Foreign Institutional Investors (FIIs) displayed a Bearish approach in the Nifty Index Futures market by Shorting 8373 contracts worth 783 crores, resulting in a decrease of 8021 contracts in the Net Open Interest. FIIs sold 2799 long contracts and covered 21 short contracts , indicating a preference for covering LONG and covering SHORT positions .With a Net FII Long Short ratio of 1.11 FIIs utilized the market fall to exit Long positions and exit short positions in NIFTY Futures.

As Discussed in Last Analysis Nifty was unable to break a fresh all time high above 18888 as Nifty made high of 18886 and again got sold off . Its 3 days NIfty was unable to cross its all time high. Nifty has again formed an Outside Bar Pattern today on Daily basis , On 26 we have very important Lunar Cycle so we should see a 200-300 points move in next 2 trading session. We also have Venus Opposition Mercury HELIO which is very important aspect for short term trading.

Nifty is heading towards 18604 which was previous all time high so it will act as support. ANy break of 18635-18604 range can lead to sharp dip towards 18413-18385 range. Monday we have very important Lunar Cycle which can lead to big move.

If the low price for the entire week is achieved on Friday, expect a much lower price next week. Nifty closing at the low of the week.Monday very imp Lunar Cycle can see a big move !! Direction first 15 mins High and Low.

Nifty has closed below Saturn Retrograde Low and Summer Solstice low Suggesting weakness is on the charts

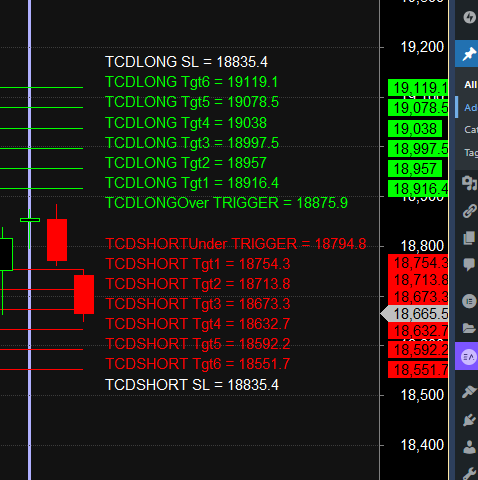

Nifty Trade Plan Based Bulls will get active above 18875 for a move towards 18916/18957/18997/19038/19078/19119. Bears will get active below 18794 for a move towards 18754/18713/18673/18632/18592/18551 — Bears did 3 target on downside waiting for 18632/18592/18551

Traders may watch out for potential intraday reversals at 09:30,10:47,12:37,2:25 How to Find and Trade Intraday Reversal Times

Nifty June Futures Open Interest Volume stood at 0.85 lakh, witnessing a liquidation of 11.7 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a addition of SHORT positions today.

Nifty Advance Decline Ratio at 10:40 and Nifty Rollover Cost is @18407 and Rollover is at 66.8%.

Major Support for Nifty us at 18668 @ 20 SMA closed below it, Heading towards 18314

Nifty options chain shows that the maximum pain point is at 18700 and the put-call ratio (PCR) is at 1.05. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 18700 strike, followed by 18800 strikes. On the put side, the highest OI is at the 18600 strike, followed by 18500 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 18500-18700 levels.

According To Todays Data, Retailers Have bought 159 K Call Option Contracts And 151 K Call Option Contracts Were Shorted by them. Additionally, They bought 99 K Put Option Contracts And 108 K Put Option Contracts were Shorted by them, Indicating A BULLISH Bias.

In Contrast, Foreign Institutional Investors (FIIs) bought 227 K Call Option Contracts And 210 K Call Option Contracts Were Shorted by them. On The Put Side, FIIs bought 227 K Put Option Contracts And 138 K Put Option Contracts were Shorted by them, Suggesting They Have Turned To BEARISH Bias.

In the cash segment, Foreign Institutional Investors (FII) sold 344 crores, while Domestic Institutional Investors (DII) sold 684 crores.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 18360-18890-19452 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable. Price made high of 18886 and reversed.

Fundamental of Trading : 1. Proper preparation 2. Hard work 3. Patience 4. A detailed plan before every trade 5. Discipline 6. Trade Journal 7. Replaying important trades

For Positional Traders, The Nifty Futures’ Trend Change Level is At 18712. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 18729 , Which Acts As An Intraday Trend Change Level.

Intraday Trading Levels

Buy Above 18701 Tgt 18732 , 18777 and 18802 (Nifty Spot Levels)

Sell Below 18630 Tgt 18600, 18572 and 18512 (Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.