Analysis of FIIs’ behavior in the Nifty Index Futures market shows a Bullish approach as they displayed a preference for LONG positions. On a net basis, FIIs went LONG 2876 contracts worth 319 crores, resulting in an decrease of 5962 contracts in the Net Open Interest.

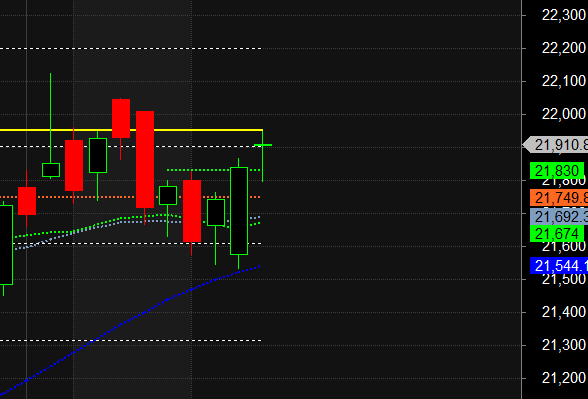

We have seen importance of Astro date and trading with price levels as Nifty protected 21500 low made was 21530 held on to its 50 DMA and stage a smart recovery and again bounced from its 3×4 gann angle. Mars being an energy plannets its adds fuel to fire. Now Bulls need to close above 21950 for upmove to continue. Bears can strike back if price breaks 21830 . Trade cautiously as today also we can see wild swings like yesterday.

Nifty again had a volatile session but continue to trade above 3×4 gann angle and closed above its short term moving averages suggesting buying at lower levels. Today we have VENUS Ingress and Gann Important 16 Feb date, For Gann Students observe what has happened at 16 Feb in last 4 years you will get an idea on gann short term cycle. For Bears to come back price needs to go below 20830.

Nifty Trade Plan for Positional Trade ,Bulls will get active above 21970 for a move towards 22043/22117 . Bears will get active below 21823 for a move towards 21750/21676.

Traders may watch out for potential intraday reversals at 10:58,11:39,01:14,02:41 How to Find and Trade Intraday Reversal Times

Nifty Feb Futures Open Interest Volume stood at 1.14 lakh cr , witnessing a liquidation of 3.6 Lakh contracts. Additionally, the increase in Cost of Carry implies that there was a closeure of SHORT positions today.

Nifty Advance Decline Ratio at 36:14 and Nifty Rollover Cost is @21592 closed above it.

Nifty Gann Monthly Buy Trade level : 21915 and Gann Monthly Sell Trade level : 21646

Nifty has closed below its above 20 DMA 21749 and 50 SMA @21499.

Nifty options chain shows that the maximum pain point is at 22000 and the put-call ratio (PCR) is at 0.82. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 21900 strike, followed by 22000 strikes. On the put side, the highest OI is at the 21800 strike, followed by 21700 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 21800-22000 levels.

In the cash segment, Foreign Institutional Investors (FII) sold 3064 crores, while Domestic Institutional Investors (DII) bought 2276 crores.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 22467-21836-21205 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

If you want to be a good trader “Be the Best Listener.” Listen To Market, Experienced Traders. If a losing trade sets you off, then this can affect your trades going forward. And this is dangerous. We call this trading on “tilt.”

For Positional Traders, The Nifty Futures’ Trend Change Level is At 21821 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 21950 , Which Acts As An Intraday Trend Change Level.

Nifty Intraday Trading Levels

Buy Above 22000 Tgt 22033, 22066 and 22108 ( Nifty Spot Levels)

Sell Below 21975 Tgt 21940, 21900 and 21850 (Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

Dear Sir,

Its amazing day to watch sincerely market yesterday as 16 feb imp date,

Learning a lot from u ,

May GOD give u Best of health and success ahead,

Regards,