Foreign Institutional Investors (FIIs) exhibited a Bullish stance in the Bank Nifty Index Futures market by Buying 14085 contracts with a total value of 979 crores. This activity led to a increase of 11013 contracts in the Net Open Interest.

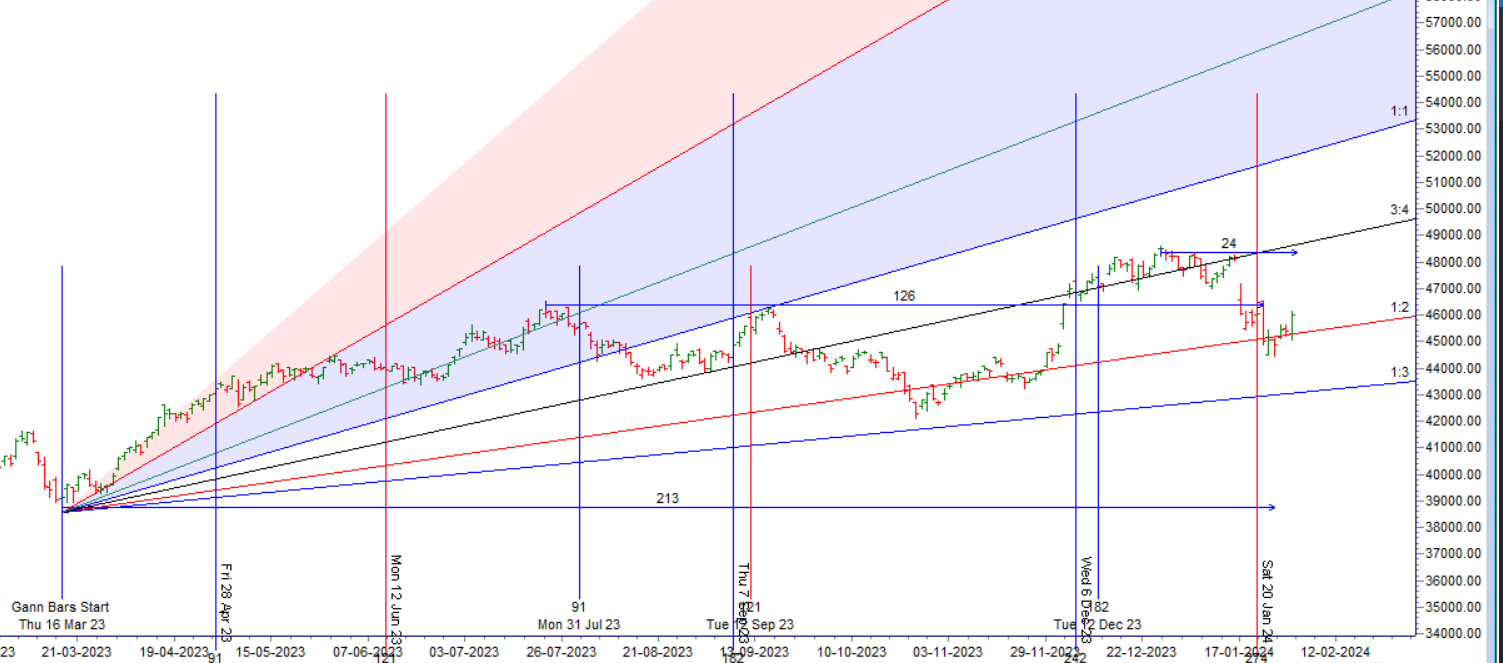

Bank Nifty formed a DOJI , VIX has touched 16 and next 2 days Volatility will be huge. Bulls need to protect 45110 for rally tommrow , Bears below 45000 can lead to fall towards the last swing low of 44729/44444.Tommrow we have Moon Declination which leads to voaltile move. We have Monthly close tommrow Bears would like to close 45000. Price is back to gann angle suport.

Tommrow we have important Bayer Rule 9: Big changes on market are when Mercury passes over 19 degrees 36 minutes of Scorpio and Sagittarius,also over 24 degrees 14 minutes of Capricorn. Bank Nifty bounced from gann angle support zone as shown in below chart. Tommrow to capture trend focus on first 15 mins High and low to capture trend. Make sure trade with right positon size as we will have high volatlity. Also try to trade after Finance Minister stops speaking and we will see option premium decay after FM completes its speech. Betwenn 1-1:15 we can see change in trend.

Bank Nifty Trade Plan for Positional Trade ,Bulls will get active above 46132 for a move towards 46345/46557/46769. Bears will get active below 45708 for a move towards 45495/45283/45071.

Traders may watch out for potential intraday reversals at 9:44,11:04,12:33,01:01,2:13 How to Find and Trade Intraday Reversal Times

Bank Nifty Feb Futures Open Interest Volume stood at 31 lakh, liqudiation of 1.9 lakh contracts. Additionally, the decrease in Cost of Carry implies that there was a covering of SHORT positions today.

Bank Nifty Advance Decline Ratio at 12:00 and Bank Nifty Rollover Cost is @45685 closed above it.

Bank Nifty Gann Annual Trend Change Level : 44680

Bank Nifty has closed above its 200/100 DMA but failed closed 50 DMA. Trend is Sell on Rise till we close above 46537.

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 43344-44634-45923. This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable. Price is near 47265

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 46000 strike, followed by the 46500 strike. On the put side, the 45500 strike has the highest OI, followed by the 5000 strike.This indicates that market participants anticipate Bank Nifty to stay within the 45000-46000 range.

The Bank Nifty options chain shows that the maximum pain point is at 46000 and the put-call ratio (PCR) is at 0.80 . Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

The rules say that we should let our profits run and cut our losses short. Most of us find that we do just the opposite. What happens is that our egos want to show off their brilliance by seeking profits. The ego is like a little child. It wants instant gratification. Taking profits early gives that quick reward.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 45593 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 46126, Which Acts As An Intraday Trend Change Level.

BANK Nifty Intraday Trading Levels

Buy Above 46000 Tgt 46166, 46343 and 46555 (BANK Nifty Spot Levels)

Sell Below 45850 Tgt 45700, 45555 and 45200 (BANK Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.