As Discussed in Last Analysis We got big move and bank nifty did all target on upside, Tommrow we have mercury retrograde as shown in below video so time to be cautious on longs as it lead to trend reversal. Swing Trade Plan is Bullish above 40248 for a move towards 340447/40645/40843, Bears will get active below 40050 for a move towards 39852/39654/39456. Bank Nifty saw profit booking from higher level, after doing 2 target on upside. Now next week will be very crucial Swing Trade Plan is Bullish above 40481 for a move towards 40681/40882/41083, Bears will get active below 40280 for a move towards 40080/39879/39677/39475

Intraday time for reversal can be at 09:45/10:45/11:53/12:29/1:47/2:20 How to Find and Trade Intraday Reversal Times

Bank Nifty rollover cost @ 38918 and Rollover @73.2 % Closed above the rollover level suggesting bias is Bearish.

Bank Nifty Sep Future Open Interest Volume is at 21.1 lakh with liquidation of 0.18 Lakh contract , with increase in Cost of Carry suggesting long positions were closed today.

When a planet is retrograde, it appears to be standing still momentarily from the viewpoint of an observer situated on planet Earth. Although orbiting planets never stand still, when a planet is retrograde it is as if two vehicles are moving in the same direction and one vehicle passes the other. As the faster vehicle (faster orbiting planet) passes the slower vehicle (slower orbiting planet), for a brief moment in time it appears as though the slower vehicle (slower orbiting planet) is moving backwards. Of course it is not really moving backwards, the effect is purely illusory. Mercury retrograde events (although not frequent) are often associated with significant market highs and lows. Life time High of Nifty on 19 October also happened on Mercury retrograde

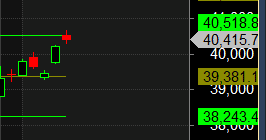

As per Musical Octave 39381 is Pivot Above it rally towards 40518 Below it 38243 . — 40518 Done

Maximum Call open interest of 28 lakh contracts was seen at 40500 strike, which will act as a crucial resistance level and Maximum PUT open interest of 21 lakh contracts was seen at 4000 strike, which will act as a crucial Support level

MAX Pain is at 40400 and PCR @1.01 . PCR below 0.95 and above 1.3 lead to trending moves, and in between leads to range bound markets.

Good risk management decreases the amount of your draw downs which makes trading a much easier proposition. Consistently growing capital is a much more pleasant process when you are not trying to come back from 25%-50% draw downs, trust me on this, been there done that.

For Positional Traders Trend Change Level is 39599 on Futures go long and short above/below it That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 40565 will act as a Intraday Trend Change Level.

Hello Sir Please Share (Gann Weekly Trade Idea For Reliance Kotak BANK ICICI BANK and Infosys ) sir these trade idea is not posted from last 2 or 3 weeks please share it if possible. ur these efforts a means a lot for us, God Bless you always for this Thanks.