Foreign Institutional Investors (FIIs) displayed a Bullish approach in the Nifty Index Futures market by Buying 3955 contracts worth 371 crores, resulting in a incease of 1943 contracts in the Net Open Interest. FIIs bought 4244 long contracts and covered 2144 short contracts , indicating a preference for adding LONG and covering SHORT positions .With a Net FII Long Short ratio of 1.05 FIIs utilized the market rise to enter Long positions and exit short positions in NIFTY Futures.

As Discussed in Last Analysis Price continue with its contraction on astro date which is perfect set up on Astro Date. India’s retail inflation drops to 25-month low in May on softer food price; industrial output rises sharply. Remmber Market are always forward looking and current data has already been anticipated and we have seen a decent rally. Tommrow we have US inflation data carry overnight position with Hedge. On Importnat observation today was Monthly Put Premium not decaying in upmove seen today.

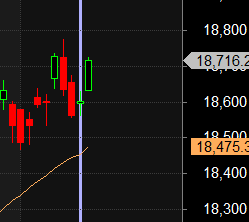

Nifty did an upmove today after Double Ingress High was breached at Open and almost did 2 target on upside. VOlatlity has dried and hopefully fed meeting tommrow night can add some volatily to the market. Till Nifty is above 18631 Double Ingress High Bulls have upperhand.

For Swing Traders Bulls will get active above 18636 for a move towards 18670/18707/18744/18781 Bears will get active below 18555 for a move towards 18522/18485/18449/18412. — Waiting for 18744/18781

Traders may watch out for potential intraday reversals at 9:24,11:16,1:06,1:53,2:50 How to Find and Trade Intraday Reversal Times

Nifty June Futures Open Interest Volume stood at 0.91 lakh, witnessing a liquidation of 5.8 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a closure of LONG positions today.

Nifty Advance Decline Ratio at 36:14 and Nifty Rollover Cost is @18407 and Rollover is at 66.8%.

Major Support for Nifty us at 18475 @ 20 SMA

Nifty options chain shows that the maximum pain point is at 18700 and the put-call ratio (PCR) is at 1.02 . Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 18600 strike, followed by 18700 strikes. On the put side, the highest OI is at the 18400 strike, followed by 18300 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 18500-18700 levels.

In the cash segment, Foreign Institutional Investors (FII) bought 1677 crores, while Domestic Institutional Investors (DII) sold 203 crores.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 17744-18272-18800 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable. Price made high of 18777

Don’t overtrade. It’s tempting to trade frequently, but this can lead to losses. It’s better to trade less and focus on making high-quality trades.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 18649. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 18763, Which Acts As An Intraday Trend Change Level.