Foreign Institutional Investors (FIIs) displayed a Bullish approach in the Bank Nifty Index Futures market by Buying 1565 contracts worth 107 crores, resulting in a increase of 6757 contracts in the Net Open Interest.

Bank Nifty has formed another Doji, indicating multiple Dojis, and is also currently forming an Inside Bar pattern. Despite the selling pressure from HDFC twins, Bank Nifty only experienced a modest decline of 100 points, highlighting the strength of the market. With today being the expiry day, it is crucial for the Bulls to defend the 45000 level. If successfully held, we may witness a rally towards 45356/45560. However, a break and close below 45000 could lead to a quick fall towards 44800/44666.

With VIX also showing Sign of Life we can have an Explosive Expiry.

Bank Nifty bulls attempted a comeback today but failed to close above the previous day’s high of 45,418. A DOJI candlestick pattern was formed with a low of 45,000 on July 4th. If the price starts trading below 45,000, we can expect a sharp sell-off towards 44,729 or 44,444. Traders can refer to the Japan Nikkei chart to observe how tops are formed. When a fall occurs, we may see a minimum decline of 729 to 1,008 points in a single trading session, shaking off weak hands.

Since the low of 38,613 on March 16th and the high of 45,655 on July 4th, the rally has amounted to a gain of 7,042 points over 110 days. Therefore, a pullback of at least 2,690 points can be expected. If you are long in the market, it is advisable to tighten your stop-loss to the low of July 4th.

On June 9th, Bayer’s rule will come into effect. Rule No. 38 states that when Mercury is in this specific motion, significant tops and bottoms are often formed.

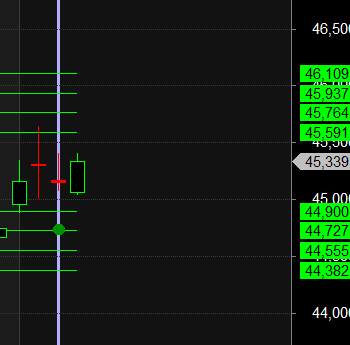

Bank Nifty Trade Plan Based Bulls will get active above 45420 for a move towards 45591/45764/45937. Bears will get active below 45070 for a move towards 44900/44727/44555.

Traders may watch out for potential intraday reversals at 9:59,10:28,1:48,2:32 How to Find and Trade Intraday Reversal Times

Bank Nifty June Futures Open Interest Volume stood at 28.8 lakh, addition of 2 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a adding of LONG positions today.

Bank Nifty Advance Decline Ratio at 11:1 and Bank Nifty Rollover Cost is @44037 and Rollover is at 72.6%

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 43444-44634-45923 . This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable. Price is near 44634

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 45500 strike, followed by the 45800 strike. On the put side, the 45000 strike has the highest OI, followed by the 44800 strike. This indicates that market participants anticipate Bank Nifty to stay within the 44800-45300 range.

The Bank Nifty options chain shows that the maximum pain point is at 45100 and the put-call ratio (PCR) is at 0.9. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

To create money management, position size calculation or the elaboration of a profitable set of rules. All of these very useful tools are of little help if you are not able to use them in a disciplined manner

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 45075 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 45323 , Which Acts As An Intraday Trend Change Level.