Identifying Gann time cycles in the stock market involves a combination of historical price analysis, geometric angles, and astrological data. Here’s a step-by-step guide to help you understand and apply Gann time cycles in your trading strategy:

Step 1: Understand the Basics of Gann Theory

- Who Was W.D. Gann?: W.D. Gann was a famous trader known for his market forecasting techniques based on time and price symmetry.

- Fundamental Concepts: Gann believed that markets are cyclical and that historical price movements could predict future trends.

Step 2: Study Historical Price Data

- Historical Analysis: Review past price movements of the stock or market index. Identify significant highs and lows.

- Patterns and Cycles: Look for recurring patterns and time intervals between these significant points.

Step 3: Use Gann Angles

- Gann Fan: Draw Gann angles from significant highs and lows. The most common angles are 1×1 (45 degrees), 1×2, and 2×1.

- Geometric Progression: Gann believed that price movements follow geometric progressions, so angles like 45°, 30°, and 60° are crucial.

Step 4: Apply Gann Time Cycles

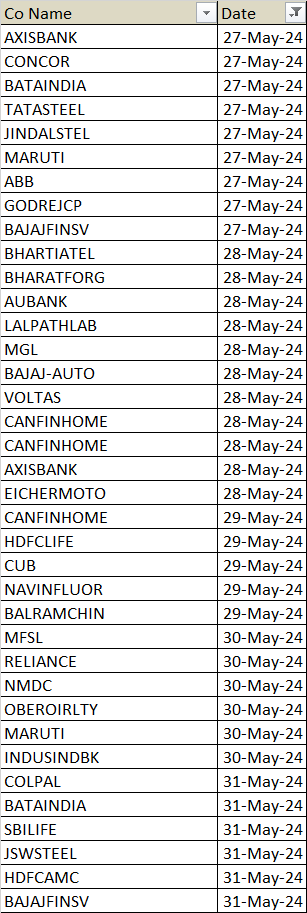

- Time Intervals: Calculate time intervals between significant highs and lows. Common cycles include 30, 60, 90, 120, and 180 days.

- Anniversaries: Look for yearly, monthly, and weekly anniversaries of past significant market moves. Gann noted that markets often turn on these dates.

Step 5: Incorporate Astrology (Optional)

- Planetary Cycles: Gann used astrological cycles, such as the positions of planets, to predict market movements. Study how planetary positions correlate with market cycles.

- Software Tools: Use specialized software that includes astrological data to overlay planetary cycles on your price charts.

Step 6: Validate with Modern Tools

- Technical Analysis: Combine Gann time cycles with modern technical analysis tools like moving averages, RSI, and MACD to confirm signals.

- Backtesting: Test your findings on historical data to see how accurately they predict future movements.

Step 7: Develop a Trading Plan

- Entry and Exit Points: Based on Gann time cycles and angles, determine potential entry and exit points.

- Risk Management: Always incorporate risk management techniques, such as stop-loss orders and position sizing, to protect your capital.

Step 8: Monitor and Adjust

- Regular Review: Continuously monitor market conditions and adjust your analysis as needed.

- Stay Informed: Keep learning about Gann theory and other complementary trading techniques to refine your strategy.

Resources

- Books and Courses: Consider reading books by or about W.D. Gann, such as “The Truth of the Stock Tape” and “45 Years in Wall Street.”

- Software: Utilize trading software that supports Gann analysis, such as GannTrader or TradingView with Gann tools.

By following these steps, you can begin to identify and utilize Gann time cycles to enhance your trading strategy in the stock market.