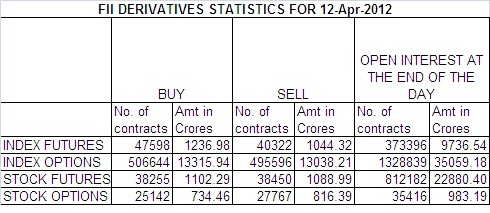

Below is my Interpretation of FII OI data Sheet for 12-Apr-12.

1. FII bought 7276 Contracts of NF worth 192 cores OI also increased by 16680. Infosys results are disaster in recent time and expect a deep cut in infy. China GDP grew at 8.1% against an expectation of 8.5%. Monthly inflation data will be keenly watched

2. As Nifty Futures was up by 40 points and OI has increased by 16680,FII have created longs in Index futures.

3. Nifty closed below 20SMA@5282 and 50 SMA@5339 for today making it bearish in short term. Trend is favoring bears and Sell on rise should be mantra for the positional traders.Yesterday 20 SMA@5290 and Nifty made a high of 5290. So keep a close watch on 5339 today.

4.Trading range for NF is 5380-5221. It touched the upper end unable to sustain and bears pushed it to lower end Low today was 5245.So tomorrow we need to closely watch 5221 on closing basis. If it closes below it bears will have upper hand for the April series.

5. As per Volume Profile chart 5319 is High Volume node Closing above 5320 NF will give strength to bulls.Infosys will be an excuse for Nifty bears to take nifty down.Support exists at 5247

6. Nifty bears can press Nifty at Opening today reason being see the below chart

6. Nifty bears can press Nifty at Opening today reason being see the below chart

Nifty Bears would like an Gap Up open as per global cues than press nifty below see the downward facing trendline .. Infy is a good excuse for a fall as it has weightage of 7% in Nifty

Nifty Bears would like an Gap Up open as per global cues than press nifty below see the downward facing trendline .. Infy is a good excuse for a fall as it has weightage of 7% in Nifty

7. Nifty April OI has decreased by 80K .Total OI stands at 1.71 cores contracts.No major commitment before the Infosys result, Monthly inflation data and China GDP number.

8. Total F&O turnover was 93K Cores with total contract traded at 2.58 lakh .

9. As per Option data Range comes in 5400-5200

11. Today both big boys were net buyers . FII sold 136 Cores and DII bought 237 cores.

12. Nifty Futures Trend Deciding level is 5215, Trend Changer at 5293 NF (Above this Level Bulls will rule Nifty/Below this levels Bears have upperhand).

Buy above 5271 Tgt 5290,5315,5339

Sell below 5255 Tgt 5233,5203 and 5198(Nifty Spot Levels)

Today was a wealth destruction day as IGL cracked almost 33% because of new government Policy,With such a crash many traders and investors are rushing in to buy IGL. My suggestion never catch a falling knife and let the dust settle before committing your money .Markets are forever.

Let me go by Disclaimer these are my personal views and trade taken on these observation should be traded with strict Sl

To Get Real Time update on Nifty during market hours you can LIKE the page.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863

Dear Bramesh sir,

Unlike other expiries, in this expiry FII’s are net buyers of index options and have bought options worth almost 2700 crores.

does this indicate a big move ahead in this series? which direction?

Thanks & Regards

Abhinay Kapoor

Dear Sir,

Lets understand the price action on day to day basis and do nt jump to conclusion.

Biased mind is a recipe for disaster.

Rgds,

Bramesh

Hi Bramesh!

For few days I have been watching the Trend decider level in NF, Its simply amazing.

today morning when NS opened at 5240 levels and I saw NF exact low at 5293, a huge premium of 50 pts. I immediately realised the remembered your levels … In the evening I went short once this level was broken and made good money 🙂

Thankyou very much

Hi Sir,

It my pleasure my analysis was able to help you.

Rgds,

Bramesh

Bramesh,

Would like to know if we can isolate the Open Interest Buy vs Sell