Foreign Institutional Investors (FIIs) displayed a Bearish approach in the Bank Nifty Index Futures market by Selling 894 contracts worth 59 crores, resulting in a increase of 1536 contracts in the Net Open Interest.

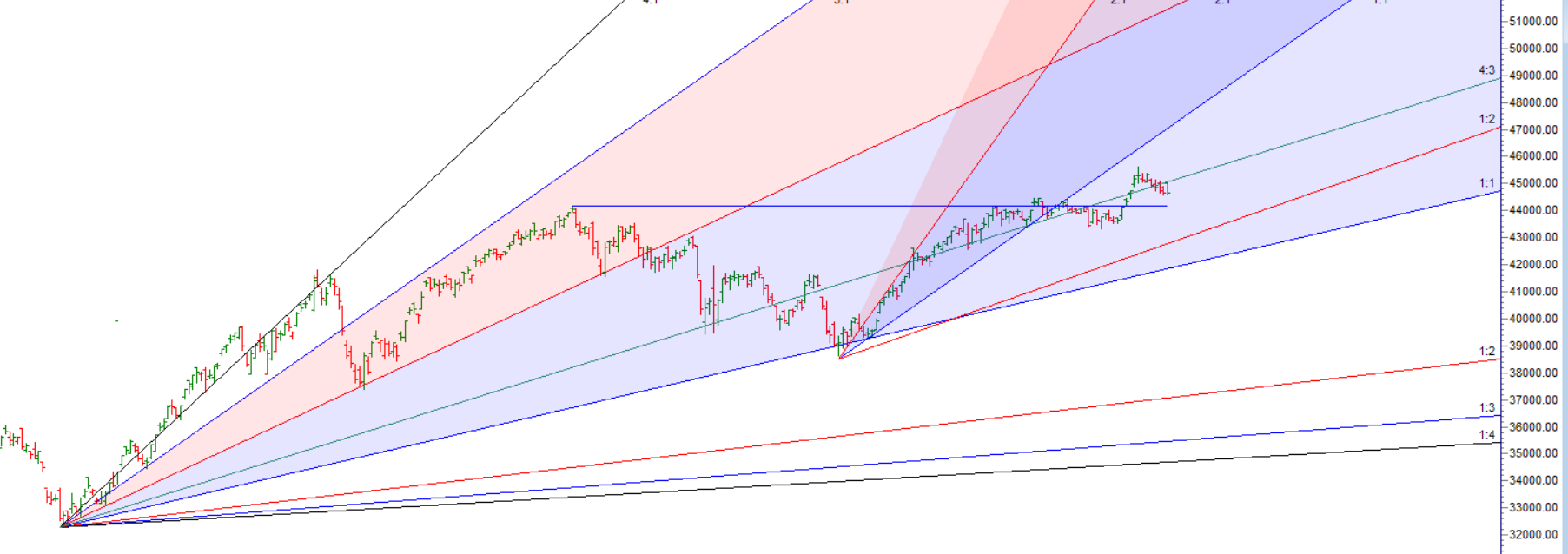

As Discussed in Last Analysis Bank NIfty continue to make lower low and closed below 4×3 gann angle for 2 day. HDFC, stopped trading on bourses post the merger with HDFC Bank that came into effect on July 1. That marks the end of a four-decade-long journey for India’s oldest mortgage lender. From Today ICICI BANK and HDFC BANK will have 75% weightage in Bank NIfty so watch for movement in these 2 stocks to capture the trend of bank Nifty.

With US inflation coming soft Bank NIfty will open with gap up but will it sustain the gap we will get indication with first 15 mins HIgh and low. 44634 is imp=portant Muscial Octave level so holding it can lead to short covering towards 45000.

Bank Nifty gave an intraday rally but faced rejection at 4×3 gann angle as shown in below chart and showed the correction .Bank Nifty is getting lot of Supply from upper side as seen in last 4 trading session price opens up see upmove in first session and gets sold off into 2 session, suggesting we are seeing Distribution on upper levels. Price is doing more of time correction rather than price correction. Momemtum will come on downside once we see a close below 20 SMA.

Sun Sextile Uranus and Venus YOD Neptune Aspect imvolving Outer Plannets are happening on Weekend so next week we can see range expansion.

Bank Nifty Trade Plan Based Bulls will get active above 44800 for a move towards 45014/45228/45441. Bears will get active below 44587 for a move towards 44373/44159/43946.

Traders may watch out for potential intraday reversals at 9:44,11:03,1:25,2:54 How to Find and Trade Intraday Reversal Times

Bank Nifty June Futures Open Interest Volume stood at 22.5 lakh, liquidation of 2.1 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a closing of LONG positions today.

Bank Nifty Advance Decline Ratio at 4:8 and Bank Nifty Rollover Cost is @44037 and Rollover is at 72.6%

Bank NIfty Support is at 20 SMA @44380

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 43444-44634-45923 . This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable. Price is near 44634

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 44800 strike, followed by the 45000 strike. On the put side, the 44500 strike has the highest OI, followed by the 44300 strike. This indicates that market participants anticipate Bank Nifty to stay within the 44500-45000 range.

The Bank Nifty options chain shows that the maximum pain point is at 44800 and the put-call ratio (PCR) is at 0.86. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

With every trade I imagine that this will be my worst trade ever. And I think about it beforehand, how much of my money I want to lose with it

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 45037 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 44952 , Which Acts As An Intraday Trend Change Level.

sir

Today ICICI BANK and HDFC BANK will have 75% weightage in Bank NIfty

nse site not updated?

shows 52%

regards

h.mehta