Foreign Institutional Investors (FIIs) exhibited a Bearish stance in the Bank Nifty Index Futures market by Shorting 48 contracts with a total value of 1.56 crores. This activity led to a decrease of 2824 contracts in the Net Open Interest.

Bank Nifty formed DOJI on Budget day nd we will open gap up today. With Goverment saying they will borrow less and bond yields are coming down its good for PSU’s bank. With gap up today 45367 is important level to watch out for, for this downtrend to get over. Monday Mercury is changing sign so take overnight positon with Hedge.

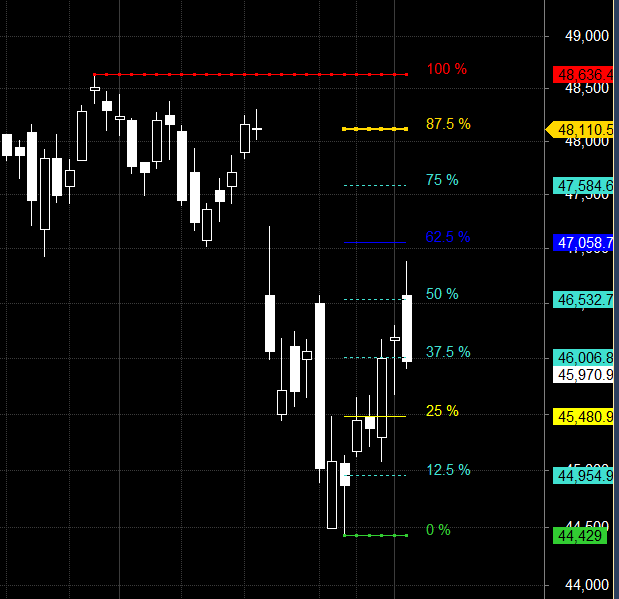

Bank Nifty reacted from the 46656 Gann Level and 46532 Octave Points and was unable to close above its 20/50 SMA, suggesting selling pressure on the higher side. SBI’s numbers came out today, but we are seeing NIM being impacted, similar to HDFC Bank.While there was an Exceptional Writeoff related to Pensions factually they underprovided earlier and had to provide now Net Interest Income has been declining for the last few quarters On Monday, we have Mercury Ingress, which generally leads to a trend change. January 15th was also a Mercury Ingress, and we have seen how Bank Nifty made a short-term top. For intraday trading, watch out for the first 15 minutes high and allow it to capture the trend of the day.

Bank Nifty Trade Plan for Positional Trade ,Bulls will get active above 46242 for a move towards 46459/46675/46892. Bears will get active below 45809 for a move towards 45493/45376/45160

Traders may watch out for potential intraday reversals at 10:25,11:38,12:19,01:45,2:38 How to Find and Trade Intraday Reversal Times

Bank Nifty Feb Futures Open Interest Volume stood at 28.4 lakh, liqudiation of 2 lakh contracts. Additionally, the decrease in Cost of Carry implies that there was a covering of SHORT positions today.

Bank Nifty Advance Decline Ratio at 04:08 and Bank Nifty Rollover Cost is @45685 closed above it.

Bank Nifty Gann Monthly Buy Trade level : 46450 and Gann Monthly Sell Trade level : 45879

Bank Nifty has closed above its 200/100 DMA but failed closed 50/20 DMA. Trend is Sell on Rise till we close above 46636.

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 43344-44634-45923. This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable. Price is near 47265

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 46000 strike, followed by the 46500 strike. On the put side, the 45500 strike has the highest OI, followed by the 5000 strike.This indicates that market participants anticipate Bank Nifty to stay within the 45000-46000 range.

The Bank Nifty options chain shows that the maximum pain point is at 46000 and the put-call ratio (PCR) is at 0.80 . Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

We donít have to beat the market. The market will give us what we earn. Just open up those egoless eyes and listen to what the market wants to tell us, not what we want to tell the market.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 45874. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 46686 , Which Acts As An Intraday Trend Change Level.

BANK Nifty Intraday Trading Levels

Buy Above 46000 Tgt 46112, 46254 and 46396 (BANK Nifty Spot Levels)

Sell Below 45888 Tgt 45729, 45610 and 45444 (BANK Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.