Wishing Readers Happy,Prosperous and Profitable New Year 2012

;

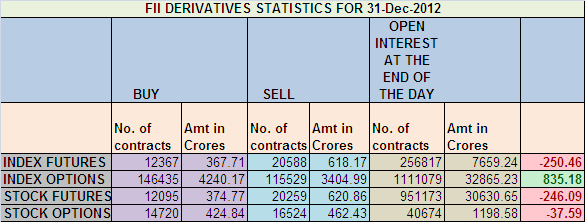

1. FIIs sold 8221 Contracts of Index Future (NSE Nifty Futures and Bank Nifty Futures combined),worth 250.46 cores with net Open Interest decreasing by 6665 contracts. Must read Common Trading Mistakes to aviod in 2013 http://bit.ly/YFgj1P

2. As CNX Nifty Future was down by 3 points with Open Interest in Index Futures decreasing by 6665, so FIIs have booked profit in longs in Nifty and Bank Nifty Futures.Nifty Futures has been trading in tight range with lowest volume of 2012 as most of FII have gone for holidays.

3. NS closed at 5905 after making high of 5919 and low of 5897.Nifty was unable to break 5930 and is near the higher end of trading range so if 5930 is not broken on closing basis in next 2 days we can see a pullback near the lower end of trading range which is 5823. The recent price action suggests that the index is taking a breather before embarking on the next major move.

4. Resistance for Nifty has come up to 5930and 5950 which needs to be watched closely ,Support now exists at 5870 and 5895.Trend is Sell on Rise till 5931 is not broken on closing basis.Tomorrow most of world markets will be having holidays and we will also get clarity on fiscal cliff situation.

5. Nifty Future January Open Interest Volume is at 1.63 cores with addition of 0.41 lakh in Open Interest, Cost fof Carry of Nifty Future at 8.Premium in NF is at 45 which is very high and it shows excessive bullishness in market participants. Whenever traders gets confidence about a move market always have a habit to surprise

;

;

;

6. Total Future & Option trading volume was lowest in 2012 at .48 lakh Cores with total contract traded again lowest in 2012 at 0.76 lakh, PCR (Put to Call Ratio) at 0.99 and VIX at 14.95. VIX rose by almost 10% because of fiscal cliff uncetanity.

7. 6000 Call Option is having highest Open Interest of 55 lakhs with addition of 4.7 lakhs in Open Interest, 5900 Nifty CE also saw addition of 1.1 lakhs in OI,6100 Call Option added 6 lakhs in OI with premium at Rs 35 .5500-6100 Call Options added 11.9 lakhs in OI.

8. 5800 Put Option is having Open Interest of 52 lakhs with addition of 4.5 lakhs in OI so firm base is set up at 5800 and 5900 Put Option added 2.3 lakhs with OI at 39 Lakhs .5500-6100 Put Options added 21.6 lakhs in OI. Range as per Rollover comes at 5990-5992 NF is maintaining it for past 2 days.

9. FIIs buying in Equity in tune of 826 cores and DII bought 200 cores in cash segment,INR closed at 54.95 Live INR rate @ http://inrliverate.blogspot.in/).

10. Nifty Futures Trend Deciding level is 5946(For Intraday Traders), Trend Changer at 5946 NF(For Positional Traders). (Above this Level Bulls will rule Nifty/Below this levels Bears have upper hand). Bank Nifty Future Trend Changer Level 12571. As both Trend Deciding and Trend Changer levels are near by expect a big move.

Buy above 5930 Tgt 5950,5965 and 5990

Sell below 5895Tgt 5870,5850,5825(Nifty Spot Levels)

Disclaimer: These are my personal views and trade taken on these observation should be traded with strict Sl

We do discussion is Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863

You can register your email address under Post In your Inbox(Right Side Column) if you want to receive mail instantaneously as soon as site get updated. You will receive a confirmation mail in your registered email address you need to click on link to get it confirmed.