Foreign Institutional Investors (FIIs) displayed a Bearish approach in the Bank Nifty Index Futures market by Shorting 7782 contracts worth 851 crores, resulting in a increase of 2846 contracts in the Net Open Interest.

Biporjoy cyclone will land In Gujarat , Saurastra and Kutch upto midnight 12 or so. Lets Keep the people of Affected Areas In Gujarat in Our Prayers .. Hope all will be Well !!

As Discussed in Last Analysis

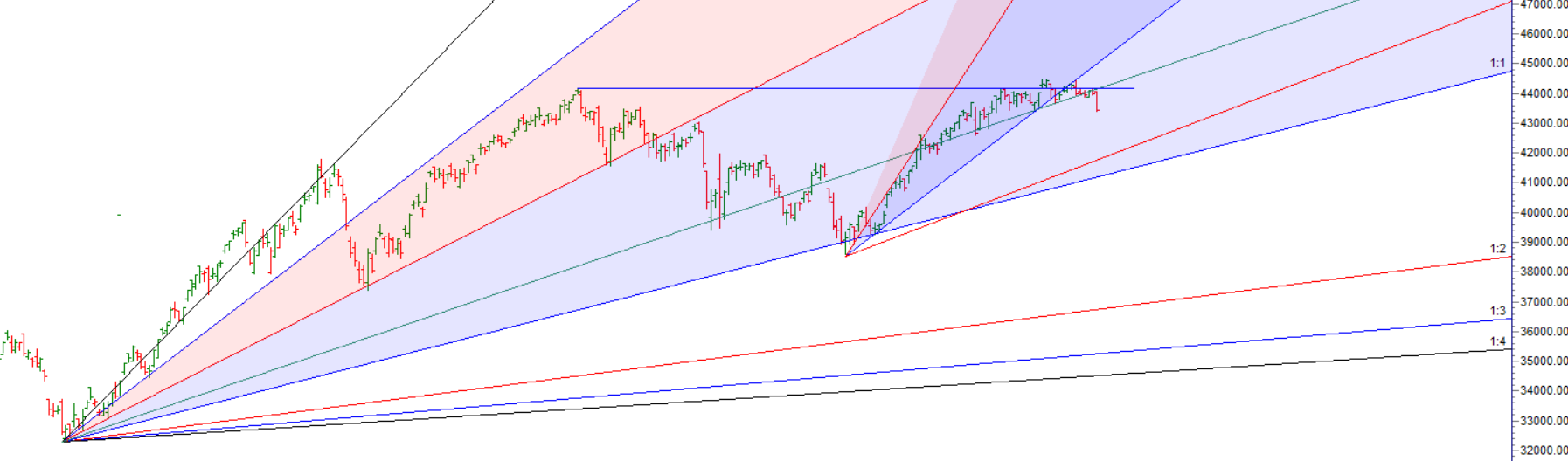

Another Side ways Day with Index doing Nothing and waiting for the FOMC meeting outcome. Bank Nifty is unable to sustain above 44151 last 52 week high ,and price is struggling near its 4×3 gann angle and today being gann time cycle so can be potential price time squaring which can lead to an explosive move.

Gann Price Time Squaring showed its Impact with bank nifty cracking almost 600 points and closing at the lowest point of the day, Till Bulls are not able to close above 44151 All Rallies will get sold into and ultimate target for this downmove can be near 41920-42042 which can come in June Expiry.

Trade Plan as per Gann Date Bulls will get active above 44222 for a move towards 44340/44468/44596/44724. Bears will get active below 43950 for a move towards 43828/43699/43571/43443. — All Target done

,Fresh Swing Plan Bears will get active below 43376 for a move towards 43105/42835. Bulls above 43647 for a move towards 43917/44151/44444.

Traders may watch out for potential intraday reversals at 9:18,10:57,11:27,12:54,2:58 How to Find and Trade Intraday Reversal Times

Bank Nifty June Futures Open Interest Volume stood at 24.8 lakh, addition of 0.60 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a adding of SHORT positions today.

Bank Nifty Advance Decline Ratio at 2:10 and Bank Nifty Rollover Cost is @43908 and Rollover is at 72.2%

Major Support for Bank Nifty us at 43998 which is 20 SMA,Finally we closed below 20 SMA heading towards 43189..

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 40789-41967-43216 . This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable. Price is has broken 43216 Heading towards 44464 — 44464 done now heading for 43216

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 43800 strike, followed by the 445000 strike. On the put side, the 43500 strike has the highest OI, followed by the 43000 strike. This indicates that market participants anticipate Bank Nifty to stay within the 43000-43500 range.

The Bank Nifty options chain shows that the maximum pain point is at 44000 and the put-call ratio (PCR) is at 0.94. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

In leveraged trades, it is how you manage risk that eventually decides if you hang on to your profits or proceed to lose it all. Therefore, traders who’ve built up substantial wealth from options do much more than setting stop-losses or using hedged strategies for their trades. Mindful of one-off events that can wipe out their hard-won capital, they sequester their capital in safe instruments, deploying only 10 or 20 per cent in trading at any given point in time. They also set limits of 2-3 per cent for the capital that they would bet on a single trade.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 44153. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 43800 , Which Acts As An Intraday Trend Change Level.