Analysis of FIIs’ behavior in the Nifty Index Futures market shows a Bearish approach as they displayed a preference for SHORT positions. On a net basis, FIIs went SHORT 1535 contracts worth 148 crores, resulting in an increase of 9645 contracts in the Net Open Interest.

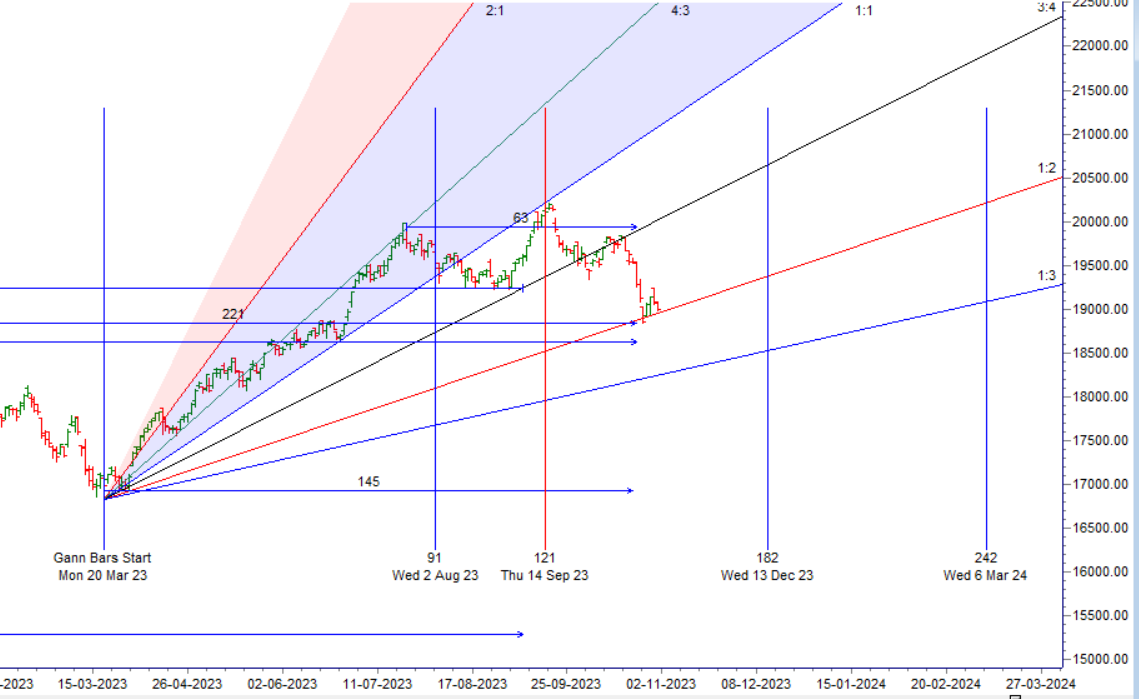

Today was Monthly close for Nifty and price has closed below last month low of 19255 , formed a lower low on Higher time Frame. Price always follow Higher time frame so trend for now is Sell on Rise till we do not see a close above 19255 for 2 days. Tommrow Saturn goes in Extreme Declination and Jupiter is Minimum Distance to Earth, so 2 Outer Plannet are forming an Astro Event. 01 Nov High and Low will remain Valid throughout the month due to Saturn and Jupiter.

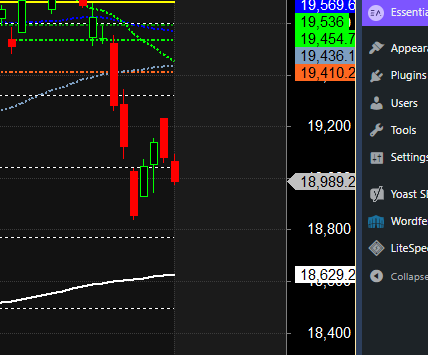

Price is back towards Gann angle, 01 Nov High is 19096 and Low is 18973. Break of any side will lead to a move of 233-323 points as Saturn and Jupiter made an Astro aspect yesterday. We will open gap up today BUlls need to sustain above 19100 for a Bullish expiry.

Nifty Trade Plan for Positional Trade ,Bulls will get active above 19112 for a move towards 19181/19249 . Bears will get active below 19043 for a move towards 18945/18906

Traders may watch out for potential intraday reversals at 09:27,10:54,12:28,1:10,2:19 How to Find and Trade Intraday Reversal Times

Nifty Nov Futures Open Interest Volume stood at 1.14 lakh cr , witnessing a addition of 4.7 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a addition of SHORT positions today.

Nifty Advance Decline Ratio at 25:25 and Nifty Rollover Cost is @19372 closed below it.

Nifty closed above 20/50/100 SMA 19100 should be watched, above it bulls will have strenght.

Nifty options chain shows that the maximum pain point is at 19100 and the put-call ratio (PCR) is at 0.80. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 19200 strike, followed by 19100 strikes. On the put side, the highest OI is at the 19000 strike, followed by 18900 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 19000-19200 levels.Total Call OI is 6.95 cr and Total Put OI is 7.58 cr

In the cash segment, Foreign Institutional Investors (FII) sold 1535 crores, while Domestic Institutional Investors (DII) bought 148 crores.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 18890-19452-20014 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.Price has closed below 19452 heading towards 18890

Just give up the idea that we can figure it out! Listen to the market shout a very clear and unmistakable direction to us. All we have to do is listen, feel, and follow the marketís signals and not hope the market follows our lead. Rest assured. It wonít!

For Positional Traders, The Nifty Futures’ Trend Change Level is At 19104. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 19101, Which Acts As An Intraday Trend Change Level.

Nifty Intraday Trading Levels

Buy Above 19100 Tgt 19125 , 19155 and 19196 ( Nifty Spot Levels)

Sell Below 19050 Tgt 19015, 18985 and 18950 (Nifty Spot Levels)

Upper End of Expiry : 19330

Lower End of Expiry : 19089

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.