Analysis of FIIs’ behavior in the Nifty Index Futures market shows a bearish approach as they displayed a preference for short positions. On a net basis, FIIs shorted 11,132 contracts worth 1,105 crores, resulting in an increase of 406 contracts in the Net Open Interest. Additionally, they sold 8,719 long contracts and added 6,869 short contracts, indicating a strategy of covering long positions and adding short positions.

The FII Long Short Ratio currently stands at 58.1%, and the FII Long to Short Ratio is at 2, indicating that FIIs have substantially reduced their long positions in the market and have utilized the market fall to exit long positions and add short positions in Nifty Futures. This behavior suggests a bearish sentiment among FIIs, potentially influencing the overall market sentiment and trend. Traders and investors should closely monitor these FII activities and adjust their trading strategies accordingly to adapt to the changing market conditions.

Nifty is on a one-way move since the 2003 Bull Run. I have not seen a 17% move in Nifty without a cut of 2-2.5% in between. Nifty has not closed 1% down in the last 3 months; the market always surprises. “Bayer Rule 2: The trend goes down within 3 days when the speed difference between Mars and Mercury is 59 minutes, leading to a big move,” will become active. We will open gap down today, with Infosys again playing a villain role for Bulls. As long as we are above 19690 (Gann number) and Rahu Ingress High, Bulls have the advantage.

Nifty experienced its first decline of more than 1% in the last 3 months. The price was unable to touch the previous day’s high and closed below the previous day’s low. We currently have Venus and Chiron in retrograde and Sun Ingress on Saturday and Sunday, which suggests that the first 15 minutes of trading on Monday will be crucial for setting the trend for the entire day.

The market is facing conflicting forces, with IT stocks showing weakness while Financial stocks, particularly ICICI Bank, reported a great set of numbers. Reliance disappointed with its O2C business performance, adding to the tug of war between bulls and bears. However, if there is a 15-minute close below 19,682, bears are likely to gain momentum and drive the market lower.

Nifty Trade Plan Bulls will get active above 19779 for a move towards 19850/19921/19991. Bears will get active below 19680 for a move towards 19610/19555/19485

Nifty is near a crucial gann number of 19683 last time this number was at 19576 price did not close below this and gave a big rally, Next 2-3 days price action near 19683 is very important able to hold we can see rally towards 19881/20000. Break of 19600 fall towards 19410 in short term. — 20 K done now dips near 19683 should be bought with 55 points sl

Traders may watch out for potential intraday reversals at 9:26,11:20,12:50,1:26,2:27 How to Find and Trade Intraday Reversal Times

Nifty July Futures Open Interest Volume stood at 1.07 lakh, witnessing a addition of 2.4 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a covering of LONG positions today.

Nifty Advance Decline Ratio at 12:38 and Nifty Rollover Cost is @18884 and Rollover is at 69.7 %.

Nifty options chain shows that the maximum pain point is at 1800 and the put-call ratio (PCR) is at 0.97. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 20000 strike, followed by 20100 strikes. On the put side, the highest OI is at the 19700 strike, followed by 19600 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 19700-20000 levels.

According To Todays Data, Retailers Have bought 211 K Call Option Contracts And 192 K Call Option Contracts Were Shorted by them. Additionally, bought 682 K Put Option Contracts And 100 K Put Option Contracts were Shorted by them, Indicating A Bullish Outlook.

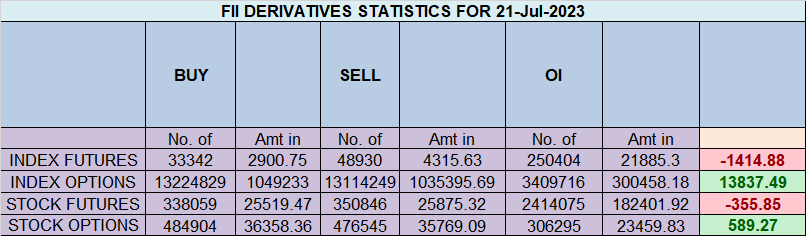

In Contrast, Foreign Institutional Investors (FIIs) bought 350 K Call Option Contracts And 369 K Call Option Contracts Were Shorted by them. On The Put Side, FIIs bought 293 K Put Option Contracts And 164 K Put Option Contracts were Shorted by them, Suggesting They Have Turned To A BEARISH Bias.

In the cash segment, Foreign Institutional Investors (FII) bought 3370 crores, while Domestic Institutional Investors (DII) sold 193 crores.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 18890-19452-20014 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.Price is near 20014

To make One Good Trade you must prepare properly, work hard, and have patience

For Positional Traders, The Nifty Futures’ Trend Change Level is At 19510 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 19893 , Which Acts As An Intraday Trend Change Level.

Intraday Trading Levels

Buy Above 19777 Tgt 19800, 19825 and 19856 (Nifty Spot Levels)

Sell Below 19700 Tgt 19666, 19633 and 19585 (Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.