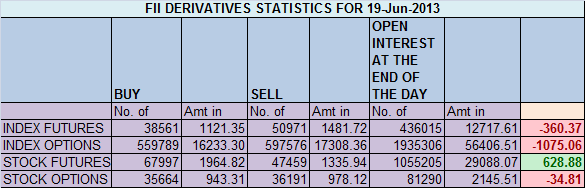

- FIIs sold 12410 Index Future worth 360 cores with net Open Interest increasing by 14688 contracts.FII continued shorting in index futures. 2 Important Post before todays crucial event of Fed Meeting Financial Market reaction to various FOMC scenarios and Will Stock Market crash if Fed ends the QE

- Nifty has closed above 200 DMA is past 4 trading sessions. Today again took resistance at the falling trendline and was unable to cross the same. Fed declension tonight should give the power to bulls to break above 5870 or break below 5770. After the formation of bullish island reversal pattern (on 14th June), Nifty may retrace down to the immediate support of around upper gap area of that pattern around 5740 levels to maintain the positiveness of island reversal pattern. If that gap is closed, then the positive effect of that pattern gets nullified.

- Nifty Future June Open Interest Volume is at 1.85 cores with addition of 7.3 lakhs in Open Interest,shorts are back in the system with fall in cost of carry.

- Total Future & Option trading volume at 1.33 lakh with total contract traded at 2 lakh , PCR (Put to Call Ratio) at 0.86.

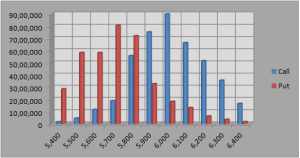

- 6000 Nifty CE is having highest OI at 89.9 lakhs with addition of 4.2 lakhs in OI , 5900 CE OI at 75 lakhs suggests upmove will be met with strong resistance and its sell on rise market . 5500-6100 CE added 1.97 lakh in OI

- 5700 PE is having highest OI of 80 lakh and will remain the wall of support. 5800 PE OI at 72 lakh with addition of 4.1 will act as minor support . 5500-6100 CE added 12.8 lakh in OI which shows till 5770 is not broken bulls are still in came. So as per options data range of 5770-5870 is getting developed.

- FIIs sold in Equity in tune of 545 cores,and DII bought 416 cores in cash segment ,INR closed at 58.5.

- Nifty Futures Trend Deciding level is 5834 (For Intraday Traders).Nifty Trend Changer Level 5888 and Bank Nifty Trend Changer level 12113.

Buy above 5828 Tgt 5850,5865 and 5883(Nifty Spot Levels)

Sell below 5790 Tgt 5770,5755 and 5740(Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/

We do discussion in Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863