Foreign Institutional Investors (FIIs) exhibited a Bearish stance in the Bank Nifty Index Futures market by Shorting 2125 contracts with a total value of 147 crores. This activity led to a decrease of 3859 contracts in the Net Open Interest.

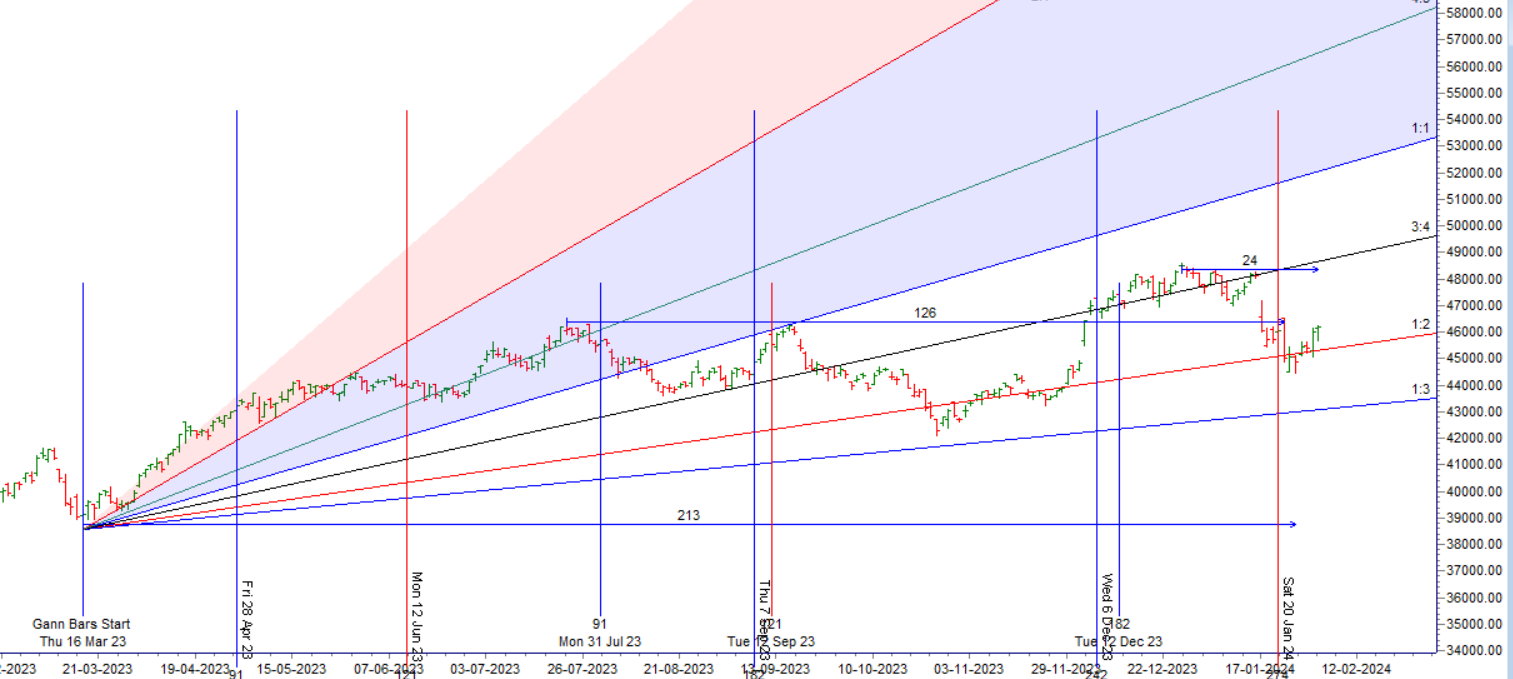

Tommrow we have important Bayer Rule 9: Big changes on market are when Mercury passes over 19 degrees 36 minutes of Scorpio and Sagittarius,also over 24 degrees 14 minutes of Capricorn. Bank Nifty bounced from gann angle support zone as shown in below chart. Tommrow to capture trend focus on first 15 mins High and low to capture trend. Make sure trade with right positon size as we will have high volatlity. Also try to trade after Finance Minister stops speaking and we will see option premium decay after FM completes its speech. Betwenn 1-1:15 we can see change in trend.

Bank Nifty formed DOJI on Budget day nd we will open gap up today. With Goverment saying they will borrow less and bond yields are coming down its good for PSU’s bank. With gap up today 45367 is important level to watch out for, for this downtrend to get over. Monday Mercury is changing sign so take overnight positon with Hedge.

Bank Nifty Trade Plan for Positional Trade ,Bulls will get active above 46132 for a move towards 46345/46557/46769. Bears will get active below 45708 for a move towards 45495/45283/45071.

Traders may watch out for potential intraday reversals at 09:23,10:39,11:37,12:30,2:23 How to Find and Trade Intraday Reversal Times

Bank Nifty Feb Futures Open Interest Volume stood at 30.4 lakh, liqudiation of 0.55 lakh contracts. Additionally, the decrease in Cost of Carry implies that there was a covering of SHORT positions today.

Bank Nifty Advance Decline Ratio at 10:02 and Bank Nifty Rollover Cost is @45685 closed above it.

Bank Nifty Gann Annual Trend Change Level : 44680

Bank Nifty has closed above its 200/100 DMA but failed closed 50 DMA. Trend is Sell on Rise till we close above 46566.

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 43344-44634-45923. This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable. Price is near 47265

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 46000 strike, followed by the 46500 strike. On the put side, the 45500 strike has the highest OI, followed by the 5000 strike.This indicates that market participants anticipate Bank Nifty to stay within the 45000-46000 range.

The Bank Nifty options chain shows that the maximum pain point is at 46200 and the put-call ratio (PCR) is at 0.80 . Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

Studies show that traders avoid risk when winning and seek risk when losing. This is the exact opposite of what needs to done to sustain in the markets. We must reprogram ourselves and create habits that are unnatural until they become our second nature.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 45712 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 46188 , Which Acts As An Intraday Trend Change Level.

BANK Nifty Intraday Trading Levels

Buy Above 46300 Tgt 46440, 46610 and 46752 (BANK Nifty Spot Levels)

Sell Below 46121 Tgt 45987, 45802 and 45610 (BANK Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.