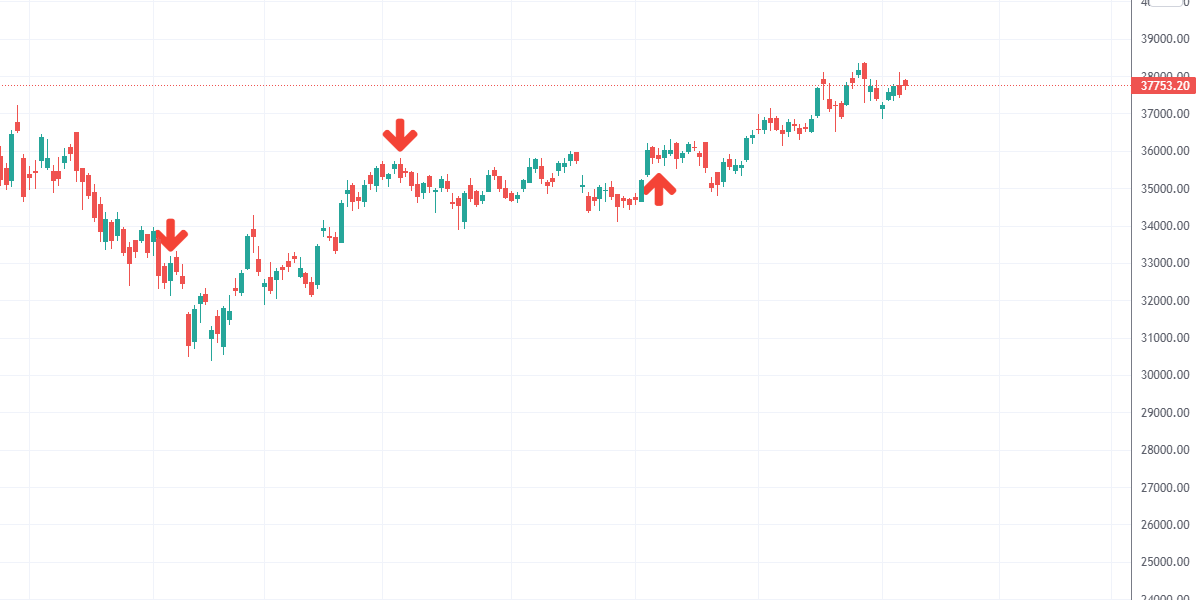

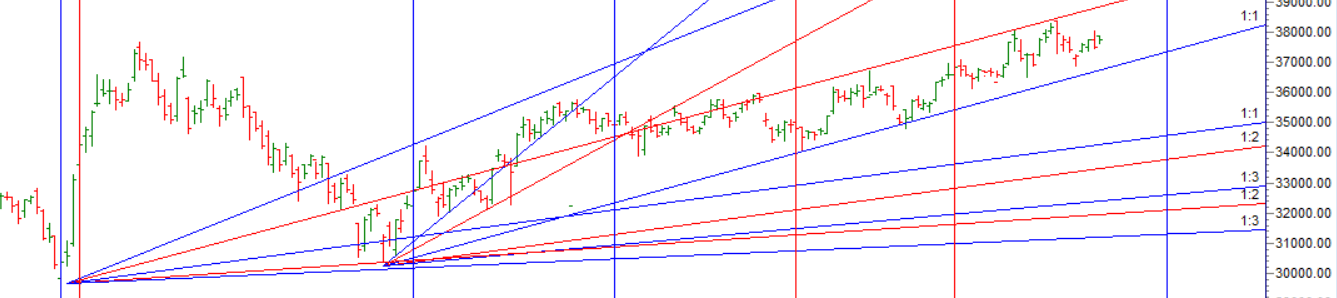

As discussed in Last Analysis All Bullish target were done above 37648 and we also saw the impact of Mars created havoc in market. Now Bulls need to move above 37645 for a move towards 37742/37840/37937/38034. Bears will get active below 37398 for a move towards 37302/37205/37109/37013. Low made was 37650 and almost did the 3 target of 37937. We have RBI Policy tomrmow as you can see in chart below of last 3 RBI Policy no major movement was seen during the day only after 2-3 days trend will emerge. Mars again created havoc for Bears every dips is getting bought into. Now Bulls need to move above 37785 for a move towards 37901/38049/38175. Bears will get active below 37610 for a move towards 37627/37502/37354.

- Intraday time for reversal can be at 9:15/10:57/12:38/1:41/2:31 How to Find and Trade Intraday Reversal Times

- Bank Nifty Oct Future Open Interest Volume is at 17.2 lakh with liqudiation of 1.7 Lakh contract , with increase in Cost of Carry suggesting LONG positions were added today.

- Options Writers can watch for the range of 38072 on upside and 37434 on downside so shorting a 38100 CE and 37400 PE with 50% premium as SL can lead to good gains.

- MAX Pain is at 37800 PCR at 0.93, Rollover Price is at 37993 closed below it and OI Breakout zone 37850 closed above it

- The Option Table data indicates decent support at 37500 and reasonable resistance at 37800.

- For Positional Traders Stay long till we are holding Trend Change Level 37704 and stay short below it. That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 37927 will act as a Intraday Trend Change Level.