Foreign Institutional Investors (FIIs) displayed a Bullish approach in the Nifty Index Futures market by Buying 5151 contracts worth 504 crores, resulting in a decrease of 8307 contracts in the Net Open Interest. FIIs sold 1304 long contracts and covered 1314 short contracts , indicating a preference for covering LONG and covering SHORT positions .With FII Long Short Ratio @94.6 % FII’s are heavily long in market , FIIs utilized the market rise to exit Long positions and exit short positions in NIFTY Futures.

Nifty formed an Inside Bar Pattern after Friday Outside Bar on Mars Ingress day and today being Mercury Ingress potential double ingress so we will see an explosive move in next 2 days, Tommrow we have 2 Aspect with North Node (Mercury Square North Node Mars Trine North Node) suggesting we can start seeing volatile mode, As NOrth Node/Rahu tend to create volatlity in the market.

Nifty last 2 day range is within the Friday range of 19525-19303 and formed a perfect DOJI pattern, Tommrow HCL Tech results will come so IT Index will be on limelight , US Inflation Data will come tommorow evening so carry overnight position with Hedge.

As Mars and Mercury Ingress will shown its impact, Bears need break of 19300 and BUlls need break of 19525 till not broken price can remain within the range. Based on Astro studies we should see the range breakout in next 2 session and move of 150-200 points in Nifty

Nifty Trade Plan Bulls will get active above 19440 for a move towards 19490/19544/19599/19653. Bears will get active below 19325 for a move towards 19272/19218/19164.

Traders may watch out for potential intraday reversals at 9:28,11:11,1:32,2:16,2:45 How to Find and Trade Intraday Reversal Times

Nifty July Futures Open Interest Volume stood at 1.01 lakh, witnessing a liquidation of 1.46 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a closing of LONG positions today.

Nifty Advance Decline Ratio at 35:15 and Nifty Rollover Cost is @18884 and Rollover is at 69.7 %.

Nifty options chain shows that the maximum pain point is at 194050 and the put-call ratio (PCR) is at 0.92. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 19500 strike, followed by 19600 strikes. On the put side, the highest OI is at the 19300 strike, followed by 19200 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 19500-19300 levels.

In the cash segment, Foreign Institutional Investors (FII) bought 1197 crores, while Domestic Institutional Investors (DII) sold 7 crores.

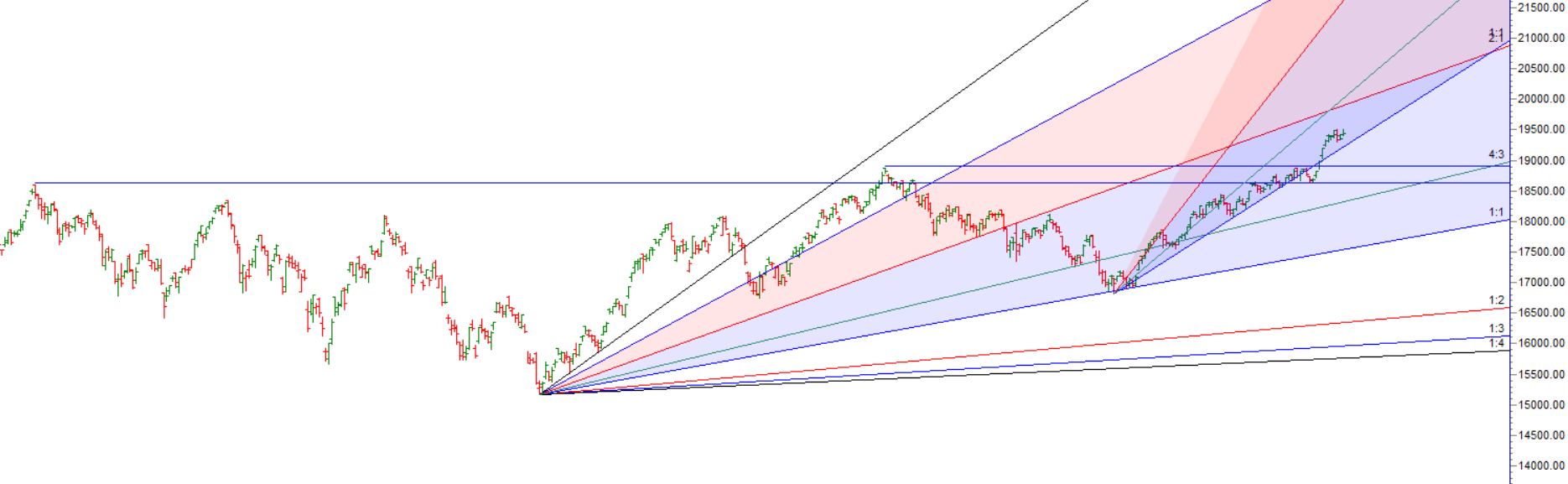

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 18890-19452-20014 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.Price has closed below 19452.

With every trade I imagine that this will be my worst trade ever. And I think about it beforehand, how much of my money I want to lose with it

For Positional Traders, The Nifty Futures’ Trend Change Level is At 19383. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 1513 , Which Acts As An Intraday Trend Change Level.