Foreign Institutional Investors (FIIs) exhibited a Bearish stance in the Bank Nifty Index Futures market by Shorting 1071 contracts with a total value of 74 crores. This activity led to a increase of 1659 contracts in the Net Open Interest.

Bank Nifty is trading above its Sun and Mars Ingress High suggesting BUlls are having upper hand till Bulls are holding 43700-43729 range.

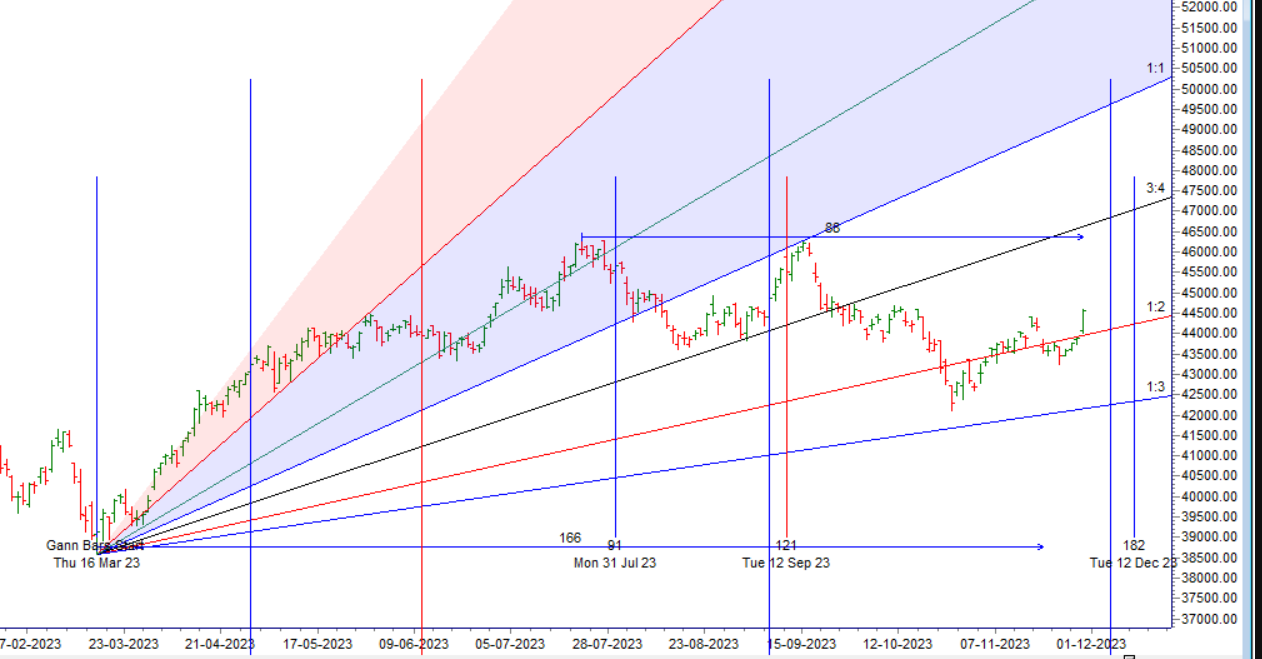

Bank Nifty gave a perfect upmove above Gann 1×2 Angle, and price has closed above its 200 DMA, Tommrow we will Monthly expiry and MSCI Rebalnacing so last 45 mins we will see big move.

Bank Nifty Trade Plan for Positional Trade ,Bulls will get active above 44632 for a move towards 44842/45052. Bears will get active below 44423 for a move towards 44213/44003

Traders may watch out for potential intraday reversals at 09:35,10:21, 01:41,2:37 How to Find and Trade Intraday Reversal Times

Bank Nifty Nov Futures Open Interest Volume stood at 12.5 lakh, liquidation of 4.4 lakh contracts. Additionally, the incarease in Cost of Carry implies that there was a liquidation of SHORT positions today.

Bank Nifty Advance Decline Ratio at 11:01 and Bank Nifty Rollover Cost is @43450 closed above it.

Bank Nifty Gann Monthly Trend Change Level : 43211 — Low made on 22 Nov 43230 and we are up 1200+ points.

Bank Nifty has closed above all its MA and Nearing Gann Annual Trend Change level of 44680.

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 42127-43444-44634-45923 . This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 44600 strike, followed by the 45000 strike. On the put side, the 44500 strike has the highest OI, followed by the 44300 strike.This indicates that market participants anticipate Bank Nifty to stay within the 45000-44500 range.

The Bank Nifty options chain shows that the maximum pain point is at 44800 and the put-call ratio (PCR) is at 0.85 . Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

My advice to any new traders is to seek a mentor who will offer you trading skills that will allow you to adapt to any market. What works one month may not work the next. But with fully developed trading skills, you can make the necessary adjustments.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 43658. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 44350 , Which Acts As An Intraday Trend Change Level.

BANK Nifty Intraday Trading Levels

Buy Above 44630 Tgt 44729, 44864 , and 45000 ( BANK Nifty Spot Levels)

Sell Below 44480 Tgt 44343, 44225 and 44108 ( BANK Nifty Spot Levels)

Upper End of Expiry : 44862

Lower End of Expiry : 44269

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.