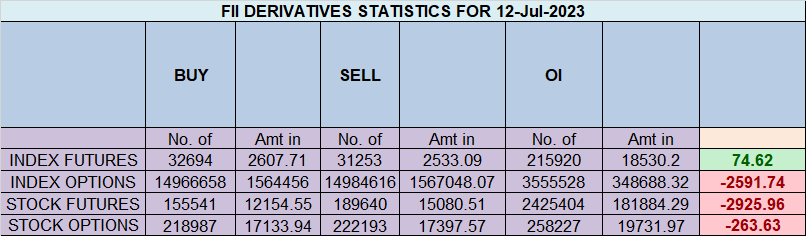

Foreign Institutional Investors (FIIs) displayed a Bearish approach in the Nifty Index Futures market by Shorting 8910 contracts worth 867 crores, resulting in a increase of 7822 contracts in the Net Open Interest. FIIs bought 1807 long contracts and added 366 short contracts , indicating a preference for adding LONG and adding SHORT positions .With FII Long Short Ratio @93.9 % FII’s are heavily long in market , FIIs utilized the market rise to enter Long positions and enter short positions in NIFTY Futures.

NIfty formed a bearish engulfing pattern Nifty last 3 day range is within the Friday range of 19525-19303. HDFC, stopped trading on bourses post the merger with HDFC Bank that came into effect on July 1. That marks the end of a four-decade-long journey for India’s oldest mortgage lender. From Today HDFC BANK will have 14.2 % weightage in NIfty. NIfty will also react to HCL Tech and TCS Results

With US inflation coming soft NIfty will open with gap up but will it sustain the gap we will get indication with first 15 mins HIgh and low.

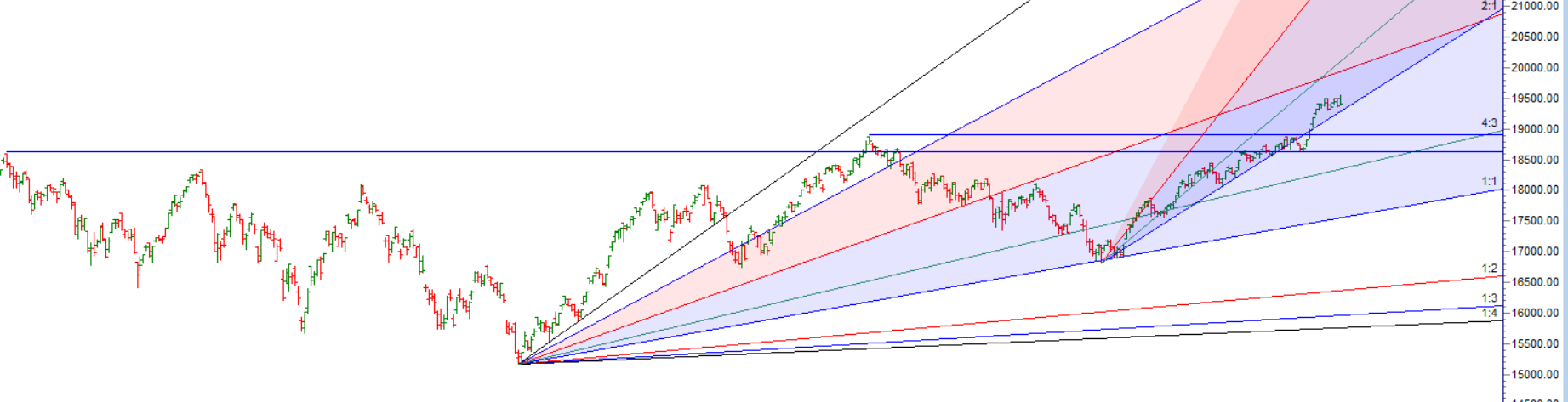

Nifty gave an intraday rally made a new all time high but once it started trading below 19523 gann level selling started to accelereate .Nifty is getting lot of Supply from upper side as seen in last 4 trading session price opens up see upmove in first session and gets sold off into 2 session, suggesting we are seeing Distribution on upper levels. Price is doing more of time correction rather than price correction. Momemtum will come on downside once we see a close below 19300.

Nifty is still trading between Friday range on closing basis

Sun Sextile Uranus and Venus YOD Neptune Aspect imvolving Outer Plannets are happening on Weekend so next week we can see range expansion.

Nifty Trade Plan Bulls will get active above 19440 for a move towards 19490/19544/19599/19653. Bears will get active below 19325 for a move towards 19272/19218/19164.

Traders may watch out for potential intraday reversals at 9:44,11:03,1:25,2:54 How to Find and Trade Intraday Reversal Times

Nifty July Futures Open Interest Volume stood at 1.04 lakh, witnessing a addition of 2.4 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a addition of LONG positions today.

Nifty Advance Decline Ratio at 18:32 and Nifty Rollover Cost is @18884 and Rollover is at 69.7 %.

Nifty options chain shows that the maximum pain point is at 19500 and the put-call ratio (PCR) is at 0.84 . Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 19500 strike, followed by 19600 strikes. On the put side, the highest OI is at the 19300 strike, followed by 19200 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 19500-19300 levels.

In the cash segment, Foreign Institutional Investors (FII) bought 1242 crores, while Domestic Institutional Investors (DII) sold 436 crores.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 18890-19452-20014 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.Price has closed below 19452.

With every trade I imagine that this will be my worst trade ever. And I think about it beforehand, how much of my money I want to lose with it

For Positional Traders, The Nifty Futures’ Trend Change Level is At 19394 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 19491 , Which Acts As An Intraday Trend Change Level.

hello sir

this is my daily morning routine to read your article it’s amazing and simple to understand.

I have one question that yesterday I bought July month 19000PE option around 24rs though mkt fall 120 pts from there, why my strike price not increase?

thanks sir .. OTM pe will increase only if price breaks near 19300