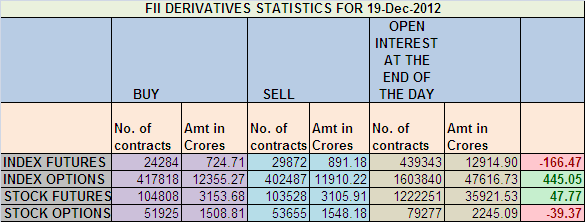

1. FIIs sold 5588 Contracts of Index Future (NSE Nifty Futures and Bank Nifty Futures combined),worth 166.47 cores with net Open Interest increasing by 5562 contracts.

2. As CNX Nifty Future was up by 18 points with Open Interest in Index Futures increasing by 5562, so FIIs have created longs in Nifty and Bank Nifty Futures. Tomorrow we have the all important election results of Gujarat and HP, Stock specific action in Adani group stocks will be seen.

3. NS closed at 5930after making high of 5939 and low of 5911, we still have an opening gap which is unfilled at 5897 and nifty maintaing it throughout the day is a bullish sign.Today again Nifty formed an NR7 day so expect volatility and range expansion tomorrow.

4. Resistance for Nifty has come up to 5950 and 5965 which needs to be watched closely ,Support now exists at 5910 and 5897.Trend is Buy on Dips till 5825 is not broken on closing basis.

5. Nifty Future December Open Interest Volume is at 2.14 cores with liquidation of 2.6 lakh in Open Interest, Cost of Carry of NF reduced to 9.Longs liquidation seen in NF and cost of carry has also reduced which is a bullish sign

6. Total Future & Option trading volume was at 1.25 lakh Cores with total contract traded 1.28 lakh, PCR (Put to Call Ratio) at 0.91 and VIX at 14.47.Cash market volume were higher today suggesting supply on higher end is getting absorbed with huge FII inflows

7. 6000 Call Option is having highest Open Interest of 1.13 Cores with liquidation of 3.5 lakhs in Open Interest, 5900 Call also saw liquidation 2.6 lakhs in OI,6100 Call Option added 6.0 lakhs in OI with premium at Rs 6 so shorts got covered in 6100 CE and longs are also added. 5500-6100 Call Options liquidated huge 10.8 lakhs in OI.

8. 5800 Put Option is having Open Interest of 95 lakhs with addition of 3.8 lakhs in OI so firm base is set up at 5800 and 5900 Put Option added 0.04 lakhs with OI at 66.9 Lakhs so Bulls again added shorts in 5900 Put as nifty was closed above 5900 .5500-6100 Put Options added 3.59 lakhs in OI. Options table have totally changed today and is now tilting on bulls side.

9. FIIs buying in Equity in tune of 1244 cores and DII sold 369 cores in cash segment,FII has bought 47.7 cores of Stock futures .INR closed at 54.96 Live INR rate @ http://inrliverate.blogspot.in/).FII has bought 12664 cores in cash segment in December series till date.

10. Nifty Futures Trend Deciding level is 5958(For Intraday Traders), Trend Changer at 5922NF(For Positional Traders). (Above this Level Bulls will rule Nifty/Below this levels Bears have upper hand). Bank Nifty Future Trend Changer Level 12375.

Buy above 5940 Tgt 5955,5970,6000

Sell below 5910 Tgt 5897,5881 and 5865(Nifty Spot Levels)

Disclaimer: These are my personal views and trade taken on these observation should be traded with strict Sl

We do discussion is Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863

You can register your email address under Post In your Inbox(Right Side Column) if you want to receive mail instantaneously as soon as site get updated. You will receive a confirmation mail in your registered email address you need to click on link to get it confirmed.

Aayush ji NR7 is Narrow Rang-7day.

What is nr7 day??

Are u on twitter??

Hi Ayush,

Hope you doubt got cleared … Thanks Albelaji for explaing.

Yes i am on twitter https://twitter.com/brahmesh

Rgds,

Bramesh