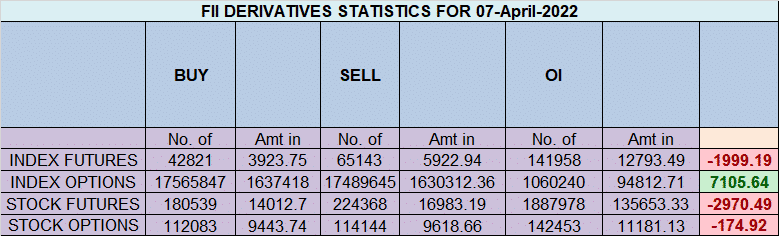

FII sold 22.3 K contract of Index Future worth 1999 cores, Net OI has decreased by 7.2 K contract 14.7 K Long contract were covered by FII and 7.5 K Shorts were covered by FII. Net FII Long Short ratio at 2 so FII used fall to exit long and enter short in Index Futures.

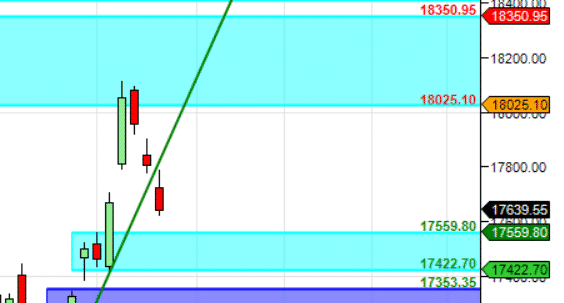

As Discussed in Last Analysis For Swing Traders Bulls need to move above 17845 for a move towards 17912/17980/18047. Bears will have chance below 17778 for a move towards 17710/17643/17576. 2 Bearish target done and now we are approaching support zone of 17559-17610. Any Sell off Before RBI event is good as market is not expecting anything great and any positive surprise can lead to short covering rally. There are 3 Major Aspect today which Involved Finnacial Plannet URanus and can lead to big move in market. Mercury Conjunct Uranus HELIO | Mercury Square Saturn HELIO | MOON Extreme Declination. First 15 mins High and Low will decide the trend of the market. For Swing Traders Bulls need to move above 17690 for a move towards 17756/17822/17889. Bears will have chance below 17587 for a move towards 17520/17454/17387.

Intraday time for reversal can be at 9:20/11:21/1:11/2:14 How to Find and Trade Intraday Reversal Times

MAX Pain is at 17750 PCR at 0.67 , Rollover cost @17418 closed above it. PCR below 0.9 and above 1.3 lead to trending moves, and in between leads to range bound markets.

Nifty April Future Open Interest Volume is at 0.98 Cores with liquidation of 3.1 Lakh with increase in cost of carry suggesting LONG positions were closed today.

The Option Table data indicates decent support at 17600 and reasonable resistance at 17900 . There is total OI of 4.66 Cores on the Call side and 3.85 Cores on the Put side, So, the activity is more on the CALL side, indicating option writers are in BEARISH zone.

FII’s sold 5009 cores and DII’s bought 1775 cores in cash segment.INR closed at 76. FII Sell data also consists of ZEE Invesco Deal so numbers are not that bad.

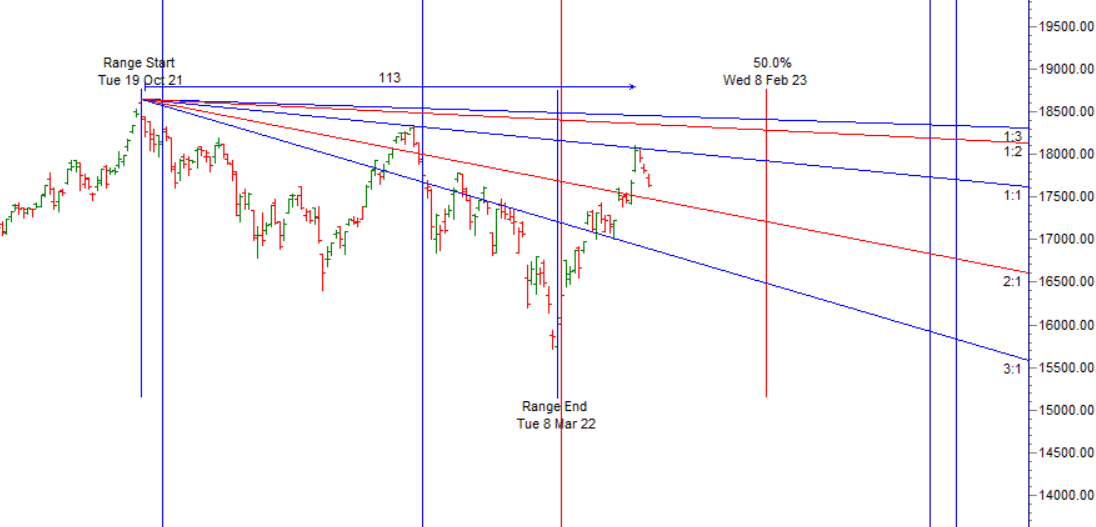

06 April was Mars and Saturn Aspect ,High of 18095 and 17921 is valid for whole year Mark in on your charts and take trade on break of High and Low.

17828 again will give us 250-300 points move. Almost 200 points done.

Governor Shaktikanta Das to announce MPC decision at 10 am. The central bank is expected to keep rates unchanged and maintain its accommodative stance in its first monetary policy committee meet for the new financial year

Aspiring traders are convinced that they can solve any problem arising in trading all by themselves. That‘s why they first look for flaws in the trading system and then fail to realise how much their own mental state causes them to do things that have unintended consequences.

For Positional Traders Stay long till we are holding Trend Change Level 17817 and stay short below it. That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 17771 will act as a Intraday Trend Change Level.