Fibonacci technique

Fib retracements

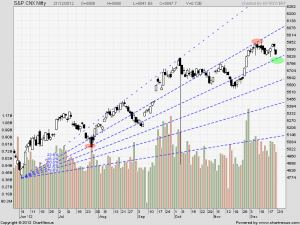

Fibonacci Ratios are drawn in above chart from 5548-5965 showing Fibonacci support and Fibonacci resistance. Close above 5965 is required for a breakout and support now exists at 5805 and 5756.

As discussed earlier Fibonacci fan helps in finding potential tops and Bottom of market from short term prospective. If we see the chart closely with Fibonacci fans 5945-5963 is level of resistance, Nifty reacted from 5965 and now support is at 5820.

Nifty Weekly Chart

Trading Monthly charts

Close above 5217 is bullish for market for rest of year, I have been writing this for almost 6 months and Nifty has made almost 20% return for the Year 2012.Support on Monthly charts comes at 5787 and resistance at 5965.As per Historical data December has been 3-4% move month in Nifty and till now we have formed a DOJI candelstick on Monthly chart so next weeks will be crucial. Will be see Santa Rally before expiry?

Nifty Trading Levels

Nifty Trend Deciding Level:5883

Nifty Resistance:5915,5965,6025 and 6069

Nifty Support:5825,5771 and 5720

Levels mentioned are Nifty Spot

Read the Weekly Analysis Part I

Let me go by Disclaimer these are my personal views and trade taken on these observation should be traded with strict Sl

We do discussion is Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863