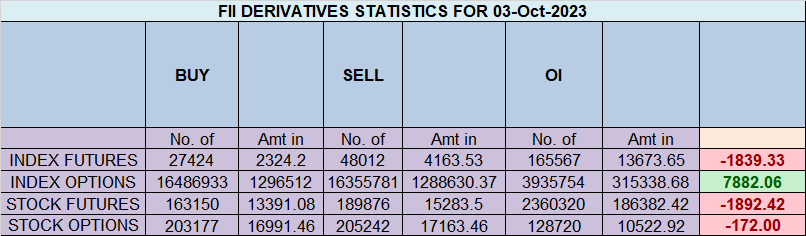

Analysis of FIIs’ behavior in the Nifty Index Futures market shows a Bearish approach as they displayed a preference for SHORT positions. On a net basis, FIIs went SHORT 14915 contracts worth 1459 crores, resulting in an increase of 14119 contracts in the Net Open Interest.

We got an excellent move yesterday based on Lunar Cycle , Now Today being NEW Moon and Moon Declination as discussed below also we have Monthly and Quaterly closing so bulls will try hard to close above 19629 and Bears below 19452-19400 range to form a gravestone doji on higher time frame.

Mars Opposition North Node genreally create short term top and bottom as discussed in below video,”RULE NO. 38 MERCURY LATITUDE HELIOCENTRIC Some mighty fine tops and bottoms are produced when Mercury in this motion passes the above mentioned degrees” Watch for firsat 15 mins High and low to capture the trend for the day.

Swing Traders can go long above 19485 for a move towards 19555/19626/19696. Bears will get active below 19344 for a move towards 19274/19204

Traders may watch out for potential intraday reversals at 9:25,11:12,1:16,2:36 How to Find and Trade Intraday Reversal Times

Nifty Oct Futures Open Interest Volume stood at 1 lakh cr , witnessing a addition of 7 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a addition of SHORT positions today.

Nifty Advance Decline Ratio at 16:34 and Nifty Rollover Cost is @19768 and Rollover is at 70.4%.

Nifty closed below 20/50/100 SMA and heading towads 19200 till we close below 19629

Nifty options chain shows that the maximum pain point is at 19400 and the put-call ratio (PCR) is at 0.83. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 19500 strike, followed by 19600 strikes. On the put side, the highest OI is at the 19400 strike, followed by 19300 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 19300 -19500 levels.Total Call OI is 4.95 cr and Total Put OI is 2.58 cr

In the cash segment, Foreign Institutional Investors (FII) sold 2034 crores, while Domestic Institutional Investors (DII) bought 1361 crores.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 18890-19452-20014 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.Price has closed below 19452 heading towards 18915

To create money management, position size calculation or the elaboration of a profitable set of rules. All of these very useful tools are of little help if you are not able to use them in a disciplined manner.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 19667 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 19580, Which Acts As An Intraday Trend Change Level.

Nifty Intraday Trading Levels

Buy Above 19424 Tgt 19448, 19485 and 19512 ( Nifty Spot Levels)

Sell Below 19375 Tgt 19343, 19310 and 19285 (Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.