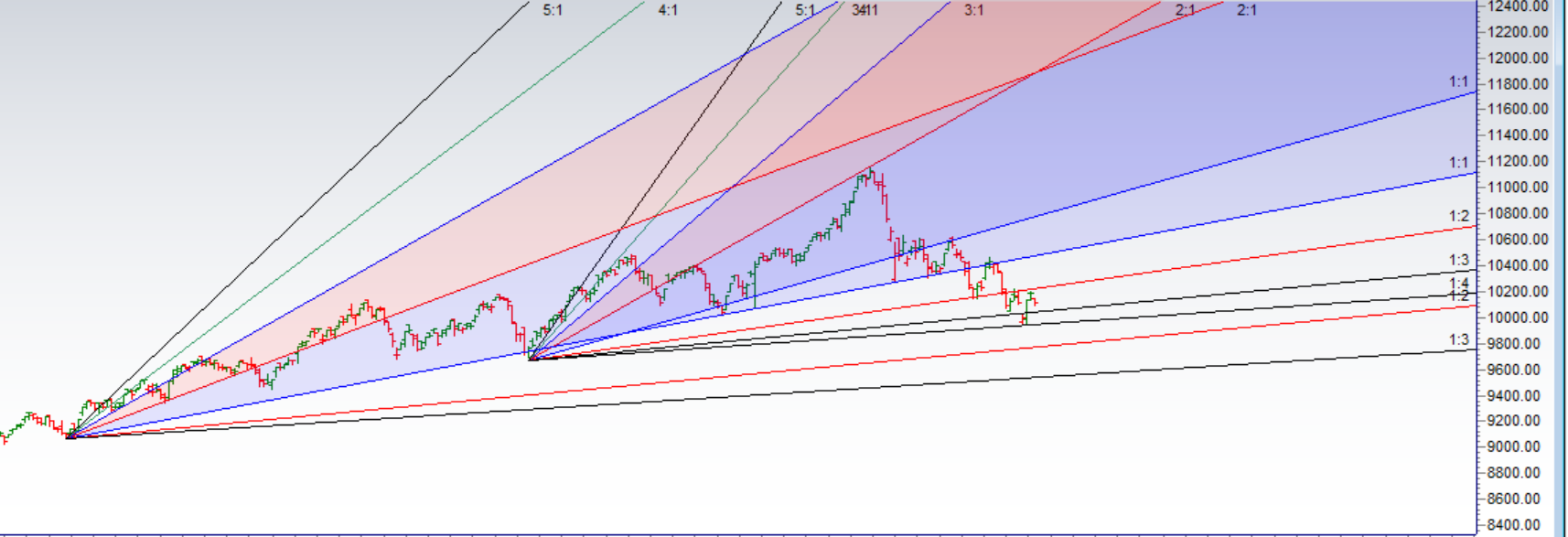

- As Discussed in Last Analysis Nifty today’s high 10207 is very crucial as its at the gann angle from where nifty was not able to close above it in past 3-4 attempts. Bulls need a close above 10210 for upmove to continue towards 10250/10333/10420. Bearish below 10100 for a move back to 10000/9936. Low made 10096 and bulls kept hold at 10100 on monthly close basis,Now bulls need close above 10210 gann angle resistance which once crossed open gate till 10500in April series. Bearish below 10077 for a move back to 10000/9920/9700. Important intraday time for reversal can be at 1:40. Bank Nifty Analysis for March Expiry

- Nifty April Future Open Interest Volume is at 1.93 core with addition of 53.7 Lakh with increase in cost of carry suggesting long position were added today, NF Rollover cost @10156 and Rollover%@ 63.3.

- Total Future & Option trading volume at 11.31 Lakh core with total contract traded at 1.72 lakh , PCR @0.95

- 10500 CE is having Highest OI at 30.9 Lakh, resistance at 10400 followed by 10500 .10000-10600 CE added 32.7 lakh in OI so bears added position in range of 10300-10500 suggesting 10500 strong resistance.

- 10000 PE OI@32 lakhs having the highest OI strong support at 10100 followed by 10000 . 10000-10500 PE added 23 Lakh in OI so bulls added position in 10000-10100 PE suggesting 10100 strong support.

- FII’s sold 1190 cores and DII’s bought 1960 cores in cash segment.INR closed at 65.17

- Nifty Futures Trend Deciding level is 10158 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 10158 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 10200 Tgt 10222,10245 and 10283 (Nifty Spot Levels)

Sell below 10170 Tgt 10145,10110 and 10080 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh