Foreign Institutional Investors (FIIs) displayed a Bearish approach in the Nifty Index Futures market by Shorting 1581 contracts worth 147 crores, resulting in a increase of 11073 contracts in the Net Open Interest. FIIs bought 6122 long contracts and added 2934 short contracts , indicating a preference for adding LONG and adding SHORT positions .With a Net FII Long Short ratio of 1.14 FIIs utilized the market rise to enter Long positions and enter short positions in NIFTY Futures.

As Discussed in Last Analysis We have Summer Solstice today watch for first 15 mins High and Low to capture the trend of the market. Price is still not able to breach 18888,Sensex made a new all time high today. My advise would be to book profits part of your position in cash and keep trailing with strict sl. Its always good to book some profits and keep cash ready to deploy at further corrections. Nifty is managed to keep sentiment positve to play mid and small cap stocks.

Nifty was unable to break a fresh all time high above 18888 as Nifty made high of 18886 and again got sold off . Its 3 days NIfty was unable to cross its all time high. Nifty has again formed an Outside Bar Pattern today on Daily basis , On 26 we have very important Lunar Cycle so we should see a 200-300 points move in next 2 trading session. We also have Venus Opposition Mercury HELIO which is very important aspect for short term trading.

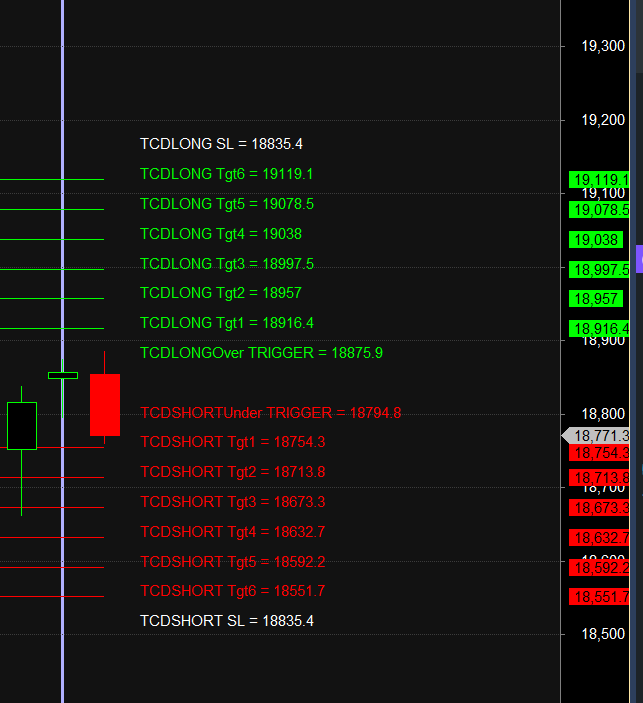

Nifty Trade Plan Based Bulls will get active above 18875 for a move towards 18916/18957/18997/19038/19078/19119. Bears will get active below 18794 for a move towards 18754/18713/18673/18632/18592/18551 — Bullls got stopped out and Bears did 1 target on downside waiting for 18713/18673/18632/18592/18551

Traders may watch out for potential intraday reversals at 09:34,10:11,11:19,12:27,2:35 How to Find and Trade Intraday Reversal Times

Nifty June Futures Open Interest Volume stood at 0.97 lakh, witnessing a addition of 5 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a addition of SHORT positions today.

Nifty Advance Decline Ratio at 11:39 and Nifty Rollover Cost is @18407 and Rollover is at 66.8%.

Major Support for Nifty us at 18659 ad@ 20 SMA

Nifty options chain shows that the maximum pain point is at 18800 and the put-call ratio (PCR) is at 0.96. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 18800 strike, followed by 18900 strikes. On the put side, the highest OI is at the 18700 strike, followed by 18600 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 18900-18700 levels.

In the cash segment, Foreign Institutional Investors (FII) sold 693 crores, while Domestic Institutional Investors (DII) bought 218 crores.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 18360-18890-19452 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable. Price made high of 18886 and reversed.

Fundamental of Trading : 1. Proper preparation 2. Hard work 3. Patience 4. A detailed plan before every trade 5. Discipline 6. Trade Journal 7. Replaying important trades

For Positional Traders, The Nifty Futures’ Trend Change Level is At 18711 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 18857 , Which Acts As An Intraday Trend Change Level.