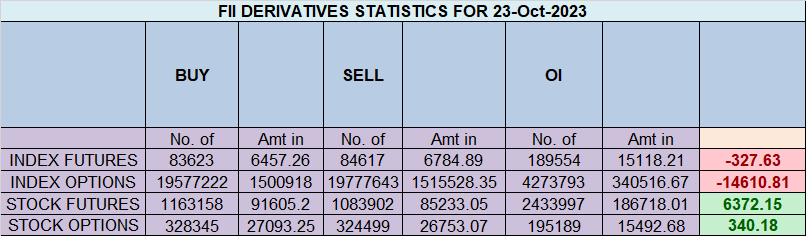

Analysis of FIIs’ behavior in the Nifty Index Futures market shows a Bearish approach as they displayed a preference for SHORT positions. On a net basis, FIIs went SHORT 396 contracts worth 53 crores, resulting in an increase of 10690 contracts in the Net Open Interest.

As Discussed in Last Analysis

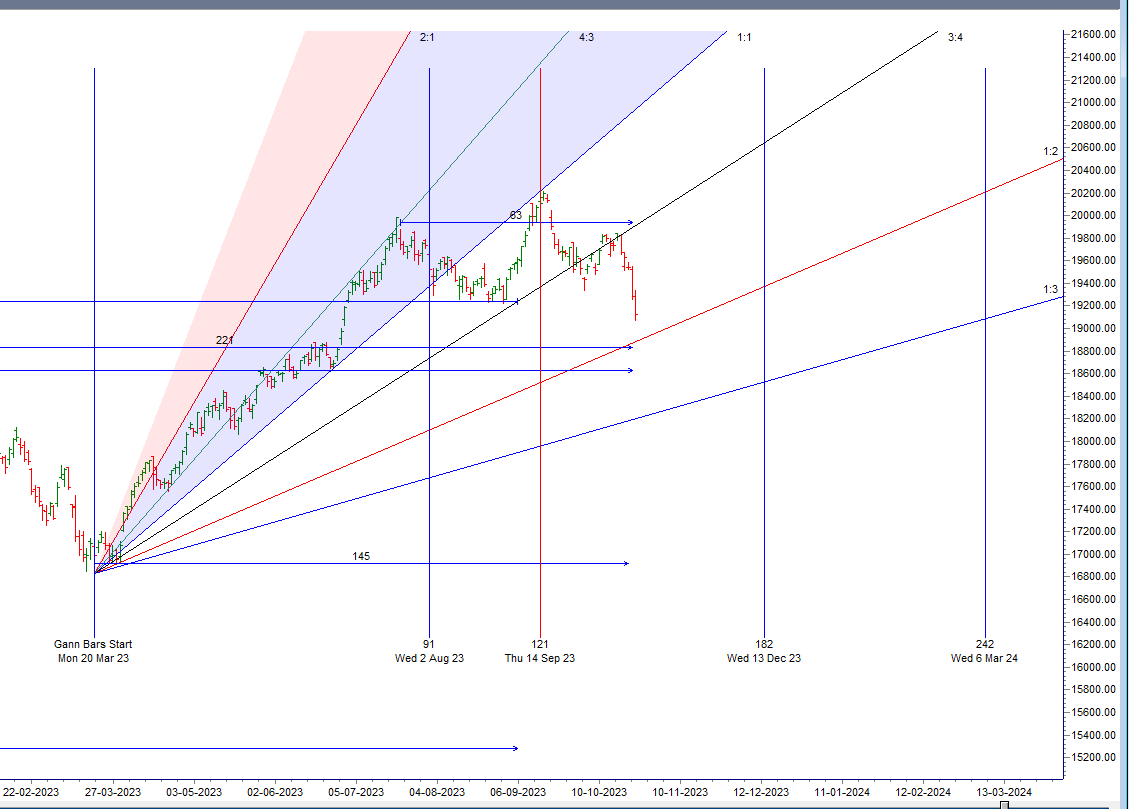

When Astro and Gann Date confluence its leads to big move , Same Happened on Monday, Nifty broke the 144 Days low of 19518 and on Weekend we had Mercury and Sun Chaging Sing which lead to Double Ingress and we broke the last swing low of 19333 and closed below it. Now 19333-19350 range will act as a Strong resistance for any pull back. Next 2 trading session are important as we have Monthly expiry coming up and “Bayer Rule 15: VENUS HELIOCENTRIC LATITUDE AT EXTREME AND LEAST SPEEDS FOR MAJOR MOVES Imp Rule”. To Capture trend of the day watch out for first 15 mins High and Low.

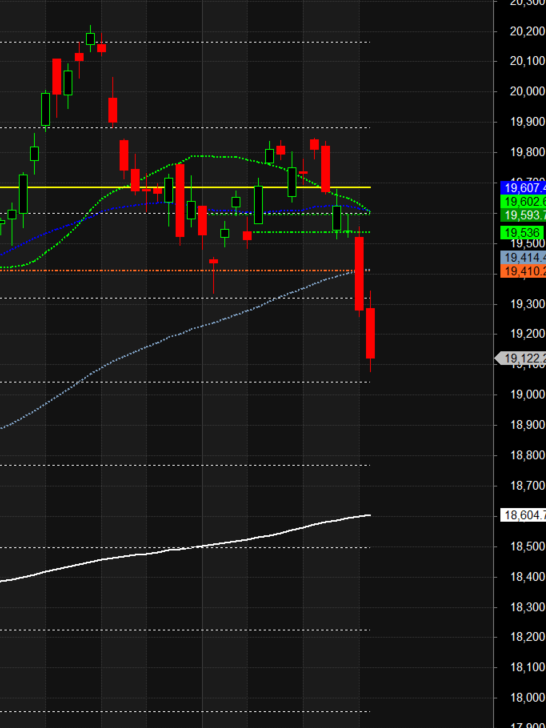

Nifty will hit near 19000 today and last 45 mins of trading will be very intresting as Last Monthly expiry happened at 19523 and we are trading around 19050 with todays gap down. Bears will put more pressure to bring the market down once we staret trading below 19000 on 15 mins closing basis. Today we have multiple Lunar dates coming togehter Moon at Perigee and Lunar Declination so again watch out for first 15 mins high and low to capture trend, till we do not close above 19333 Bears will have uppar hand and 18888 last swing high will act as strong support.

Nifty Trade Plan for Positional Trade ,Bulls will get active above 19128 for a move towards 19208/19277 . Bears will get active below 19069 for a move towards 19000/18930

Traders may watch out for potential intraday reversals at 09:27,10:36,12:33,1,2:47 How to Find and Trade Intraday Reversal Times

Nifty Nov Futures Open Interest Volume stood at 0.72 lakh cr , witnessing a addition of 30 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a addition of SHORT positions today.

Nifty Advance Decline Ratio at 10:40 and Nifty Rollover Cost is @19768 and Rollover is at 70.4%.

Nifty closed above 20/50/100 SMA and last swing low of 19333 heading towads 19108/19044 till we close below 19410.

Nifty options chain shows that the maximum pain point is at 19100 and the put-call ratio (PCR) is at 0.70. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 19300 strike, followed by 19200 strikes. On the put side, the highest OI is at the 19100 strike, followed by 19000 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 19000-19200 levels.Total Call OI is 6.95 cr and Total Put OI is 7.58 cr

In the cash segment, Foreign Institutional Investors (FII) sold 1093 crores, while Domestic Institutional Investors (DII) bought 736 crores.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 18890-19452-20014 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.Price has closed below 19452 heading towards 18890

By implementing contingency planning, you can take swift, decisive action the instant one of your positions changes its behavior or is hit with an unexpected event.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 19632. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 19205 , Which Acts As An Intraday Trend Change Level.

Nifty Intraday Trading Levels

Buy Above 19100 Tgt 19125 , 19155 and 19196 ( Nifty Spot Levels)

Sell Below 19050 Tgt 19015, 18985 and 18950 (Nifty Spot Levels)

Upper End of Expiry : 19162

Lower End of Expiry : 18937

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.