- FII’s sold 18.2 K contract of Index Future worth 1516 cores ,8.3 K Long contract were covered by FII’s and 9.9 K Short contracts were added by FII’s. Net Open Interest increased by 1.6 K contract, so rise in market was used by FII’s to exit long and enter short in Index futures. FII’s Long to Short Ratio at 0.76 .Why Do Traders Overtrade?

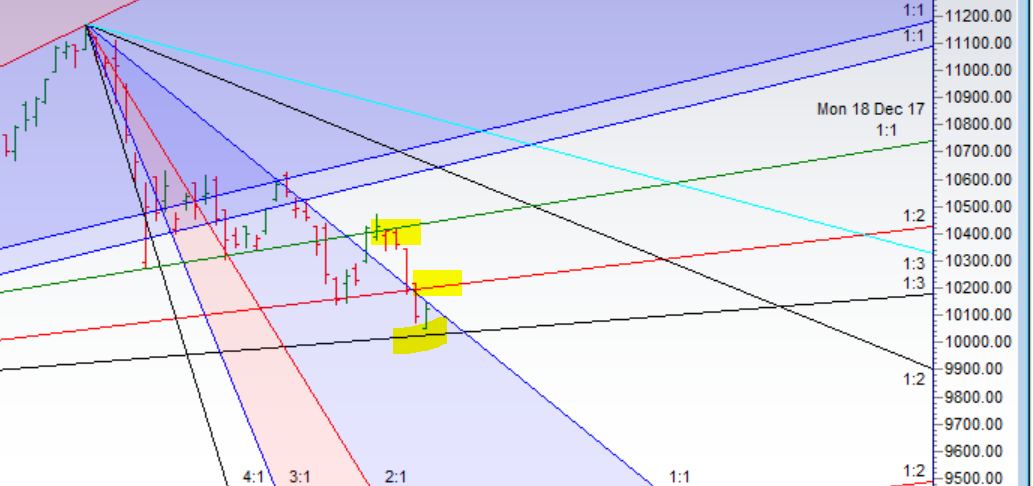

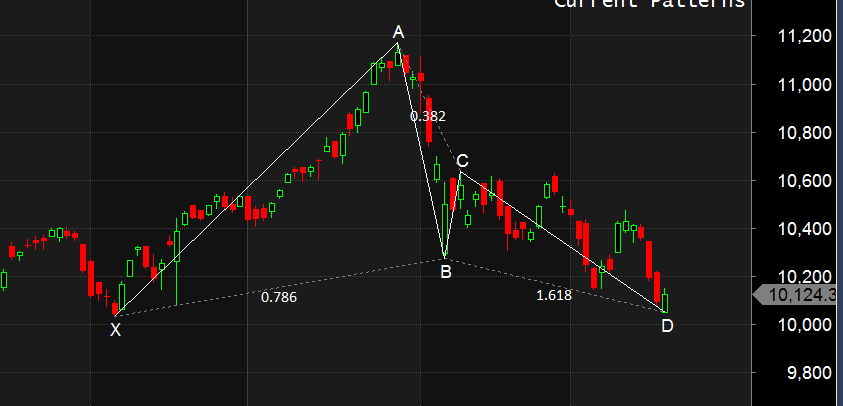

- As Discussed in Last Analysis As yesterday was an important trend change date break of 10336 can see fast move of 100-150 points and break of 10420 a rise of 100-150 points. Thanks all for your warm wishes feeling much better now. Nifty saw the expected fall as 10336 was broken and as discussed in morning on facebook low made was 10050 and we saw small bouceback. Till we are holding range of 10012-10050 bulls can see relief rally towards 10250/10410 as we are near gann angle support and also forming Bullish Butterfly pattern.Bullish above 10155 for a move towards 10230/10333/10410. Break of 10000 on closing basis can see fast fall towards 9920/9850. Important intraday time for reversal can be at 12:021/2:40. Bank Nifty holds to support zone of 24100,EOD Analysis

- Nifty March Future Open Interest Volume is at 2.31 core with addition of 0.79 Lakh with increase in cost of carry suggesting long position were added today, NF Rollover cost @10395 closed above it.

- Total Future & Option trading volume at 6.94 Lakh core with total contract traded at 1.60 lakh , PCR @0.81

- 10500 CE is having Highest OI at 63.8 Lakh, resistance at 10300 followed by 10400 .10000-10600 CE added 600 in OI so bears added position in range of 10400-10300. FII bought 410 CE and 2.6 K CE were shorted by them. Retail bought 20 K CE and 19.8 K CE were shorted by them.

- 10000 PE OI@66 lakhs having the highest OI strong support at 10100 followed by 10000 . 10000-10500 PE liquidated 4.2 Lakh in OI so bulls covered major position in 10200-10300 PE. FII sold 6.1 K PE and 4.2 K PE were shorted by them. Retail bought 35.8 K PE and 18.3 K PE were shorted by them.

- FII’s bought 344 cores and DII’s bought 731 cores in cash segment.INR closed at 65.19

- Nifty Futures Trend Deciding level is 10138 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 10239 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 10155 Tgt 10170,10191 and 10210 (Nifty Spot Levels)

Sell below 10100 Tgt 10070,10050 and 10020 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh