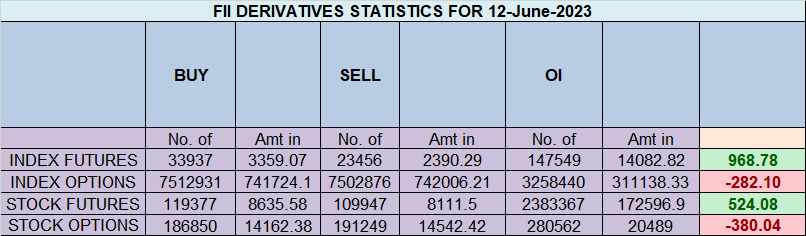

Foreign Institutional Investors (FIIs) displayed a Bearish approach in the Nifty Index Futures market by Buying 10592 contracts worth 988 crores, resulting in a decease of 13246 contracts in the Net Open Interest. FIIs sold 1492 long contracts and added 11973 short contracts were covered by them, indicating a preference for covering LONG and SHORT positions .With a Net FII Long Short ratio of 0.97 FIIs utilized the market fall to exit Long positions and exit short positions in NIFTY Futures.

As Discussed in Last Analysis A double ingress refers to the occurrence when two planets change their zodiac signs simultaneously. This alignment can have astrological implications and is often believed to influence various aspects of life, including financial markets.In astrology, planetary movements are considered to have a profound impact on human behavior and events. When two planets experience a double ingress, their combined energies and influences can create a unique configuration that may affect the overall market sentiment and specifically impact sectors such as banking. Last time we had Double Ingress on 19 May where Nifty made a short term bottom and saw a significant rally from 18060 till 18777.

Mercury is moving in Gemni and Pluto in Capricon on 11 JUne and Rahu in Aries on 12 June suggesting we are going to see an explosive move in Nifty.

Price continue with its contraction on astro date which is perfect set up on Astro Date. India’s retail inflation drops to 25-month low in May on softer food price; industrial output rises sharply. Remmber Market are always forward looking and current data has already been anticipated and we have seen a decent rally. Tommrow we have US inflation data carry overnight position with Hedge. On Importnat observation today was Monthly Put Premium not decaying in upmove seen today.

For Swing Traders Bulls will get active above 18636 for a move towards 18670/18707/18744/18781 Bears will get active below 18555 for a move towards 18522/18485/18449/18412.

Traders may watch out for potential intraday reversals at 9:28,11:13,12:03,1:06,2:12,2:57 How to Find and Trade Intraday Reversal Times

Nifty June Futures Open Interest Volume stood at 0.91 lakh, witnessing a liquidation of 5.8 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a closure of LONG positions today.

Nifty Advance Decline Ratio at 33:17and Nifty Rollover Cost is @18407 and Rollover is at 66.8%.

Major Support for Nifty us at 18453 @ 20 SMA

Nifty options chain shows that the maximum pain point is at 18600 and the put-call ratio (PCR) is at 1.02 . Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 18600 strike, followed by 18700 strikes. On the put side, the highest OI is at the 18400 strike, followed by 18300 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 18500-18700 levels.

According To Todays Data, Retailers Have bought 756 K Call Option Contracts And 780 K Call Option Contracts Were Shorted by them. Additionally, They bought 956 K Put Option Contracts And 757 K Shorted Put Option Contracts were Shorted by them, Indicating A BEARISH Bias.

In Contrast, Foreign Institutional Investors (FIIs) bought 170 K Call Option Contracts And 98 K Call Option Contracts Were Shorted by them. On The Put Side, FIIs bought 72 K Put Option Contracts And 135 K Put Option Contracts were Shorted by them, Suggesting They Have Turned To BULLISH Bias.

In the cash segment, Foreign Institutional Investors (FII) sold 626 crores, while Domestic Institutional Investors (DII) bought 1793 crores.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 17744-18272-18800 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable. Price made high of 18777

Don’t overtrade. It’s tempting to trade frequently, but this can lead to losses. It’s better to trade less and focus on making high-quality trades.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 18641 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 18669 , Which Acts As An Intraday Trend Change Level.