AXIS BANK

Positional Traders can use the below mentioned levels

Close below 948 Target 920

Intraday Traders can use the below mentioned levels

Buy above 955 Tgt 962, 968 and 975 SL 949

Sell below 945 Tgt 939, 930 and 921 SL 951

LTIM

Positional Traders can use the below mentioned levels

Close above 4915 Target 5008

Intraday Traders can use the below mentioned levels

Buy above 4915 Tgt 4950, 4980 and 5020 SL 4900

Sell below 4850 Tgt 4825, 4800 and 4777 SL 4864

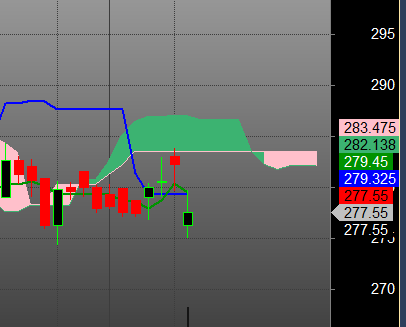

VEDL

Positional Traders can use the below mentioned levels

Close below 276 Target 266

Intraday Traders can use the below mentioned levels

Buy above 278 Tgt 280, 282 and 284.5 SL 276

Sell below 275 Tgt 273, 271 and 269 SL 277

How to trade Intraday and Positional Stocks Analysis — Click on this link

As always I wish you maximum health and trading success

-

All prices relate to the NSE Spot/Cash Market

-

Calls are based on the previous trading day’s price activity.

-

Intraday call is valid for the next trading session only unless otherwise mentioned.

-

Stop-loss levels are given so that there is a level below/above, which the market will tell us that the call has gone wrong. Stop-loss is an essential risk control mechanism; it should always be there.

-

Book, at least, part profits when the prices reach their targets; if you continue to hold on to positions then use trailing stops to lock in your profits.