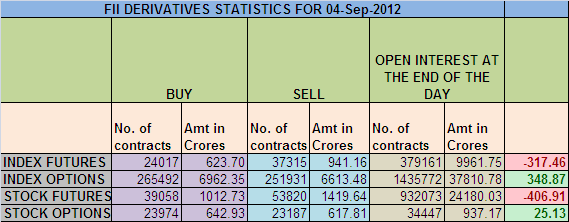

1. FII sold 13298 Contracts of Index Future,worth 317.46 cores with net OI decreasing by 27718 contracts.

2. As Nifty Future was up by 16.50 points and OI has decreased by 27718,so profit booking happened on longs carried by FII in August Series.So FII have been reducing the long exposure in Index future and shorting stock futures.

3. NS closed at 5274 after making the higher low of 5233 , Nifty broke the inside day pattern today morning but unable to give the follow up move. Nifty also closed above 5263 which is 50 SMA.As per gap theory gap till 5220 once nifty entered the gap region should be filled as soon as possible and till now nifty is unable to do so. So rise should be treated with caution as Nifty can fall to fill the gap.

4. Resistance for Nifty has come up to 5288 and 5306 which needs to be watched closely ,Support now exists at 5238 and 5220 .Trend is Sell on Rise till 5338 is not broken on closing basis.

5. Nifty September OI is at 1.89 cores with an unwinding of 8.18 Lakh in OI,so shorts which entered the system yesterday got squared off today. Rollover range for September Series comes at 5400-5290.

6. Total F&O turnover was 0.73 lakh Cores with total contract traded at 1.69 lakh lowest in September Series.

7. 5400 CE is having highest OI of 62 lakhs with an addition of 4.4 lakhs in OI. 4900-5600 CE added 19 lakhs in OI.

8. 5200 PE added 2.8 lakh in OI and having the highest OI at 66 lakhs so 5200 is firm base at the starting of September series.4900-5600 PE added 12 lakhs in OI.

9.FII bought 304 cores and DII sold 105 cores in cash segment,INR closed at 55.52 Live INR rate @ http://inrliverate.blogspot.in/).FII were again sellers of 406 cores in Stock futures.

10. Nifty Futures Trend Deciding level is 5254, Trend Changer at 5298 NF. (Above this Level Bulls will rule Nifty/Below this levels Bears have upper hand).

Buy above 5278 Tgt 5295,5315 and 5345

Sell below 5238 Tgt 5220,5200 and 5166 (Nifty Spot Levels)

Disclaimer: These are my personal views and trade taken on these observation should be traded with strict Sl

We do discussion is Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863

You can register your email address under Post In your Inbox(Right Side Column) if you want to receive mail instantaneously as soon as site get updated. You will receive a confirmation mail in your registered email address you need to click on link to get it confirmed.

Dear Bramesh, I have benifited a lot from your analysis from time to time. But always i wanted to add one thing to your analysis…””there is no point in finding support/resistance on something which is not tradable like nifty spot. Support/Resistance exist for NF only and levels/gaps/everything should be given per NF levels only””. hope this will be taken in right spirits.

regards

Nitin

Dear Nitin,

Traders who trade in large quantity will always track NS as its more reliable as compared to NF as its keep moving in Premium and discount.

You need to develop the art to trade as per NS.

Rgds,

Bramesh