 and 5750(Nifty Spot Levels)

Sell below 5640 Tgt 5620,5600and 5584(Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/

We do discussion in Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863