Analysis of FIIs’ behavior in the Nifty Index Futures market shows a Bullish approach as they displayed a preference for LONG positions. On a net basis, FIIs went LONG 900 contracts worth 84.54 crores, resulting in an increase of 4976 contracts in the Net Open Interest.

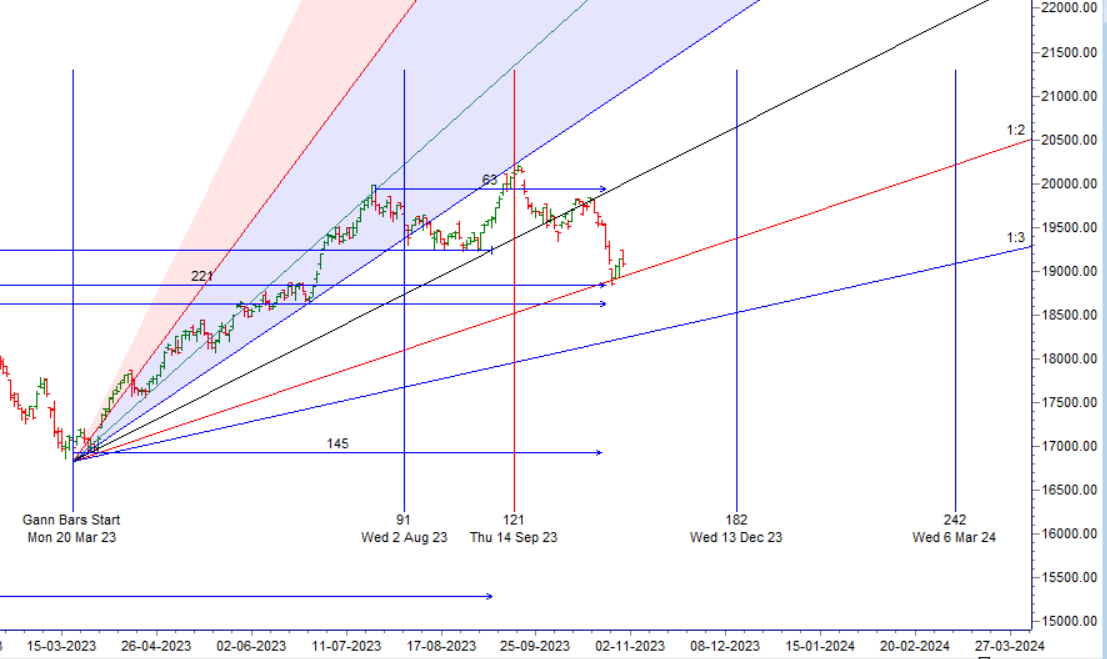

Today was Monthly close for Nifty and price has closed below last month low of 19255 , formed a lower low on Higher time Frame. Price always follow Higher time frame so trend for now is Sell on Rise till we do not see a close above 19255 for 2 days. Tommrow Saturn goes in Extreme Declination and Jupiter is Minimum Distance to Earth, so 2 Outer Plannet are forming an Astro Event. 01 Nov High and Low will remain Valid throughout the month due to Saturn and Jupiter.

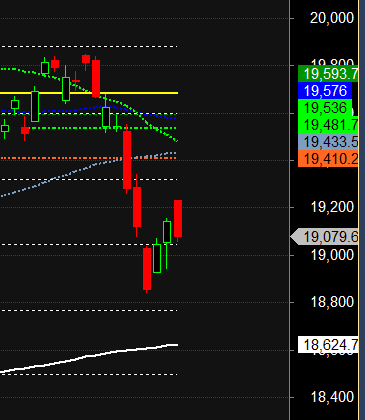

Nifty Trade Plan for Positional Trade ,Bulls will get active above 19112 for a move towards 19181/19249 . Bears will get active below 19043 for a move towards 18945/18906

Traders may watch out for potential intraday reversals at 9:56,12:33,1:14,2:58 How to Find and Trade Intraday Reversal Times

Nifty Nov Futures Open Interest Volume stood at 1.09 lakh cr , witnessing a addition of 0.84 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a addition of SHORT positions today.

Nifty Advance Decline Ratio at 25:25 and Nifty Rollover Cost is @19372 closed below it.

Nifty closed above 20/50/100 SMA and last swing low of 19333 heading towads 18888/18625 till we close below 19321.

Nifty options chain shows that the maximum pain point is at 19100 and the put-call ratio (PCR) is at 0.80. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 19300 strike, followed by 19200 strikes. On the put side, the highest OI is at the 19100 strike, followed by 19000 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 19000-19200 levels.Total Call OI is 6.95 cr and Total Put OI is 7.58 cr

In the cash segment, Foreign Institutional Investors (FII) sold 696 crores, while Domestic Institutional Investors (DII) bought 340 crores.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 18890-19452-20014 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.Price has closed below 19452 heading towards 18890

Just give up the idea that we can figure it out! Listen to the market shout a very clear and unmistakable direction to us. All we have to do is listen, feel, and follow the marketís signals and not hope the market follows our lead. Rest assured. It wonít!

For Positional Traders, The Nifty Futures’ Trend Change Level is At 19105 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 19177, Which Acts As An Intraday Trend Change Level.

Nifty Intraday Trading Levels

Buy Above 19100 Tgt 19125 , 19155 and 19196 ( Nifty Spot Levels)

Sell Below 19050 Tgt 19015, 18985 and 18950 (Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.