Foreign Institutional Investors (FIIs) displayed a Bullish approach in the Bank Nifty Index Futures market by Buying 5330 contracts worth 352 crores, resulting in a decrease of 5922 contracts in the Net Open Interest.

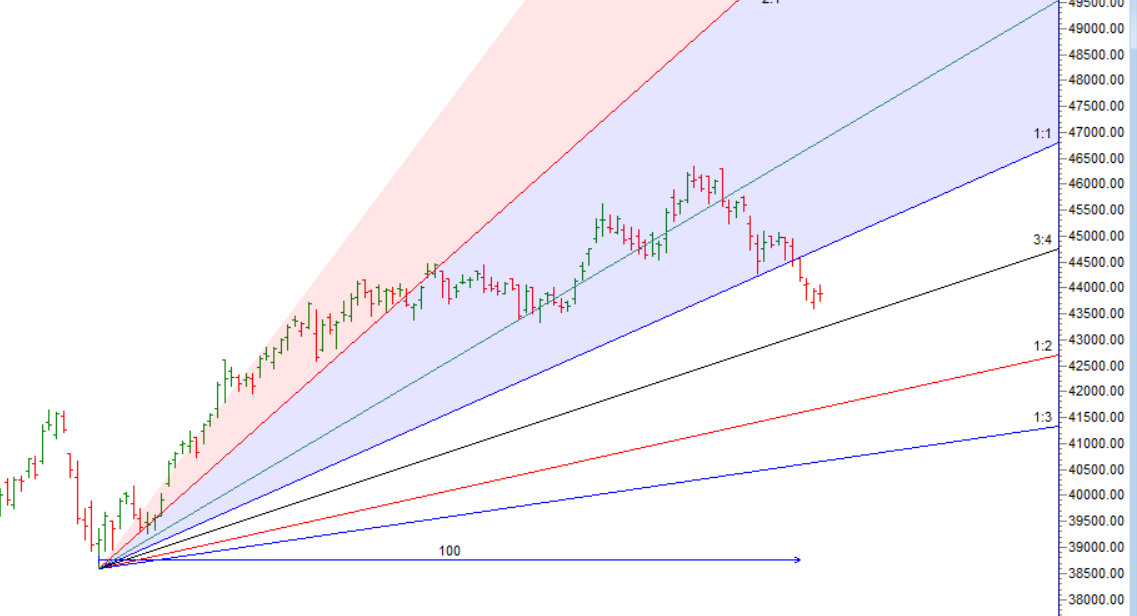

Bank Nifty saw the effect of 99 Gann Bars as we have discussed in last analysis, Now today we have an important astro date as discussed in below video, Till Bulls are able to hold 43600 We can see relief rally towards 44226/44435, Any break of 43600 can see fast fall towards 43000/42700.

Bank Nifty formed a Perfect DOJI today with price struggling to close above the previous day high, on Weekly chart we will be forming 4 red candel in row, Bulls would like to close around 44000-44050 tommrow and bears would like to close baround 43500-43525 range for a big move next week as multiple astro dates are coming.

Bank Nifty Trade Plan Bulls will get active above 43919 for a move towards 44132/44344/44566. Bears will get active below 43843 for a move towards 43631/43418

Traders may watch out for potential intraday reversals at 10:31,11:20,12:03,2:06,2:46 How to Find and Trade Intraday Reversal Times

Bank Nifty June Futures Open Interest Volume stood at 21.1 lakh, additon of 1.32 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a addition of SHORT positions today.

Bank Nifty Advance Decline Ratio at 7:5 and Bank Nifty Rollover Cost is @46143 and Rollover is at 70.3%

Bank Nifty has bounced from 100 SMA @43657, Till 43657 is held bounce towards 44000/44225, Break of 43600 fast fall towards 43000.

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 43444-44634-45923 . This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable. Price is near 43344

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 44000 strike, followed by the 44200 strike. On the put side, the 43500 strike has the highest OI, followed by the 43200 strike.This indicates that market participants anticipate Bank Nifty to stay within the 43500-44000 range.

The Bank Nifty options chain shows that the maximum pain point is at 43800 and the put-call ratio (PCR) is at 0.91. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

One of the most important attributes of a professional trader is the willingness to accept full responsibility for one’s actions. One can never improve if every mistake is the broker’s, or the fault of the data vendor, or the software.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 44988. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 44081, Which Acts As An Intraday Trend Change Level.

Intraday Trading Levels

Buy Above 43920 Tgt 44050, 44225 and 44444 (Bank Nifty Spot Levels)

Sell Below 43843 Tgt 43729, 43610 and 43500 (Bank Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.