Foreign Institutional Investors (FIIs) displayed a Bullish approach in the Bank Nifty Index Futures market by Buying 3230 contracts worth 221 crores, resulting in a increase of 5288 contracts in the Net Open Interest.

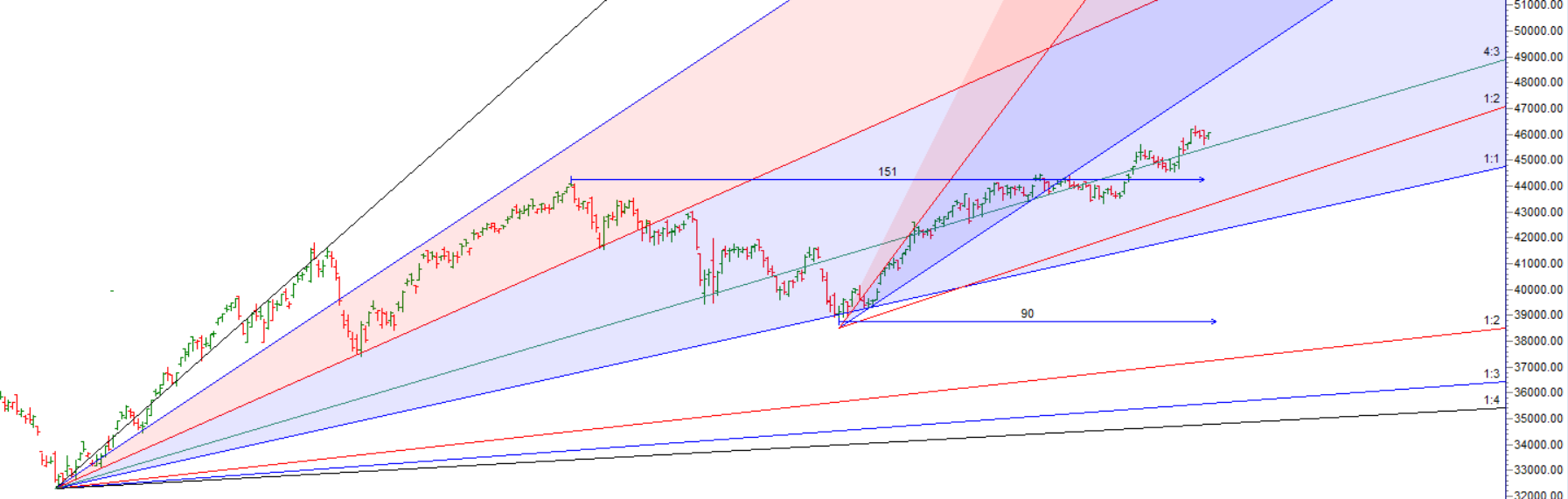

As Discussed in Last Analysis Bank Nifty made a lower low after DOJI on Frtiday, ICICI Bank results were unable to move bank nifty suggesting we are seeing distribution at higher levels and price can head towards 4×3 around 45500 gann angle as shown in below chart.

Fed raises interest rates by 25 BPS

There are some important astrological dates tomorrow, so the first 15 minutes’ high and low can provide guidance for the day’s market direction.Additionally, the market is likely to react to the FOMC (Federal Open Market Committee) decision.

Bank Nifty has been trading in a sideways zone, which suggests that a trending move may be expected in the next two days. This sideways movement could lead to a breakout or breakdown, depending on the prevailing market sentiment. AXIS BANK Results today if compared on QoQ Basis were worst in Banking Sector, with Rise in Both NPA and Provisions and taking Hit on Profitablity.

Astrological analysis can be an interesting way to observe potential market movements.

Regarding astrological aspects, “Bayer Rule 21 (variation C)” suggests that strong moves may occur within 5-8 days when retrograde Venus makes a conjunction with retrograde Mercury. The Venus Conjunct Mercury aspect is considered very important for short-term swings in the market. Similarly, the Mercury Trine North Node aspect is also deemed significant for short-term swings.

Bank Nifty Trade Plan Based Bulls will get active above 46191 for a move towards 46357/46524/46690. Bears will get active below 45858 for a move towards 45692/45526/45359

Traders may watch out for potential intraday reversals at 10:11,12:40,1:22,1:58 How to Find and Trade Intraday Reversal Times

Bank Nifty June Futures Open Interest Volume stood at 11.4 lakh, liquidation of 1.95 lakh contracts. Additionally, the decrease in Cost of Carry implies that there was a liquidation of LONG positions today.

Bank Nifty Advance Decline Ratio at 11:1 and Bank Nifty Rollover Cost is @44037 and Rollover is at 72.6%

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 43444-44634-45923 . This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable. Price is near 45923

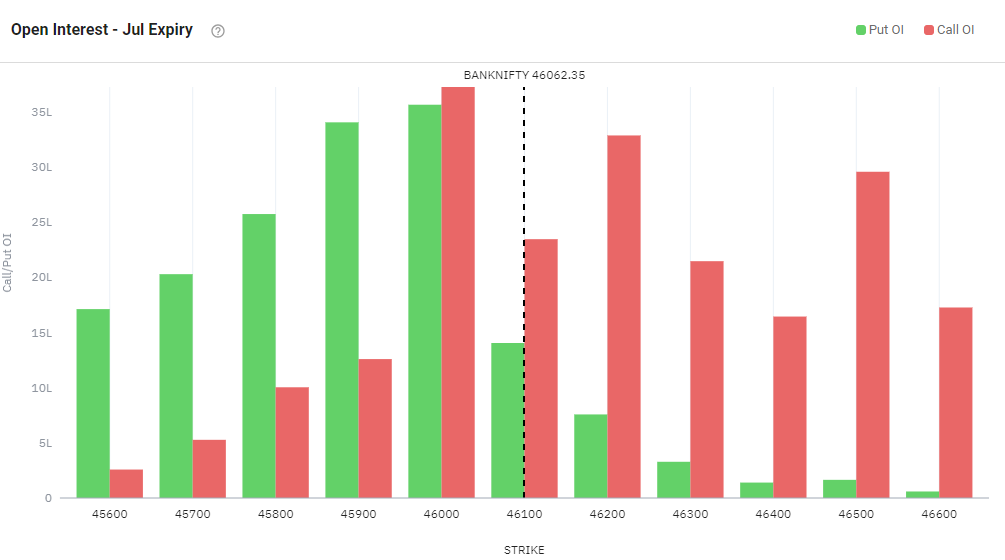

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 46000 strike, followed by the 46200 strike. On the put side, the 45700 strike has the highest OI, followed by the 45500 strike. Total Calls OI is 2.08 CR and Total Put OI is 1.61 CR, This indicates that market participants anticipate Bank Nifty to stay within the 45800-46200 range.

The Bank Nifty options chain shows that the maximum pain point is at 46000 and the put-call ratio (PCR) is at 0.9 . Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

Your goal every day is to improve. Each day is a gift from the market to improve. Work hard. Each day is an opportunity to get better. Focus on the process

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 45330. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 45983 , Which Acts As An Intraday Trend Change Level.

Intraday Trading Levels

Buy Above 46100 Tgt 46212, 46314 and 46464 (Nifty Spot Levels)

Sell Below 45950 Tgt 45816, 45729 and 45610 (Nifty Spot Levels)

Upper End of Expiry : 46314

Lower End of Expiry : 45809

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.