Crude oil is one of the most actively traded commodities in the financial markets, and the Multi Commodity Exchange of India (MCX) provides a platform for traders to participate in crude oil trading. Understanding the weekly market analysis is crucial for traders who are looking to make informed decisions and optimize their trading strategies. In this article, we will provide a comprehensive analysis of MCX crude oil trading for the week, covering various aspects such as technical analysis, fundamental factors, and market sentiment. The report covers a wide range of topics, including Gann Harmonic and Astro Analysis.

The MCX crude oil futures contract is a popular choice for Indian traders looking to trade crude oil. The contract is based on the prices of crude oil traded on the New York Mercantile Exchange (NYMEX), the global benchmark for crude oil prices. MCX crude oil futures are traded in Indian Rupees (INR) per barrel, with each contract representing 100 barrels of crude oil.

In the week of May 1 to May 05, 2023, MCX crude oil futures opened at INR 6163 per barrel and closed at INR 5841 per barrel, a Decrease of 7%. The highest price reached during the week was INR 6378 per barrel, while the lowest price was INR 5545 per barrel.

Based on the weekly chart, crude oil prices has formed Bearish Enguling pattern on weekly chart and broken its 50 DMA suggesting price can see more downside.

MCX Crude Oil Gann Angle Chart

Crude price showed strong revesal can lead to gap filling till 6000/6200 once above 5900.

MCX Crude Oil Astro Support and Resistace Line

Above 5900 Price can see rally towards 6000/6108 once mercury line of resistance is broken.

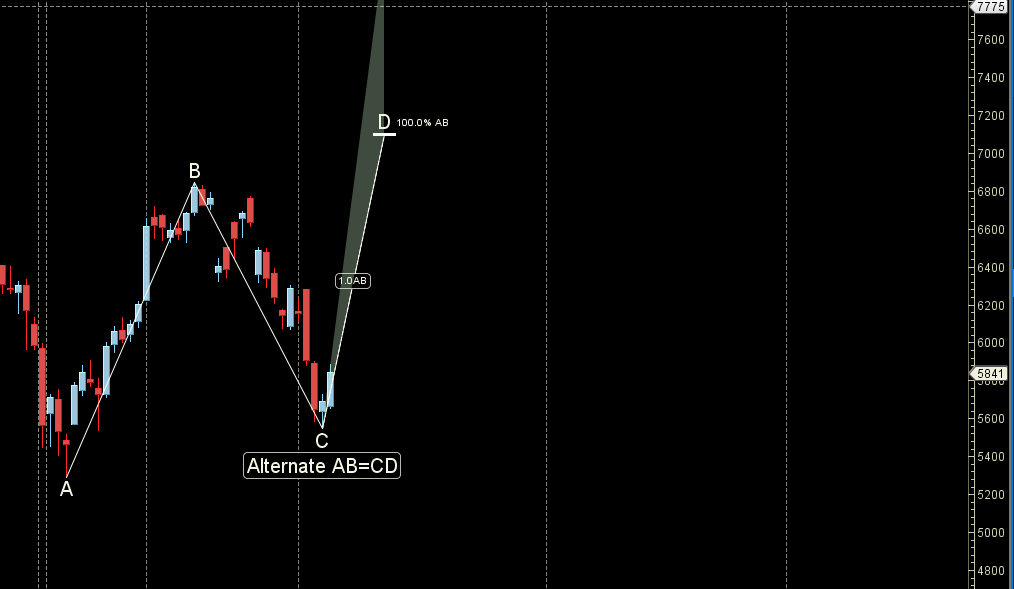

MCX Crude Oil Crude Harmonic

Crude can see move towards 6000/6108 above 5900